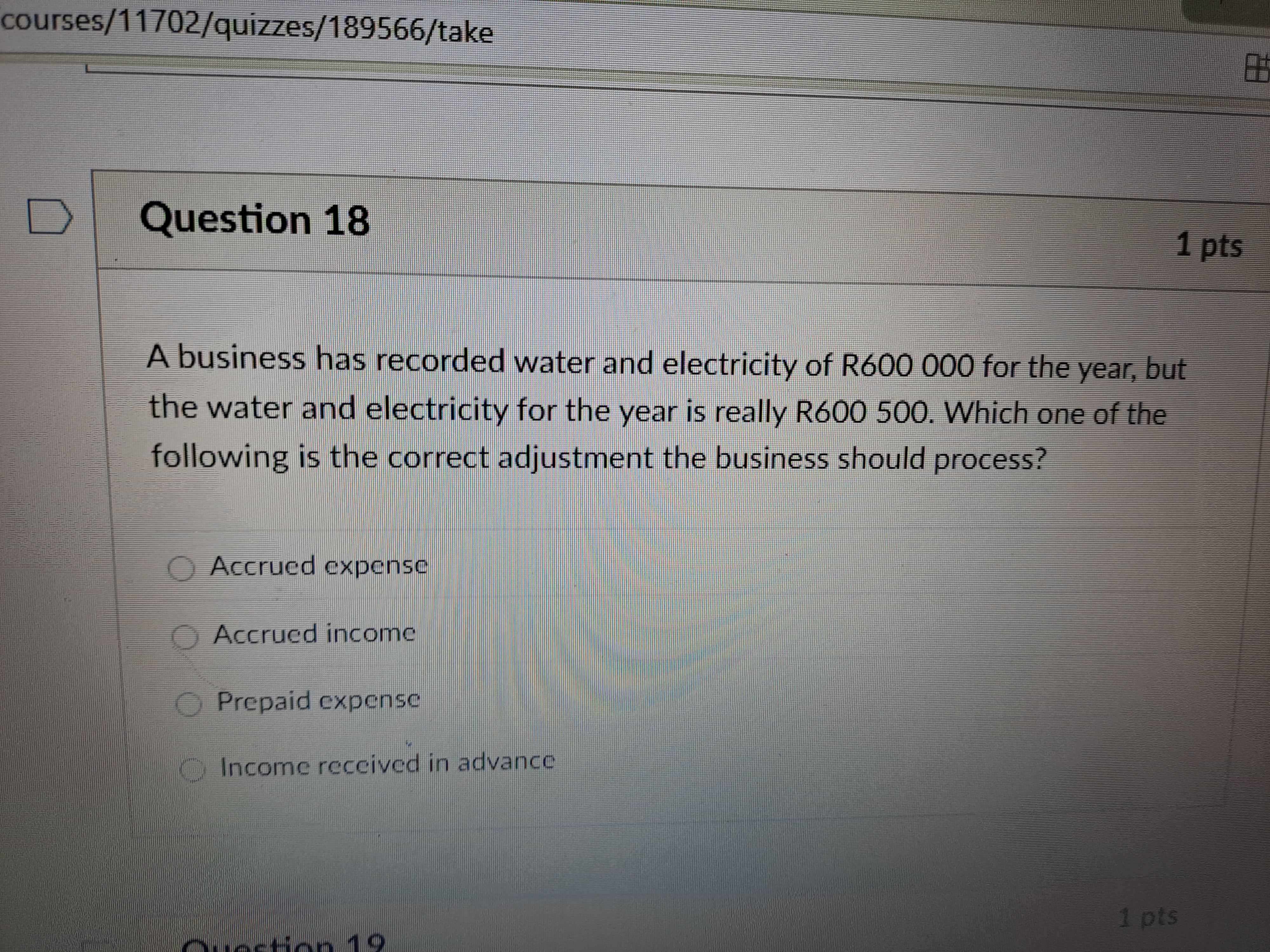

A business has recorded water and electricity of R600,000 for the year, but the water and electricity for the year is really R600,500. Which one of the following is the correct adj... A business has recorded water and electricity of R600,000 for the year, but the water and electricity for the year is really R600,500. Which one of the following is the correct adjustment the business should process?

Understand the Problem

The question is asking which adjustment the business should make to correct its financial records for water and electricity expenses, which have been recorded inaccurately.

Answer

Accrued expense.

The final answer is Accrued expense.

Answer for screen readers

The final answer is Accrued expense.

More Information

Accrued expenses are liabilities for goods or services received but not yet paid or recorded. Recognizing this adjustment ensures the financial statements accurately reflect the business's obligations.

Tips

A common mistake is confusing 'accrued expenses' with 'prepaid expenses'. Remember, accrued expenses are incurred but not yet recorded or paid.

Sources

- Solved: A business has recorded water and electricity... - studocu.com

AI-generated content may contain errors. Please verify critical information