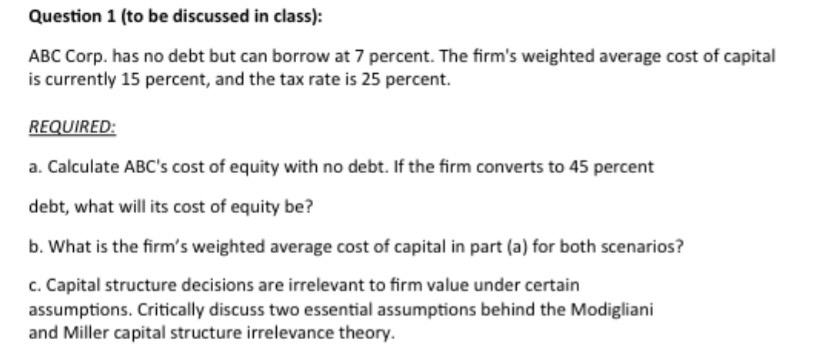

Calculate ABC's cost of equity with no debt. If the firm converts to 45 percent debt, what will its cost of equity be? What is the firm's weighted average cost of capital in part (... Calculate ABC's cost of equity with no debt. If the firm converts to 45 percent debt, what will its cost of equity be? What is the firm's weighted average cost of capital in part (a) for both scenarios? Critically discuss two essential assumptions behind the Modigliani and Miller capital structure irrelevance theory.

Understand the Problem

The question provides a scenario involving ABC Corp's finances and requires calculations related to the cost of equity and the weighted average cost of capital under different debt scenarios. It also asks for a discussion of capital structure theory.

Answer

Cost of equity with no debt: $15\%$; Cost of equity with 45% debt: approximately $17.08\%$; WACC with no debt: $15\%$; WACC with 45% debt: approximately $15.41\%$.

Answer for screen readers

a. Cost of equity with no debt: $15%$. Cost of equity with 45% debt: approximately $17.08%$.

b. WACC with no debt: $15%$. WACC with 45% debt: approximately $15.41%$.

c. Essential assumptions of Modigliani-Miller Theory include no taxes and no bankruptcy costs.

Steps to Solve

-

Determine Cost of Equity with No Debt To find the cost of equity when there is no debt, we can use the fact that the weighted average cost of capital (WACC) equals the cost of equity for an all-equity firm. Thus, the cost of equity ( r_e ) is: $$ r_e = WACC = 15% $$

-

Calculate Cost of Equity at 45% Debt Now, we need to apply the formula for the cost of equity when the company has some leverage. The formula derived from the capital asset pricing model (CAPM) is: $$ r_e = r_0 + \frac{(r_0 - r_d)(D/E)}{(1 - T)} $$ Where ( r_0 ) is the cost of equity without debt (15%), ( r_d ) is the cost of debt (7%), ( D/E ) is the debt-to-equity ratio, and ( T ) is the tax rate (25%).

First, we need to find ( D/E ) when the firm has 45% debt. This means that: $$ D/E = \frac{0.45}{0.55} \approx 0.8182 $$

Substituting into the cost of equity equation: $$ r_e = 0.15 + \frac{(0.15 - 0.07)(0.8182)}{(1 - 0.25)} $$

- Calculate WACC for Both Scenarios The formula for WACC is: $$ WACC = \frac{E}{V} r_e + \frac{D}{V} r_d (1-T) $$ For the scenario with no debt, WACC is just the cost of equity: $$ WACC_{no\ debt} = 15% $$

For the scenario with 45% debt, substitute ( r_d ) and calculate:

- ( D = 0.45 )

- ( E = 0.55 )

- Substitute ( r_e ) from step 2 to find WACC.

-

Discuss Capital Structure Theories

Outline the essential assumptions of Modigliani-Miller theory:

- No taxes or bankruptcy costs

- Investors can borrow/lend at the same rate as firms

Also, mention how these assumptions affect the relevance of capital structure decisions.

a. Cost of equity with no debt: $15%$. Cost of equity with 45% debt: approximately $17.08%$.

b. WACC with no debt: $15%$. WACC with 45% debt: approximately $15.41%$.

c. Essential assumptions of Modigliani-Miller Theory include no taxes and no bankruptcy costs.

More Information

The cost of equity reflects investors' required return, while WACC represents the average return required by all capital providers. Modigliani-Miller suggests that under certain conditions, optimal capital structure does not exist for firm valuation.

Tips

- Miscalculating the debt-to-equity ratio.

- Confusing cost of debt and after-tax cost of debt in WACC.

- Ignoring the tax shield provided by debt when calculating WACC.

AI-generated content may contain errors. Please verify critical information