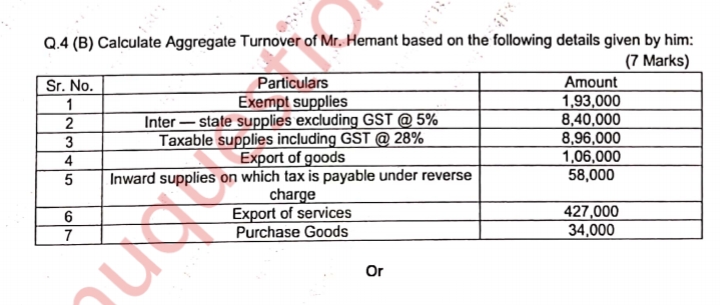

Calculate Aggregate Turnover of Mr. Hemant based on the following details given by him.

Understand the Problem

The question is asking to calculate the aggregate turnover of Mr. Hemant based on various financial details provided. This involves adding up the relevant amounts according to the rules and exemptions related to GST.

Answer

The aggregate turnover of Mr. Hemant is $20,73,000$.

Answer for screen readers

The aggregate turnover of Mr. Hemant is $20,73,000$.

Steps to Solve

- Identify Eligible Inclusions for Turnover To calculate the aggregate turnover, consider the items that contribute to it as per GST regulations. The relevant items are:

- Inter – state supplies

- Taxable supplies (exclusive of GST)

- Export of goods

- Export of services

-

Exclude Non-eligible Items Do not include exempt supplies, inward supplies on which tax is payable under reverse charge, and purchase goods since they do not count towards gross turnover.

-

Calculate Total Aggregate Turnover Add the eligible amounts:

-

Inter – state supplies: $8,40,000$

-

Taxable supplies (excluding GST): To find this, first determine the taxable amount from the provided inclusive amount at 28%. This is done using the formula:

$$ \text{Taxable supplies} = \frac{\text{Total inclusive amount}}{1 + \text{GST rate}} $$

Thus,

$$ \text{Taxable supplies} = \frac{8,96,000}{1 + 0.28} = \frac{8,96,000}{1.28} = 7,00,000 $$

-

Export of goods: $1,06,000$

-

Export of services: $4,27,000$

Now, sum these amounts:

$$ \text{Aggregate Turnover} = 8,40,000 + 7,00,000 + 1,06,000 + 4,27,000 $$

- Final Calculation Calculating the sum:

$$ \text{Aggregate Turnover} = 8,40,000 + 7,00,000 + 1,06,000 + 4,27,000 = 20,73,000 $$

The aggregate turnover of Mr. Hemant is $20,73,000$.

More Information

The calculation of aggregate turnover is crucial for GST compliance and reporting. Understanding which supplies count towards this total helps businesses gauge their obligations under GST law.

Tips

- Including exempt supplies in the aggregate turnover calculation. Always check which items are eligible.

- Forgetting to convert the taxable supplies from inclusive GST to exclusive amounts correctly.

AI-generated content may contain errors. Please verify critical information