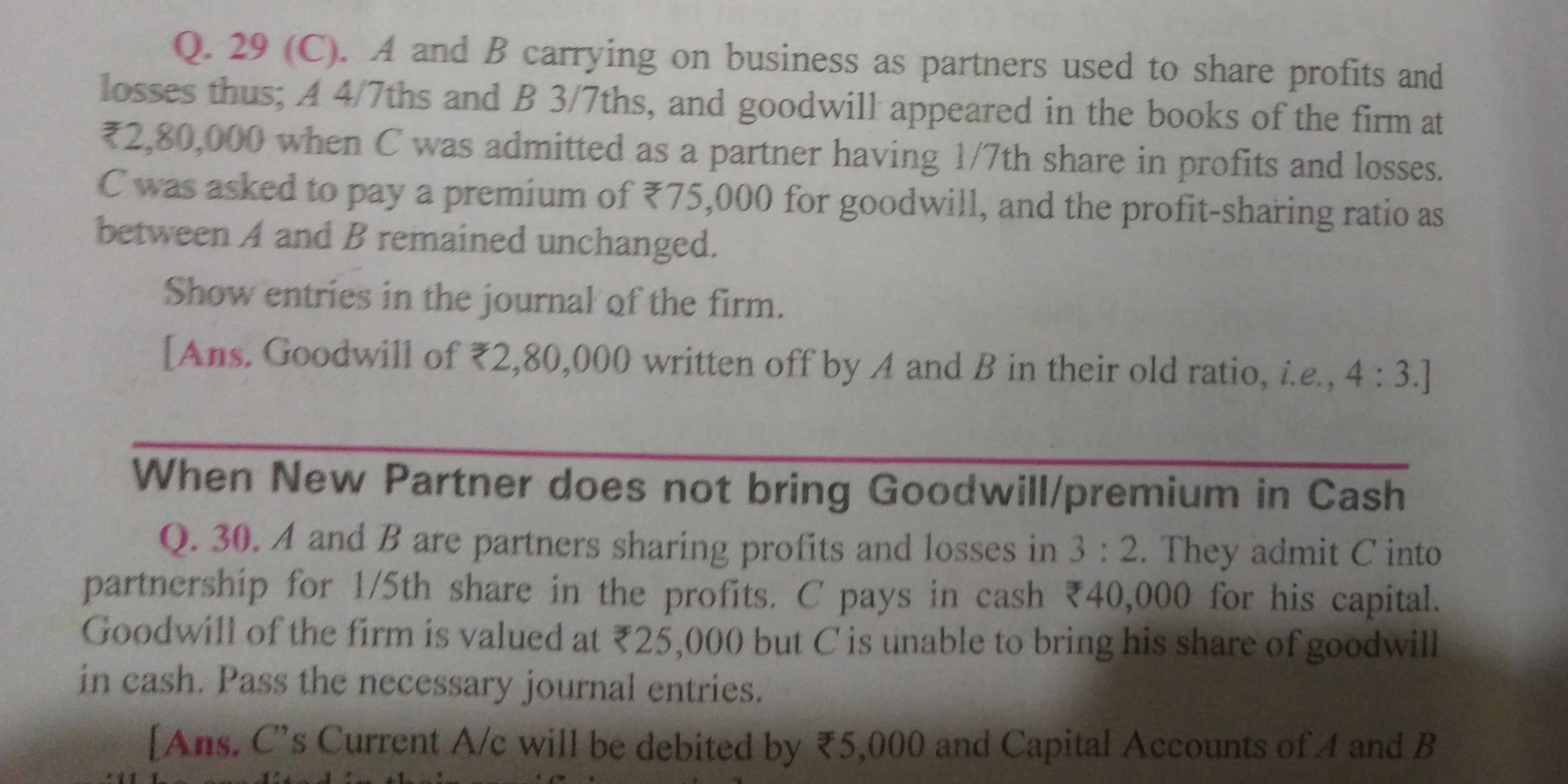

A and B carrying on business as partners used to share profits and losses thus; A 4/7ths and B 3/7ths, and goodwill appeared in the books of the firm at ₹2,80,000 when C was admitt... A and B carrying on business as partners used to share profits and losses thus; A 4/7ths and B 3/7ths, and goodwill appeared in the books of the firm at ₹2,80,000 when C was admitted as a partner having 1/7th share in profits and losses. C was asked to pay a premium of ₹75,000 for goodwill, and the profit-sharing ratio as between A and B remained unchanged. Show entries in the journal of the firm.

Understand the Problem

The question is asking to show the journal entries for a partnership involving three partners, A, B, and C, with specific shares in profit and losses, as well as involving goodwill calculations. The details include how goodwill is treated when C enters the partnership and how it affects the existing partners A and B.

Answer

- Journal entries include writing off goodwill and recording cash payment for goodwill by partner C.

Answer for screen readers

- Write off existing goodwill:

Dr: Goodwill Account ₹2,80,000

Cr: A's Capital Account ₹1,60,000

Cr: B's Capital Account ₹1,20,000

- Record premium paid by C:

Dr: Cash Account ₹75,000

Cr: A's Capital Account ₹42,857.14

Cr: B's Capital Account ₹32,142.86

Steps to Solve

- Calculate the Goodwill Share for A and B

Since the total goodwill is ₹2,80,000 and partner C is entitled to a 1/7th share, we first determine C's share:

[ \text{C's share of goodwill} = \frac{1}{7} \times 2,80,000 = ₹40,000 ]

Next, we find the remaining goodwill that needs to be shared between A and B:

[ \text{Goodwill for A and B} = 2,80,000 - 40,000 = ₹2,40,000 ]

Now, we calculate A and B's share of this remaining goodwill based on their existing profit-sharing ratio of 4:3.

[ \text{Total parts} = 4 + 3 = 7 ]

- Distribute Goodwill Between A and B

Now we allocate the remaining goodwill to A and B:

- A's portion:

[ \text{A's share of goodwill} = \frac{4}{7} \times 2,40,000 = ₹1,37,142.86 \text{ (approx)} ]

- B's portion:

[ \text{B's share of goodwill} = \frac{3}{7} \times 2,40,000 = ₹1,02,857.14 \text{ (approx)} ]

- Record the Goodwill Adjustment Journal Entries

Now we need to write off the total goodwill in the books by making the necessary journal entries:

- First, we write off the existing goodwill:

Debit: Goodwill Account ₹2,80,000

Credit: A's Capital Account ₹1,60,000

Credit: B's Capital Account ₹1,20,000

- Next, we record the payment of goodwill premium from partner C:

Debit: Cash Account ₹75,000

Credit: A's Capital Account ₹42,857.14

Credit: B's Capital Account ₹32,142.86

- Final Journal Entries

Thus, the final journal entries can be summarized as follows:

- Write off existing goodwill:

Dr: Goodwill Account ₹2,80,000

Cr: A's Capital Account ₹1,60,000

Cr: B's Capital Account ₹1,20,000

- Record premium paid by C:

Dr: Cash Account ₹75,000

Cr: A's Capital Account ₹42,857.14

Cr: B's Capital Account ₹32,142.86

- Write off existing goodwill:

Dr: Goodwill Account ₹2,80,000

Cr: A's Capital Account ₹1,60,000

Cr: B's Capital Account ₹1,20,000

- Record premium paid by C:

Dr: Cash Account ₹75,000

Cr: A's Capital Account ₹42,857.14

Cr: B's Capital Account ₹32,142.86

More Information

This process demonstrates how to account for goodwill when a new partner is admitted to a partnership, including adjustments to each partner's capital account based on the new partner's entry and the existing goodwill in the firm's records.

Tips

- Failing to apportion the goodwill correctly based on the profit-sharing ratio.

- Not accurately recording the entries, which can lead to incorrect capital balances for the partners.

AI-generated content may contain errors. Please verify critical information