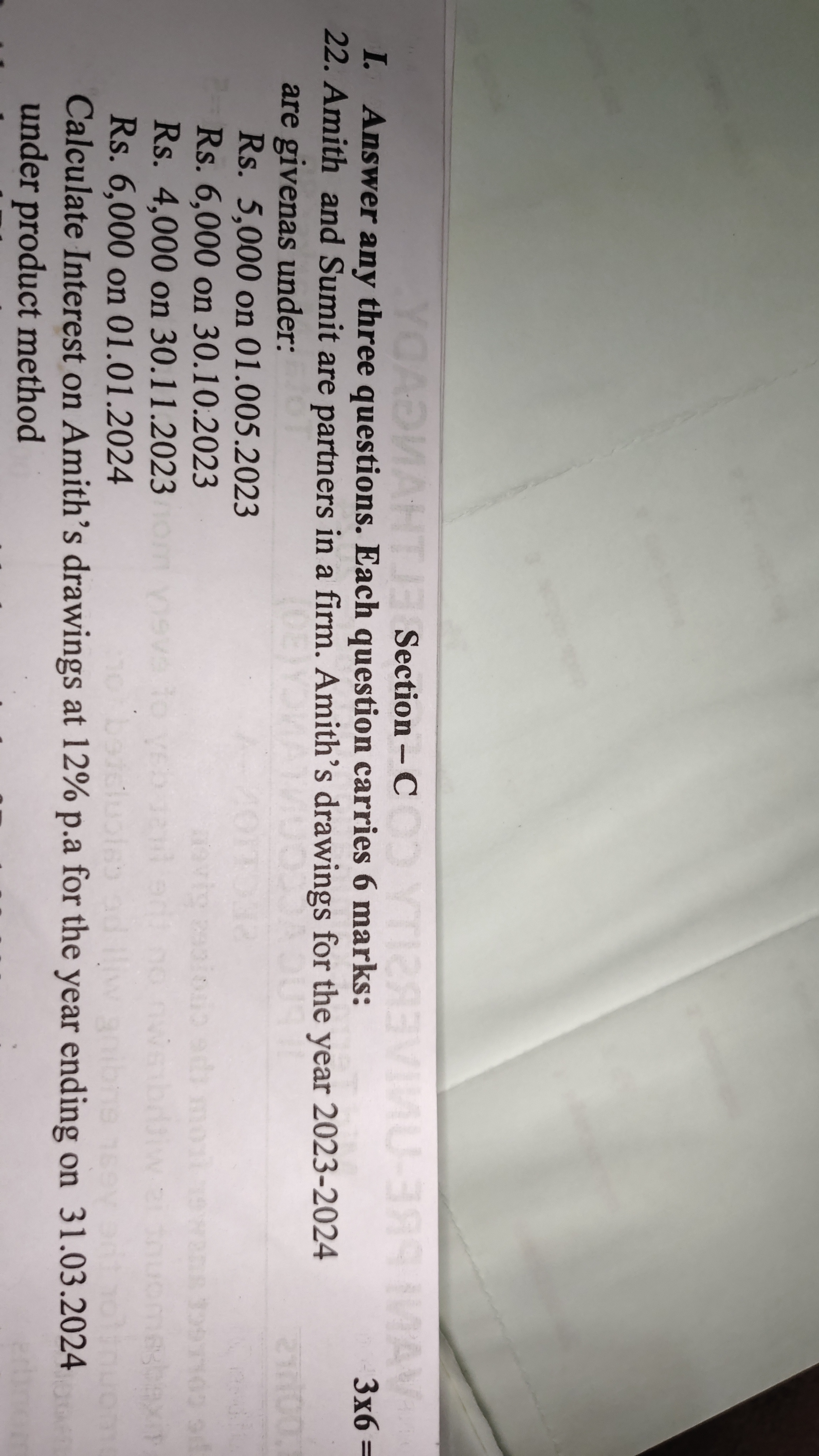

Calculate interest on Amith's drawings at 12% p.a. for the year ending on 31.03.2024.

Understand the Problem

The question is asking to calculate the interest on Amith's drawings using the product method, based on the provided details of amounts and dates for the year 2023-2024.

Answer

The total interest on Amith's drawings is ₹1268.

Answer for screen readers

The total interest on Amith's drawings for the year ending on 31.03.2024 is ₹1268.

Steps to Solve

- Identify the Drawings and Dates Amith made various drawings during the year 2023-2024. The amounts and dates are:

- ₹5,000 on 01.05.2023

- ₹6,000 on 30.10.2023

- ₹4,000 on 30.11.2023

- ₹6,000 on 01.01.2024

- Calculate the Time Period for Each Drawing We need to calculate the time each amount stays in the account until the end date (31.03.2024). The time is expressed in months.

- ₹5,000 on 01.05.2023 stays for 10 months (May to March)

- ₹6,000 on 30.10.2023 stays for 5 months (October to March)

- ₹4,000 on 30.11.2023 stays for 4 months (November to March)

- ₹6,000 on 01.01.2024 stays for 3 months (January to March)

- Calculate Interest for Each Drawing We will use the formula for simple interest: $$ \text{Interest} = \frac{\text{Principal} \times \text{Rate} \times \text{Time}}{100} $$ The rate is 12% per annum.

-

For ₹5,000: $$ \text{Interest} = \frac{5000 \times 12 \times 10}{100 \times 12} = ₹500 $$

-

For ₹6,000: $$ \text{Interest} = \frac{6000 \times 12 \times 5}{100 \times 12} = ₹360 $$

-

For ₹4,000: $$ \text{Interest} = \frac{4000 \times 12 \times 4}{100 \times 12} = ₹192 $$

-

For ₹6,000: $$ \text{Interest} = \frac{6000 \times 12 \times 3}{100 \times 12} = ₹216 $$

- Total Interest Calculation Add all the calculated interests together: $$ \text{Total Interest} = ₹500 + ₹360 + ₹192 + ₹216 = ₹1268 $$

The total interest on Amith's drawings for the year ending on 31.03.2024 is ₹1268.

More Information

Interest calculation is a fundamental aspect of finance, particularly for managing partnerships and personal accounts. Understanding the product method allows partners to accurately assess the financial standing over time.

Tips

- Not converting the time period into months correctly.

- Forgetting to apply the correct interest formula.

- Summing the individual interests inaccurately.

AI-generated content may contain errors. Please verify critical information