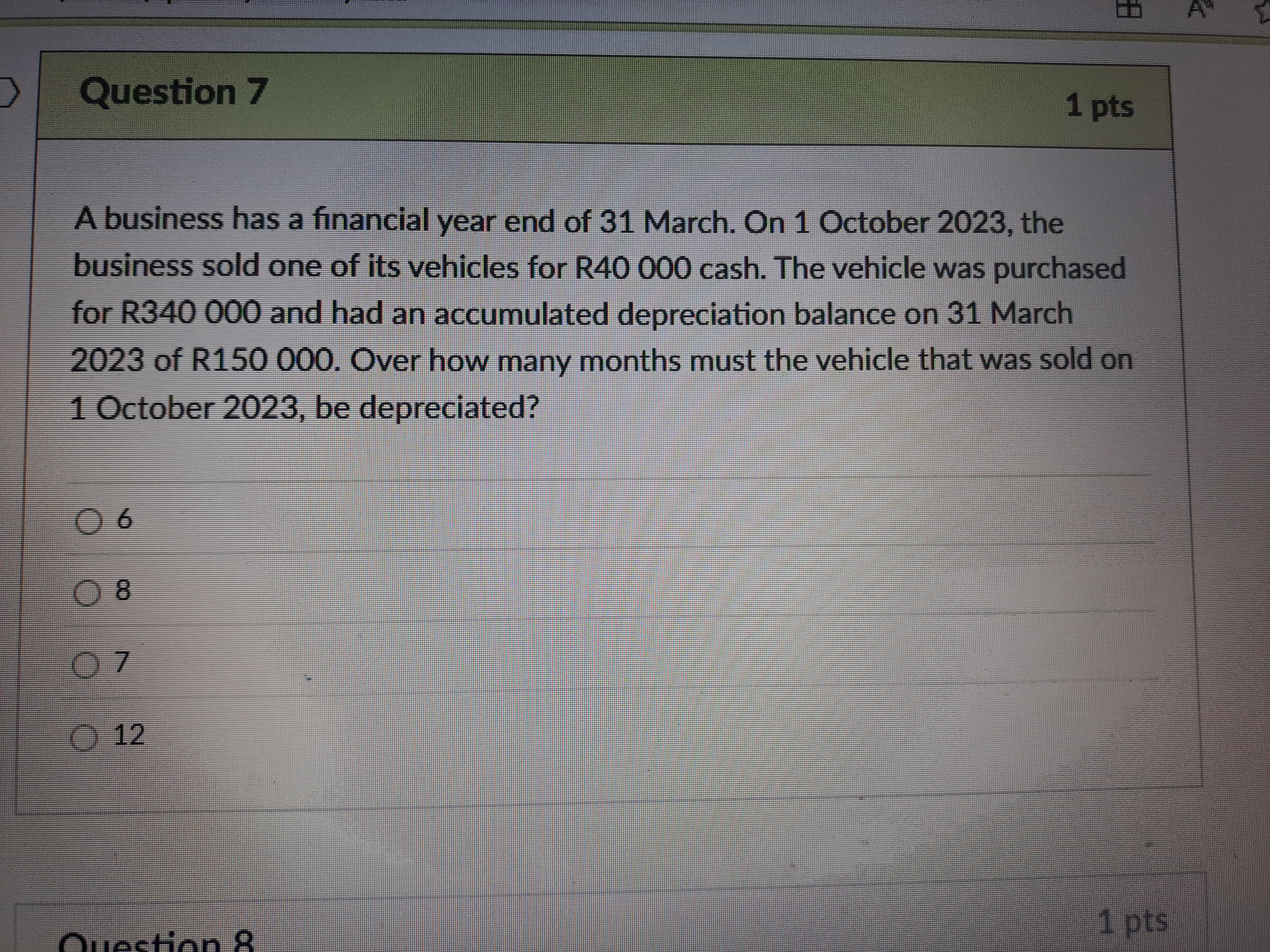

A business has a financial year end of 31 March. On 1 October 2023, the business sold one of its vehicles for R40 000 cash. The vehicle was purchased for R340 000 and had an accumu... A business has a financial year end of 31 March. On 1 October 2023, the business sold one of its vehicles for R40 000 cash. The vehicle was purchased for R340 000 and had an accumulated depreciation balance on 31 March 2023 of R150 000. Over how many months must the vehicle that was sold on 1 October 2023, be depreciated?

Understand the Problem

The question is asking how many months the vehicle sold on 1 October 2023 must be depreciated, based on its purchase price and accumulated depreciation up to a specific date.

Answer

$6$

Answer for screen readers

The vehicle must be depreciated for $6$ months.

Steps to Solve

- Identify Relevant Dates

The vehicle was sold on 1 October 2023, and the financial year ends on 31 March. We need to calculate the depreciation from 1 April 2023 to the date of sale.

- Calculate the Time Period

From the sale date (1 October 2023) to the end of the financial year (31 March 2024):

- Count the months:

- October (1 month)

- November (2 months)

- December (3 months)

- January (4 months)

- February (5 months)

- March (6 months)

- Total Depreciation Period

The total number of months from 1 October 2023 to 31 March 2024 is 6 months.

The vehicle must be depreciated for $6$ months.

More Information

The answer reflects the time remaining in the financial year after the sale. Vehicles must continue to be depreciated according to the company's accounting policy, even if they are sold during the fiscal period.

Tips

Individuals often forget to count the months correctly or miscalculate the number of months until the end of the financial year. To avoid this mistake, carefully list each month clearly.

AI-generated content may contain errors. Please verify critical information