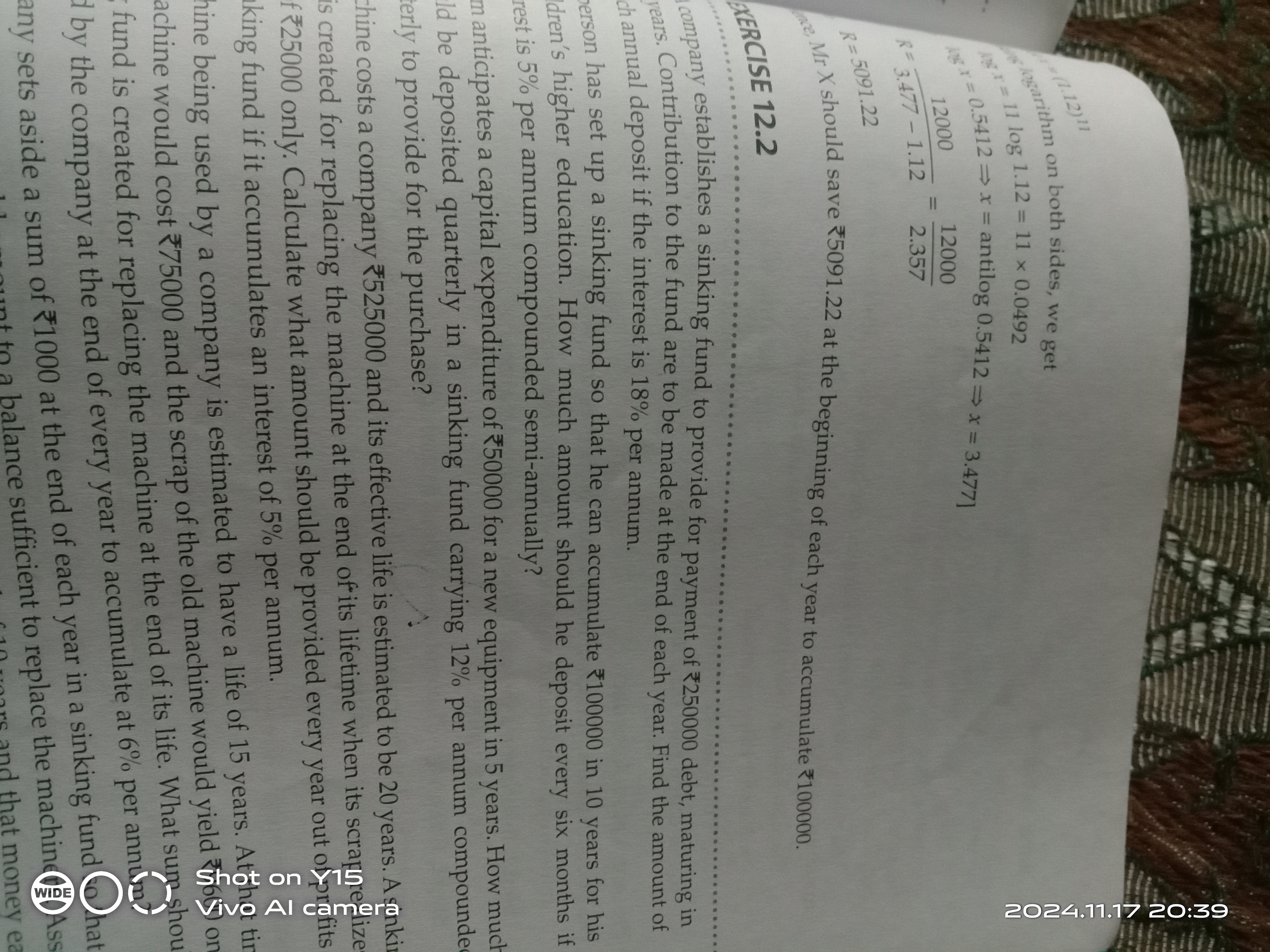

A company creates a sinking fund carrying 12% interest compounded semi-annually to accumulate ₹100000 in 15 years. How much should be deposited every six months?

Understand the Problem

The question is asking for the calculation of the amount that should be deposited into a sinking fund to accumulate a certain amount over a specified period, considering interest and other conditions. This involves financial mathematics and annuity formulas.

Answer

₹1715.84

Answer for screen readers

The amount that should be deposited quarterly in the sinking fund is approximately ₹1715.84.

Steps to Solve

-

Determine the future value needed The future value needed for the sinking fund is ₹250000 for replacing the machine.

-

Identify the interest rate and compounding frequency The interest rate is 12% per annum, compounded quarterly. Since it's compounded quarterly, we need to calculate the quarterly interest rate as follows: $$ r = \frac{12%}{4} = 3% = 0.03 $$ The number of compounding periods (quarters) over 15 years (15 years × 4 quarters) is: $$ n = 15 \times 4 = 60 $$

-

Use the future value of an annuity formula The formula for the future value of an ordinary annuity is given as: $$ FV = P \frac{(1 + r)^n - 1}{r} $$ Therefore, we will rearrange it to find the amount to deposit each period (P): $$ P = \frac{FV \cdot r}{(1 + r)^n - 1} $$

-

Plug in the values Substituting $FV = 250000$, $r = 0.03$, and $n = 60$ into the formula: $$ P = \frac{250000 \cdot 0.03}{(1 + 0.03)^{60} - 1} $$

-

Calculate the denominator First, we compute $(1 + 0.03)^{60} = 1.03^{60}$. Using this value: $$ 1.03^{60} \approx 5.383 $$ Thus, the denominator becomes: $$ 1.03^{60} - 1 \approx 5.383 - 1 = 4.383 $$

-

Final calculation of P Now substituting back to find $P$: $$ P = \frac{250000 \cdot 0.03}{4.383} \approx \frac{7500}{4.383} \approx 1715.84 $$

The amount that should be deposited quarterly in the sinking fund is approximately ₹1715.84.

More Information

This calculation is based on the future value of an ordinary annuity, which is commonly used in financial mathematics to determine how much to save regularly to reach a specific financial goal at the end of a specified period.

Tips

- Failing to adjust the interest rate for compounding frequency (e.g., using annual rates for quarterly calculations).

- Forgetting to account for the correct number of periods, especially when years are involved.

- Confusing future value (FV) and present value (PV) in calculations.

AI-generated content may contain errors. Please verify critical information