Calculate the costs of the refrigerator models using activity-based costing (ABC) based on the provided data.

Understand the Problem

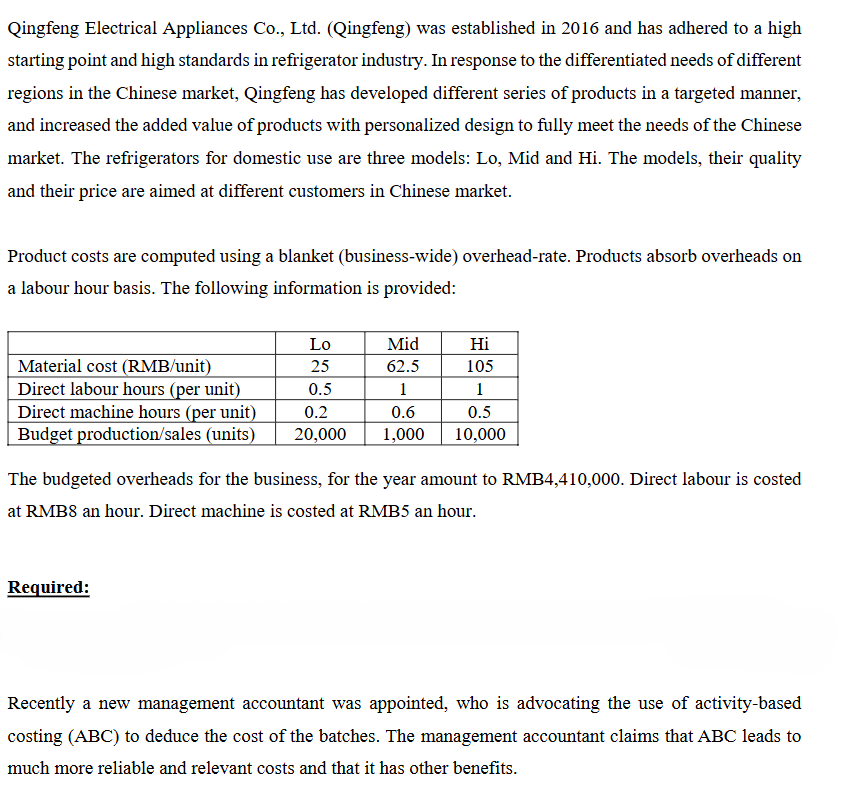

The question is about calculating the costs of different refrigerator models using activity-based costing (ABC) based on provided data. It requires interpretation of costs, direct labour hours, machine hours, and production units to analyze financial planning.

Answer

Total cost for Lo = RMB 600,000, for Mid = RMB 73,500, for Hi = RMB 1,155,000.

Answer for screen readers

- Total direct labour cost = RMB 168,000

- Total direct machine cost = RMB 48,000

- Total cost for Lo = RMB 500,000 + RMB 80,000 + RMB 20,000 = RMB 600,000

- Total cost for Mid = RMB 62,500 + RMB 8,000 + RMB 3,000 = RMB 73,500

- Total cost for Hi = RMB 1,050,000 + RMB 80,000 + RMB 25,000 = RMB 1,155,000

Steps to Solve

- Calculate Total Direct Labour Cost

To find the total direct labour cost, we first determine the total direct labour hours for each model.

For Lo:

- Direct labour hours per unit = 0.5

- Budget production (units) = 20,000

- Total direct labour hours for Lo = $0.5 \times 20,000 = 10,000$ hours

For Mid:

- Direct labour hours per unit = 1

- Budget production (units) = 1,000

- Total direct labour hours for Mid = $1 \times 1,000 = 1,000$ hours

For Hi:

- Direct labour hours per unit = 1

- Budget production (units) = 10,000

- Total direct labour hours for Hi = $1 \times 10,000 = 10,000$ hours

Now sum the direct labour hours: $$ \text{Total direct labour hours} = 10,000 + 1,000 + 10,000 = 21,000 \text{ hours} $$

Now, calculate the total direct labour cost using the rate of RMB 8/hour: $$ \text{Total direct labour cost} = 21,000 \times 8 = RMB 168,000 $$

- Calculate Total Direct Machine Cost

Next, we calculate the total direct machine cost using the machine hours for each model.

For Lo:

- Direct machine hours per unit = 0.2

- Total direct machine hours for Lo = $0.2 \times 20,000 = 4,000$ hours

For Mid:

- Direct machine hours per unit = 0.6

- Total direct machine hours for Mid = $0.6 \times 1,000 = 600$ hours

For Hi:

- Direct machine hours per unit = 0.5

- Total direct machine hours for Hi = $0.5 \times 10,000 = 5,000$ hours

Now sum the direct machine hours: $$ \text{Total direct machine hours} = 4,000 + 600 + 5,000 = 9,600 \text{ hours} $$

Now, calculate the total direct machine cost using the rate of RMB 5/hour: $$ \text{Total direct machine cost} = 9,600 \times 5 = RMB 48,000 $$

- Calculate Total Overheads

The total budgeted overheads for the business is given as RMB 4,410,000. This includes both direct labour and direct machine costs.

- Calculate Total Cost for each Model

We now compute the total cost for each model (Lo, Mid, Hi) including material cost, direct labour cost, and direct machine cost.

For Lo:

- Material cost per unit = RMB 25

- Total material cost = $25 \times 20,000 = RMB 500,000$

- Model cost = Material Cost + Direct Labour Cost + Direct Machine Cost

For Mid:

- Material cost per unit = RMB 62.5

- Total material cost = $62.5 \times 1,000 = RMB 62,500$

For Hi:

- Material cost per unit = RMB 105

- Total material cost = $105 \times 10,000 = RMB 1,050,000$

Now, calculate total costs for each model:

- Lo Total Cost = $500,000 + (0.5 \times 8 \times 20,000) + (0.2 \times 5 \times 20,000)$

- Mid Total Cost = $62,500 + (1 \times 8 \times 1,000) + (0.6 \times 5 \times 1,000)$

- Hi Total Cost = $1,050,000 + (1 \times 8 \times 10,000) + (0.5 \times 5 \times 10,000)$

- Summarize Total Costs

Finally, sum all costs to provide insights into the financial planning for the models and deduce which model contributes to the costs effectively.

- Total direct labour cost = RMB 168,000

- Total direct machine cost = RMB 48,000

- Total cost for Lo = RMB 500,000 + RMB 80,000 + RMB 20,000 = RMB 600,000

- Total cost for Mid = RMB 62,500 + RMB 8,000 + RMB 3,000 = RMB 73,500

- Total cost for Hi = RMB 1,050,000 + RMB 80,000 + RMB 25,000 = RMB 1,155,000

More Information

The costs provided allow a comprehensive overview of resource allocation for each model. Understanding these breakdowns is essential for effective financial planning and management decision-making.

Tips

- Not Summing Correctly: Double-check totals when calculating for each model.

- Forgetting Overheads: Ensure to include both direct costs and overheads when analyzing financial impact.

- Misinterpreting Units: Verify if calculations for hours or units align with context (e.g., per annum vs. total).

AI-generated content may contain errors. Please verify critical information