Understand the Problem

The question is asking for information related to the income tax procedures as detailed in the document. It likely pertains to rectification of mistakes and relevant sections related to tax assessment and appeals.

Answer

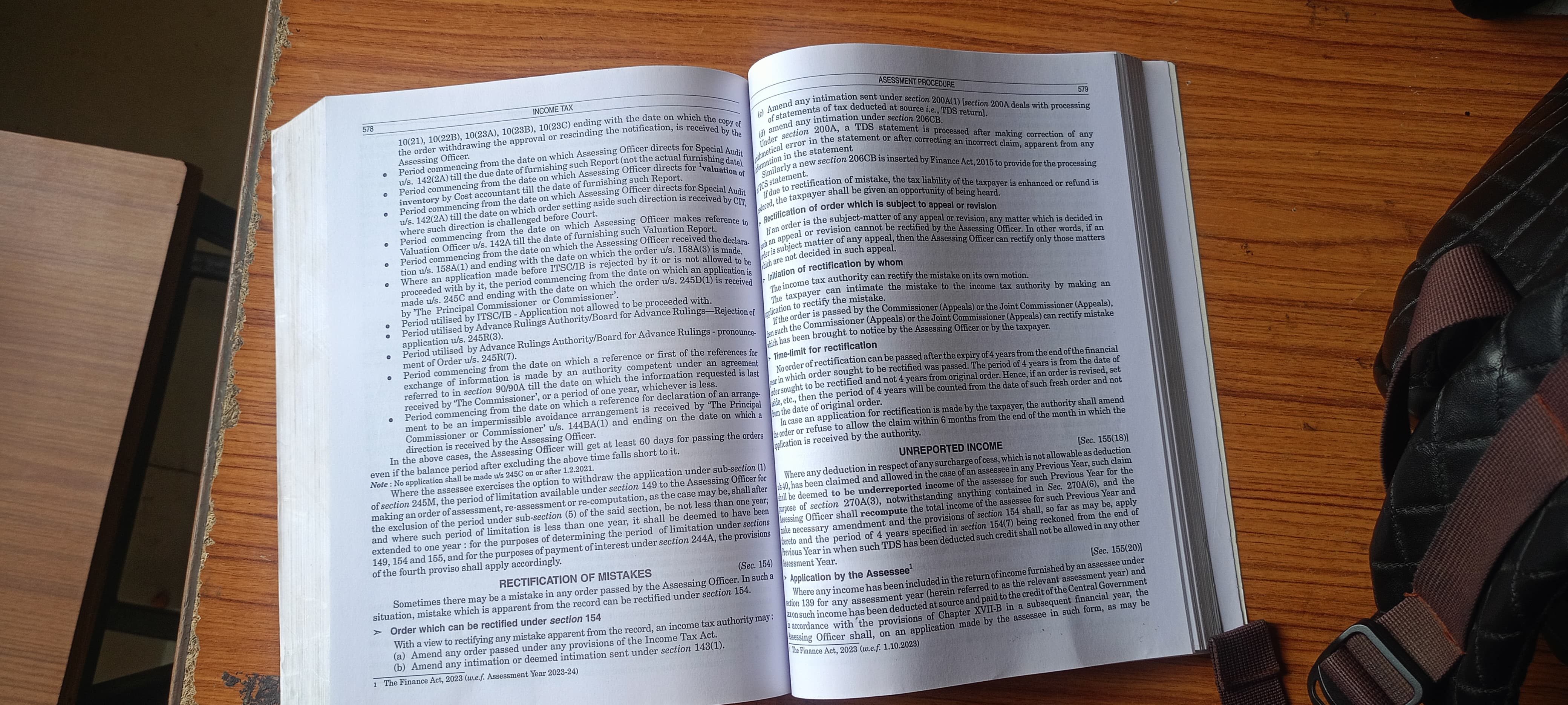

The page covers tax rectification processes and unreported income.

The page discusses procedures for rectification of mistakes and unreported income in tax assessments.

Answer for screen readers

The page discusses procedures for rectification of mistakes and unreported income in tax assessments.

More Information

Rectification of mistakes involves correcting errors in tax returns and assessments, under section 154, allowing adjustments based on administrative or assessment officer’s discretion.

Tips

Ensure all taxable income is accurately reported to avoid adjustments or penalties.

AI-generated content may contain errors. Please verify critical information