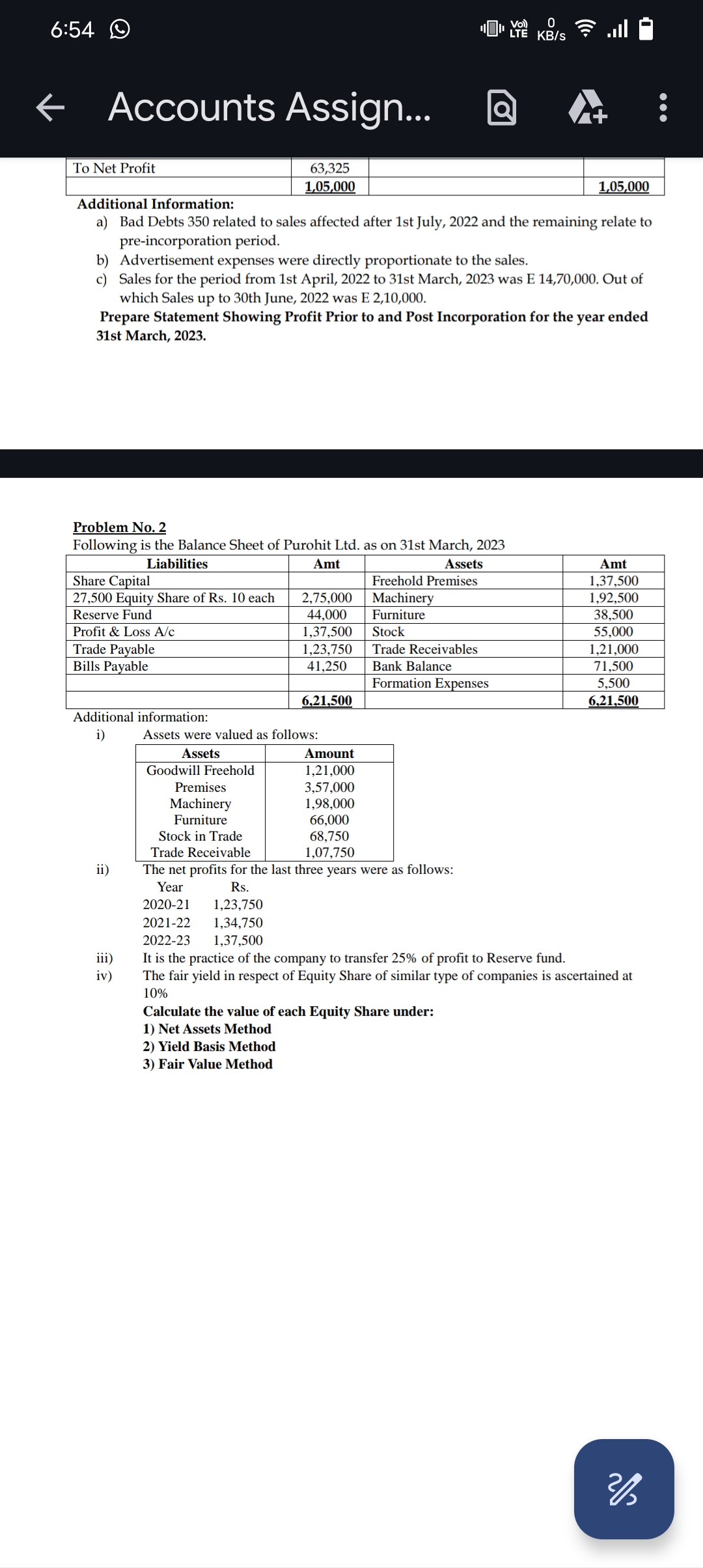

Calculate the value of each Equity Share under: 1) Net Assets Method 2) Yield Basis Method 3) Fair Value Method

Understand the Problem

The question is asking us to calculate the value of each equity share using three different methods: Net Assets Method, Yield Basis Method, and Fair Value Method. It includes financial data and additional information about profits and assets.

Answer

- Net Assets Method: $3.56$

Answer for screen readers

- Value per Share (Net Assets Method): $3.56$

- Value per Share (Yield Basis Method): $9,87,500$

- Value per Share (Fair Value Method): $13,16,670$

Steps to Solve

- Calculate Total Assets

Sum the values of all assets listed in the balance sheet.

[ \text{Total Assets} = \text{Goodwill} + \text{Premises} + \text{Machinery} + \text{Furniture} + \text{Stock} + \text{Trade Receivables} ]

[ \text{Total Assets} = 1,21,000 + 3,57,000 + 1,98,000 + 66,000 + 68,750 + 1,07,750 = 7,19,500 ]

- Calculate Total Liabilities

Sum the values of all liabilities listed in the balance sheet.

[ \text{Total Liabilities} = \text{Share Capital} + \text{Reserve Fund} + \text{Profit & Loss A/c} + \text{Trade Payable} + \text{Bills Payable} ]

[ \text{Total Liabilities} = 2,75,000 + 44,000 + 1,37,500 + 1,23,750 + 41,250 = 6,21,500 ]

- Calculate Net Assets Using Net Assets Method

Net Assets Method calculates the equity by subtracting total liabilities from total assets.

[ \text{Net Assets} = \text{Total Assets} - \text{Total Liabilities} ] [ \text{Net Assets} = 7,19,500 - 6,21,500 = 98,000 ]

- Determine Value per Share Using Net Assets Method

Divide the net assets by the number of equity shares to find the value per share.

[ \text{Value per Share (Net Assets Method)} = \frac{\text{Net Assets}}{\text{Number of Shares}} ] [ \text{Value per Share} = \frac{98,000}{27,500} \approx 3.56 ]

- Calculate Average Net Profit for Yield Basis Method

Calculate the average net profit for the past three years.

[ \text{Average Net Profit} = \frac{(1,23,750 + 1,34,750 + 1,37,500)}{3} = \frac{3,95,000}{3} = 1,31,667 ]

- Transfer 25% of Profit to Reserve Fund

Calculate the amount transferred to the reserve.

[ \text{Reserve Transfer} = 0.25 \times \text{Average Net Profit} = 0.25 \times 1,31,667 \approx 32,917 ]

- Calculate Adjusted Net Profit

Subtract the reserve from the average net profit to find the adjusted profit.

[ \text{Adjusted Net Profit} = \text{Average Net Profit} - \text{Reserve Transfer} ] [ \text{Adjusted Net Profit} = 1,31,667 - 32,917 \approx 98,750 ]

- Calculate Value per Share Using Yield Basis Method

Use the fair yield to calculate the value per share.

[ \text{Value per Share (Yield Basis Method)} = \frac{\text{Adjusted Net Profit}}{\text{Fair Yield}} ]

[ \text{Value per Share} = \frac{98,750}{0.10} = 9,87,500 ]

- Calculate Value per Share Using Fair Value Method

Divide the average profit by the required yield rate.

[ \text{Value per Share (Fair Value Method)} = \frac{\text{Average Net Profit}}{\text{Fair Yield Rate}} ] [ \text{Value per Share} = \frac{1,31,667}{0.10} = 13,16,670 ]

- Value per Share (Net Assets Method): $3.56$

- Value per Share (Yield Basis Method): $9,87,500$

- Value per Share (Fair Value Method): $13,16,670$

More Information

The calculations show different methods for valuing a company's shares, reflecting varying perspectives on profitability and asset valuation. Each method emphasizes different aspects of company performance and financial health.

Tips

- Forgetting to correctly sum total assets and liabilities.

- Not properly adjusting profits before calculating share value under the Yield Basis Method.

- Miscalculating the fair yield or average profit, leading to incorrect valuations.

AI-generated content may contain errors. Please verify critical information