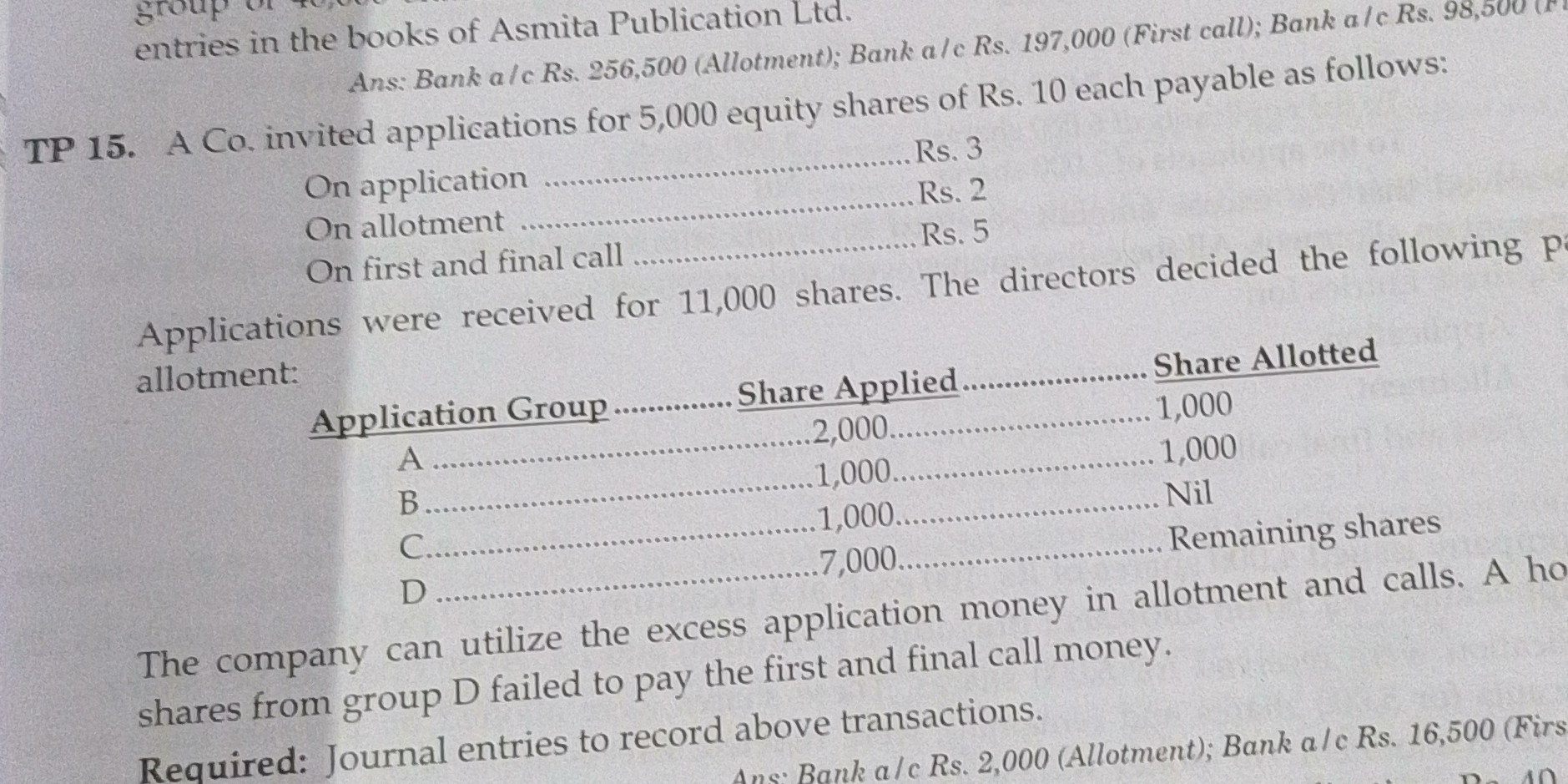

A company invited applications for 5,000 equity shares of Rs. 10 each payable as follows: On application Rs. 3; On allotment Rs. 2; On first and final call Rs. 5. Applications were... A company invited applications for 5,000 equity shares of Rs. 10 each payable as follows: On application Rs. 3; On allotment Rs. 2; On first and final call Rs. 5. Applications were received for 11,000 shares. The directors decided the following allotment: Application Group A: 2,000 shares applied, 1,000 shares allotted; B: 1,000 applied and allotted; C: 1,000 applied and nil allotted; D: 7,000 applied and remaining shares allotted. Required: Journal entries to record above transactions.

Understand the Problem

The question is asking for journal entries to be recorded for share applications and allotments made by a company based on the details provided regarding the applications received. It requires accounting entries to track the financial implications of share allotment and excess applications.

Answer

The journal entries for the transactions are recorded in the respective accounts as detailed above.

Answer for screen readers

Bank A/c Dr 15,000

To Share Application A/c 15,000

Bank A/c Dr 10,000

To Share Allotment A/c 10,000

Bank A/c Dr 25,000

To Share First and Final Call A/c 25,000

Share Application A/c Dr 3,000

To Share Allotment A/c 3,000

Steps to Solve

-

Calculate Total Applications and Allotment

A Co. received applications for 11,000 shares, but only 5,000 are available for allotment. The allotment is done as follows:

- Application Group A: 2,000 applied, 1,000 allotted.

- Application Group B: 1,000 applied, 1,000 allotted.

- Application Group C: 1,000 applied, 0 allotted.

- Application Group D: 7,000 applied, remaining shares allotted (3,000 shares).

-

Record Application Money Received

For applications received:

- Total amount from Group A: $1,000 \times 3 = 3,000$

- Total amount from Group B: $1,000 \times 3 = 3,000$

- Total amount from Group C: $1,000 \times 3 = 3,000$

- Total amount from Group D: $3,000 \times 3 = 9,000$

Thus, total application money received is:

$$ \text{Total Application Money} = 3,000 + 3,000 + 0 + 9,000 = 15,000 $$

Journal entry:

Bank A/c Dr 15,000 To Share Application A/c 15,000 -

Record Allotment Money Received

On allotment, each person is to pay Rs. 2 per share allotted:

Total allotment money = $5,000 \times 2 = 10,000$

Journal entry:

Bank A/c Dr 10,000 To Share Allotment A/c 10,000 -

Record Calls Made

The first and final call of Rs. 5 must be paid by shareholders on 5,000 shares allotted. Total call money = $5,000 \times 5 = 25,000$.

Journal entry:

Bank A/c Dr 25,000 To Share First and Final Call A/c 25,000 -

Utilize Excess Application Money

According to the information provided, Group D's excess applications can be utilized because they failed to pay the first and final call.

Journal entry for adjusting:

Share Application A/c Dr 3,000 To Share Allotment A/c 3,000

Bank A/c Dr 15,000

To Share Application A/c 15,000

Bank A/c Dr 10,000

To Share Allotment A/c 10,000

Bank A/c Dr 25,000

To Share First and Final Call A/c 25,000

Share Application A/c Dr 3,000

To Share Allotment A/c 3,000

More Information

These journal entries reflect the transactions related to the share application, allotment, and subsequent calls made on the shares. It's important to record these accurately for proper financial tracking in accounting.

Tips

- Not calculating the total application money correctly.

- Forgetting to record the adjustment for excess applications.

- Failing to clearly distinguish between each type of journal entry, leading to confusion in financial records.

AI-generated content may contain errors. Please verify critical information