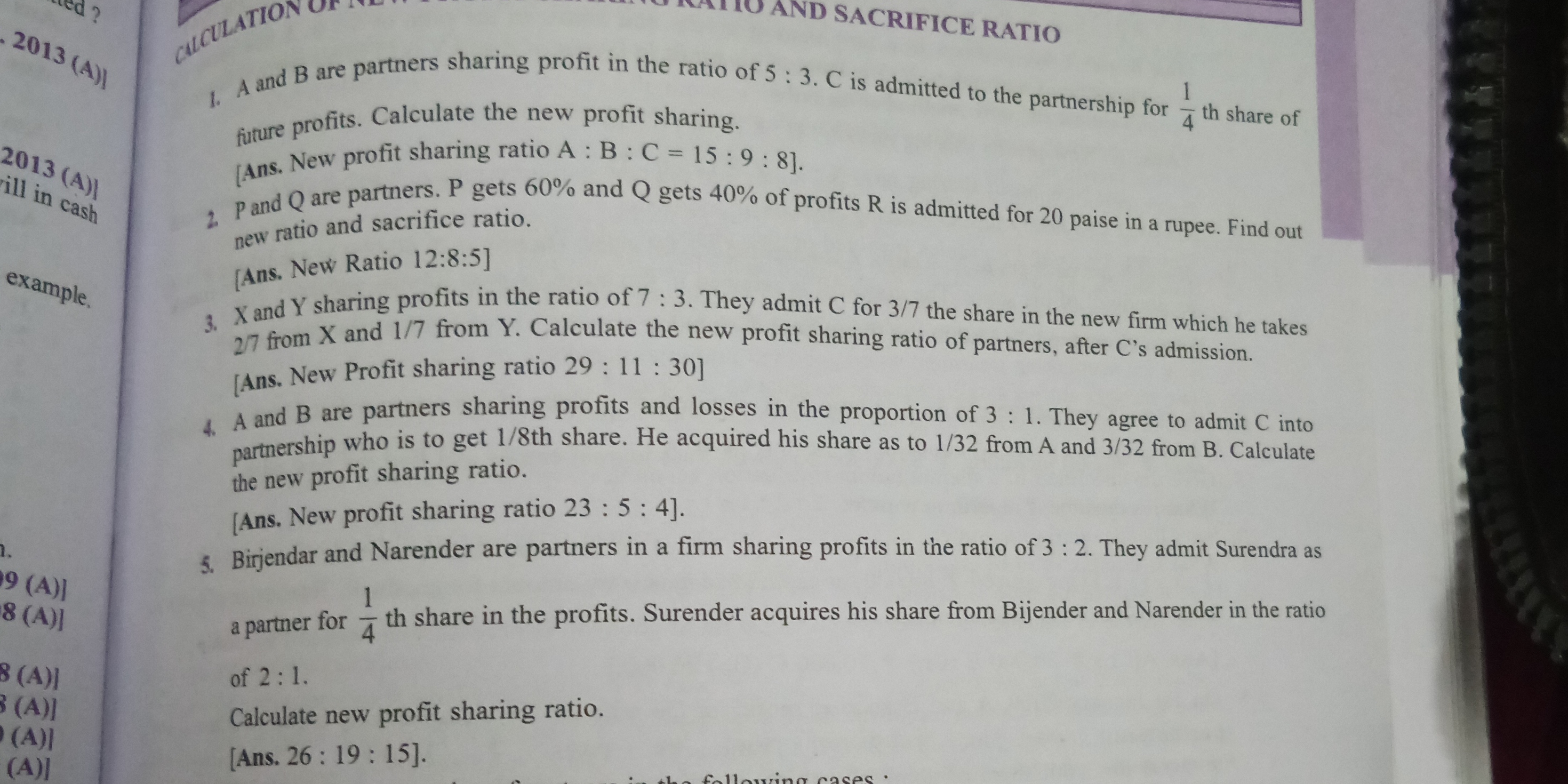

A and B are partners sharing profits in the ratio of 5:3. C is admitted to the partnership for 1/4 th share of future profits. Calculate the new profit sharing.

Understand the Problem

The question is asking for the calculation of new profit sharing ratios among partners in various scenarios based on their initial ratios and the shares acquired or admitted by new partners.

Answer

The new profit-sharing ratio is $A : B : C = 15 : 9 : 8$.

Answer for screen readers

The new profit-sharing ratio is $A : B : C = 15 : 9 : 8$.

Steps to Solve

-

Identify the initial profit-sharing ratios A and B share profits in the ratio of 5:3. This can be represented as: $$ A : B = 5 : 3 $$

-

Calculate the total initial share The total initial shares owned by A and B is: $$ 5 + 3 = 8 $$

-

Determine the share for C C is admitted for a 1/4 share of future profits. To find the equivalent portion in terms of the total share: $$ C's \text{ share} = \frac{1}{4} \text{ of total shares} $$

-

Calculate the remaining share for A and B Since C takes 1/4 of the total share, A and B together will have: $$ \text{Remaining share} = 1 - \frac{1}{4} = \frac{3}{4} $$

-

Determine the new shares of A and B after C's admission The remaining share will still be split between A and B in their original ratio of 5:3. Thus:

-

A's new share: $$ A's new share = \frac{5}{8} \times \frac{3}{4} = \frac{15}{32} $$

-

B's new share: $$ B's new share = \frac{3}{8} \times \frac{3}{4} = \frac{9}{32} $$

- Convert all shares to a common denominator To express all shares with a common denominator:

- A’s share: $$ \frac{15}{32} = \frac{15}{32} $$

- B’s share: $$ \frac{9}{32} = \frac{9}{32} $$

- C’s share: $$ C's share = \frac{1}{4} = \frac{8}{32} $$

- Write the new profit-sharing ratio The new profit-sharing ratio will thus be: $$ A : B : C = \frac{15}{32} : \frac{9}{32} : \frac{8}{32} = 15 : 9 : 8 $$

The new profit-sharing ratio is $A : B : C = 15 : 9 : 8$.

More Information

In this problem, we calculated the new profit-sharing ratio after admitting a new partner, C. The concept involves understanding how existing shares are adjusted based on new admissions. It's essential for partnerships in business to define clear profit-sharing ratios, especially when new partners are introduced.

Tips

- Neglecting to adjust existing shares: When admitting a new partner, ensure to recalculate the remaining shares correctly before redistributing them.

- Not converting shares to a common format: It's important to express all shares in a consistent form (like fractions with a common denominator) to compare them accurately.

AI-generated content may contain errors. Please verify critical information