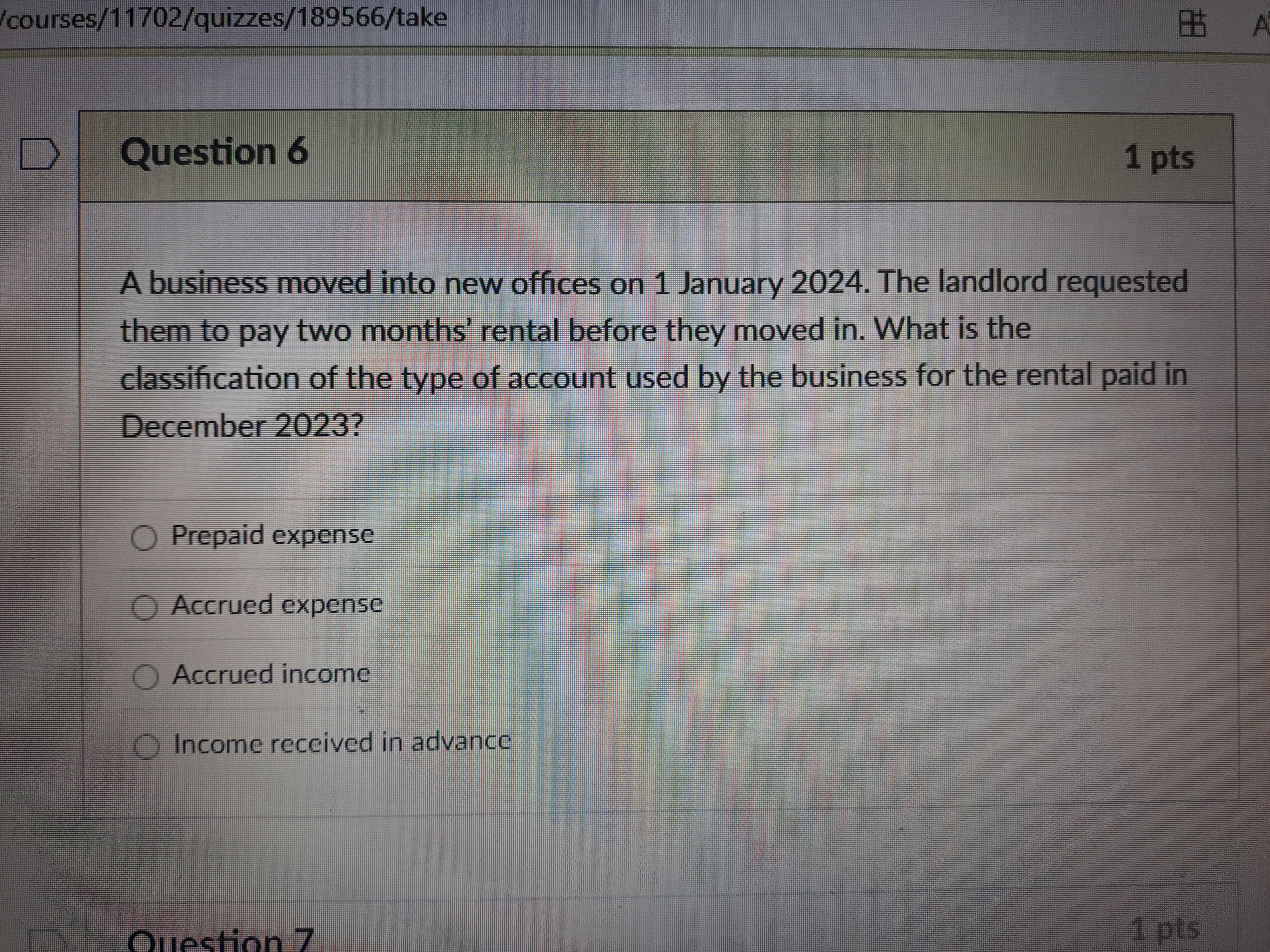

A business moved into new offices on 1 January 2024. The landlord requested them to pay two months’ rental before they moved in. What is the classification of the type of account u... A business moved into new offices on 1 January 2024. The landlord requested them to pay two months’ rental before they moved in. What is the classification of the type of account used by the business for the rental paid in December 2023?

Understand the Problem

The question is asking to identify the type of account classification for the rental payment made by a business in December 2023 for a lease that starts in January 2024. This relates to the accounting treatment of prepayments or accruals.

Answer

Prepaid Expense

The classification of the type of account used by the business for the rental paid in December 2023 is Prepaid Expense.

Answer for screen readers

The classification of the type of account used by the business for the rental paid in December 2023 is Prepaid Expense.

More Information

Prepaid expenses are costs that have been paid in advance and will provide future economic benefits. They are recorded as current assets on the balance sheet until the expense is incurred.

Tips

A common mistake is confusing prepaid expenses with accrued expenses. Remember, prepaid expenses are paid for in advance, while accrued expenses have been incurred but not yet paid.

Sources

AI-generated content may contain errors. Please verify critical information