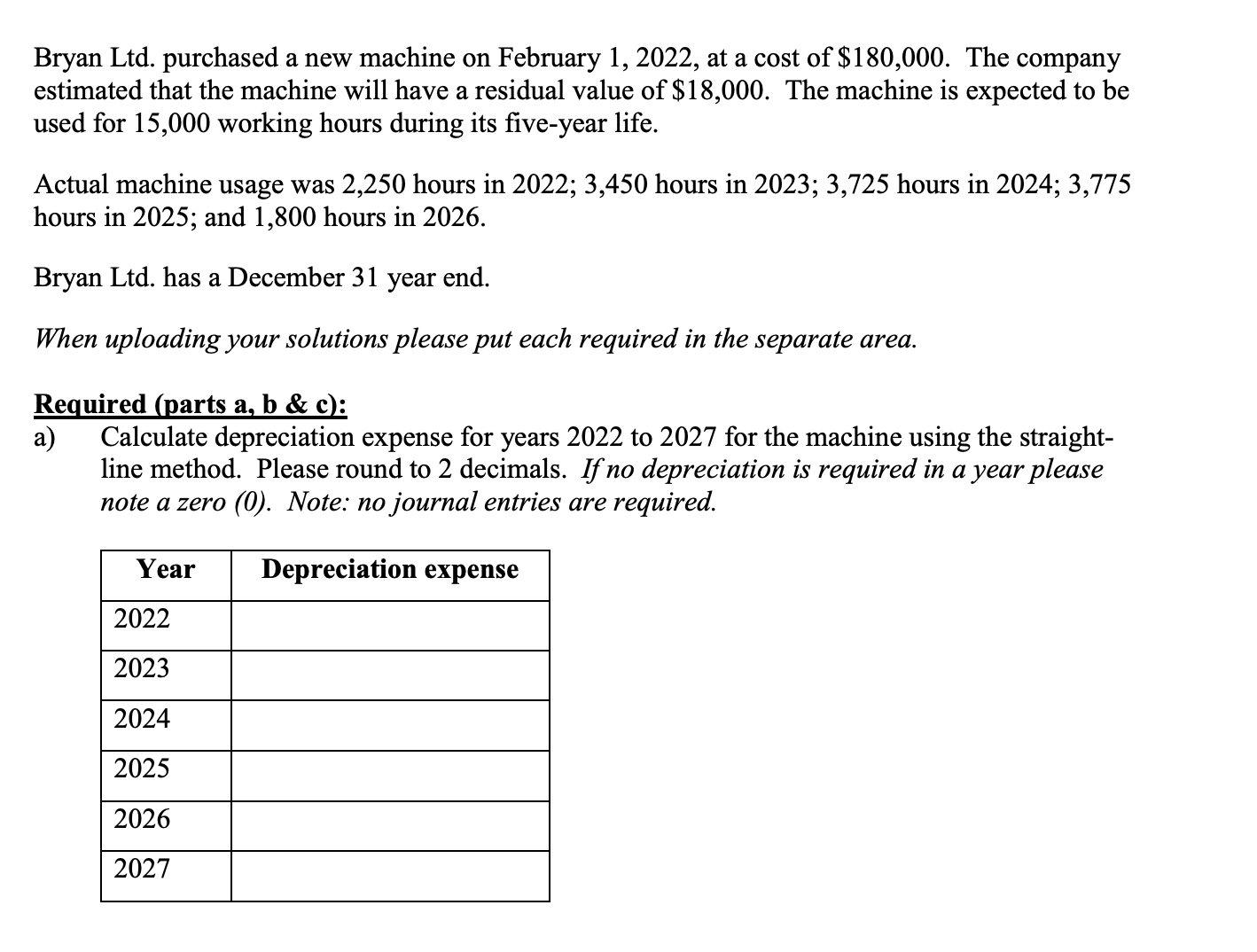

Calculate depreciation expense for years 2022 to 2027 for the machine using the straight-line method.

Understand the Problem

The question is asking for the calculation of depreciation expense for the years 2022 to 2027, based on the straight-line method of depreciation for a new machine. It provides specific details about the machine's cost, residual value, expected usage, and actual usage in various years, which will be needed to determine the annual depreciation expense for each specified year.

Answer

The annual depreciation expense for each year from 2022 to 2027 is $32,400.00.

Answer for screen readers

| Year | Depreciation Expense |

|---|---|

| 2022 | $32,400.00 |

| 2023 | $32,400.00 |

| 2024 | $32,400.00 |

| 2025 | $32,400.00 |

| 2026 | $32,400.00 |

| 2027 | $32,400.00 |

Steps to Solve

- Calculate Depreciable Amount

First, determine the depreciable amount of the machine: [ \text{Depreciable Amount} = \text{Cost} - \text{Residual Value} ] Substituting the values: [ \text{Depreciable Amount} = 180,000 - 18,000 = 162,000 ]

- Determine Annual Depreciation Expense

Next, find the annual depreciation expense using the straight-line method. Since the machine is expected to be used for five years, calculate: [ \text{Annual Depreciation Expense} = \frac{\text{Depreciable Amount}}{\text{Useful Life}} ] Substituting the values: [ \text{Annual Depreciation Expense} = \frac{162,000}{5} = 32,400 ]

- Identify Depreciation for Each Year

Now, fill in the depreciation expenses for each year from 2022 to 2027. Since there are no usage restrictions under the straight-line method, the depreciation expense is the same each year:

- 2022: $32,400

- 2023: $32,400

- 2024: $32,400

- 2025: $32,400

- 2026: $32,400

- 2027: $32,400

- Note Years with Zero Depreciation

In this case, every year from 2022 to 2027 has a depreciation expense. There are no years where depreciation is noted as zero.

| Year | Depreciation Expense |

|---|---|

| 2022 | $32,400.00 |

| 2023 | $32,400.00 |

| 2024 | $32,400.00 |

| 2025 | $32,400.00 |

| 2026 | $32,400.00 |

| 2027 | $32,400.00 |

More Information

The straight-line method of depreciation evenly spreads the cost of the asset over its useful life. Here, the machine's cost minus its residual value is evenly allocated over five years, resulting in consistent annual expenses.

Tips

- Miscalculating the depreciable amount by not subtracting the residual value properly.

- Forgetting to confirm the useful life of the asset.

AI-generated content may contain errors. Please verify critical information