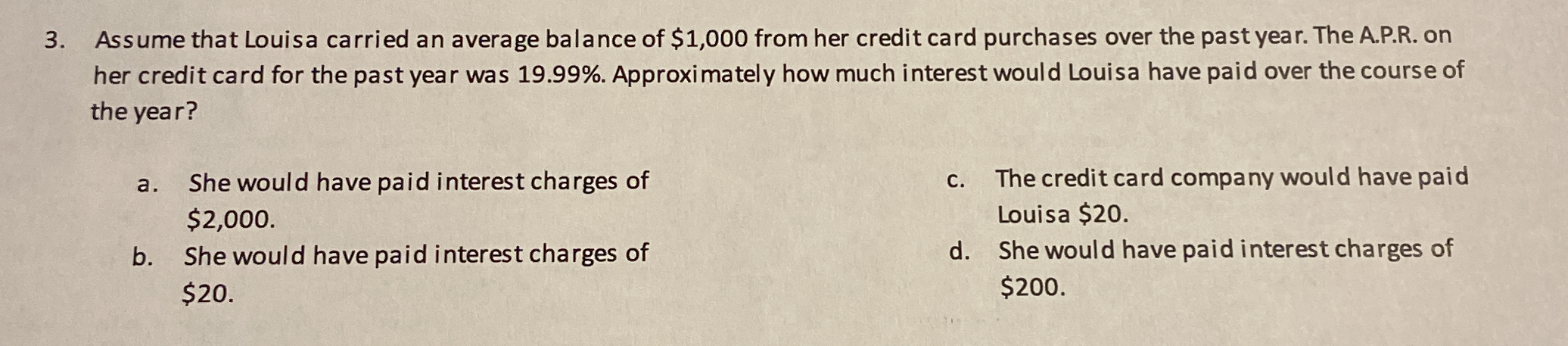

Assume that Louisa carried an average balance of $1,000 from her credit card purchases over the past year. The APR on her credit card for the past year was 19.99%. Approximately ho... Assume that Louisa carried an average balance of $1,000 from her credit card purchases over the past year. The APR on her credit card for the past year was 19.99%. Approximately how much interest would Louisa have paid over the course of the year?

Understand the Problem

The question asks us to calculate the interest charges Louisa would have paid on her credit card balance of $1,000 at an annual percentage rate (APR) of 19.99% over the course of one year.

Answer

Louisa would have paid approximately $199.90 in interest charges.

Answer for screen readers

Louisa would have paid approximately $199.90 in interest charges.

Steps to Solve

- Identify the formula for interest calculation

To calculate the interest charges on the credit card balance, we use the formula:

$$ \text{Interest} = \text{Principal} \times \text{Rate} \times \text{Time} $$

Where:

- Principal = $1,000 (the average balance)

- Rate = 19.99% (the annual percentage rate, as a decimal it is $0.1999$)

- Time = 1 year

- Convert the annual percentage rate to decimal form

Before calculating, convert the APR to its decimal equivalent:

$$ \text{Rate} = \frac{19.99}{100} = 0.1999 $$

- Substitute the values into the formula

Now, substitute the values into the interest formula:

$$ \text{Interest} = 1000 \times 0.1999 \times 1 $$

- Calculate the interest

Perform the multiplication:

$$ \text{Interest} = 1000 \times 0.1999 = 199.90 $$

This means Louisa would have paid approximately $199.90 in interest over the year.

Louisa would have paid approximately $199.90 in interest charges.

More Information

The annual interest charges on credit cards can accumulate quickly, significantly impacting overall debt if not paid off. Understanding APR and how it affects borrowing costs is crucial for effective financial management.

Tips

- Ignoring the time factor: Some may forget to consider the time (in years) when calculating interest.

- Not converting the percentage to a decimal: Remembering to convert the percentage (APR) to decimal form is essential for accurate calculations.

AI-generated content may contain errors. Please verify critical information