Calculate for each product the full cost using the traditional direct labor hour basis absorption of overheads. The management accountant wants to use activity-based costing to cal... Calculate for each product the full cost using the traditional direct labor hour basis absorption of overheads. The management accountant wants to use activity-based costing to calculate for each product. Explain the features of this method.

Understand the Problem

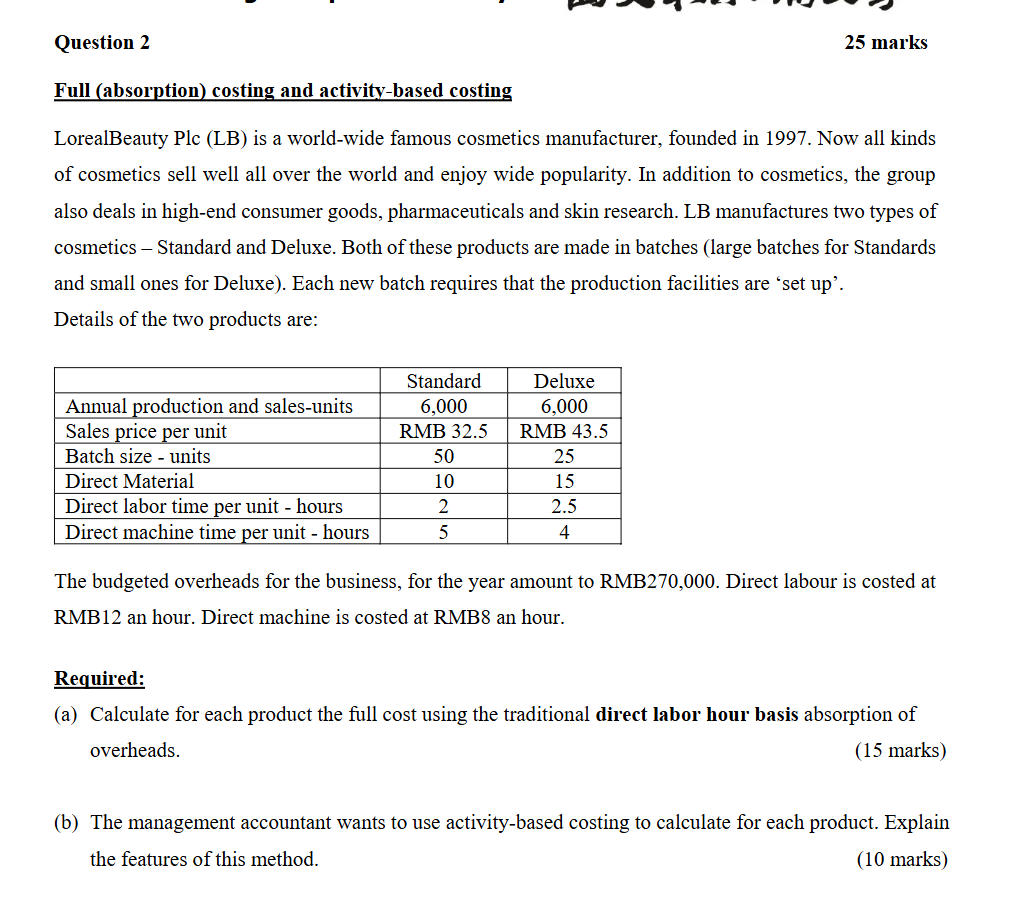

The question requires calculating the full cost of two cosmetic products (Standard and Deluxe) using traditional and activity-based costing methods, with details provided about production, costs, and overheads.

Answer

- Standard: $54$ - Deluxe: $70$

Answer for screen readers

The full cost per unit using traditional direct labor hour basis is:

- Standard: RMB 54

- Deluxe: RMB 70

Steps to Solve

-

Calculate Direct Costs To find the direct costs for each product, sum the direct material and direct labor costs per unit.

-

For Standard:

- Direct Material: RMB 10

- Direct Labor: RMB 2 \times 12 = RMB 24

- Total Direct Cost = $10 + 24 = 34$

-

For Deluxe:

- Direct Material: RMB 15

- Direct Labor: RMB 2.5 \times 12 = RMB 30

- Total Direct Cost = $15 + 30 = 45$

-

-

Calculate Total Overhead Cost The total budgeted overheads for the year are RMB 270,000. Since we are using direct labor hours to allocate overhead, we need to find the total direct labor hours for both products.

-

Standard:

- Direct labor time per unit: 2 hours

- Total for 6000 units = $6000 \times 2 = 12,000$ hours

-

Deluxe:

- Direct labor time per unit: 2.5 hours

- Total for 6000 units = $6000 \times 2.5 = 15,000$ hours

-

Total Direct Labor Hours = $12000 + 15000 = 27000$ hours

-

-

Calculate Overhead Rate Determine the overhead absorption rate by dividing the total overhead costs by the total direct labor hours.

- Overhead Rate = $\frac{RMB 270,000}{27,000 \text{ hours}} = RMB 10$ per hour

-

Allocate Overhead to Each Product Calculate the overhead allocated to each product based on the total direct labor hours utilized.

- Standard Overhead = $12,000 , \text{hours} \times 10 = RMB 120,000$

- Deluxe Overhead = $15,000 , \text{hours} \times 10 = RMB 150,000$

-

Calculate Full Cost per Unit for Each Product Add the allocated overhead and direct costs for each product to find the total cost and then divide by the annual production to find the cost per unit.

-

Standard Total Cost = $120,000 + 34 \times 6000 = RMB 120,000 + 204,000 = RMB 324,000$

-

Cost per Unit (Standard) = $\frac{RMB 324,000}{6000} = RMB 54$

-

Deluxe Total Cost = $150,000 + 45 \times 6000 = RMB 150,000 + 270,000 = RMB 420,000$

-

Cost per Unit (Deluxe) = $\frac{RMB 420,000}{6000} = RMB 70$

-

The full cost per unit using traditional direct labor hour basis is:

- Standard: RMB 54

- Deluxe: RMB 70

More Information

The traditional costing method allocates overhead costs based on direct labor hours. This approach may not accurately reflect the actual resource consumption of the products, leading to potential miscosting.

Tips

- Neglecting to calculate total direct labor hours correctly: Always double-check the calculations based on the number of units produced.

- Incorrectly calculating overhead rates: Ensure the total overhead is divided by the correct total hours.

- Forgetting to sum direct costs correctly: Make sure all components of direct costs (materials and labor) are added accurately.

AI-generated content may contain errors. Please verify critical information