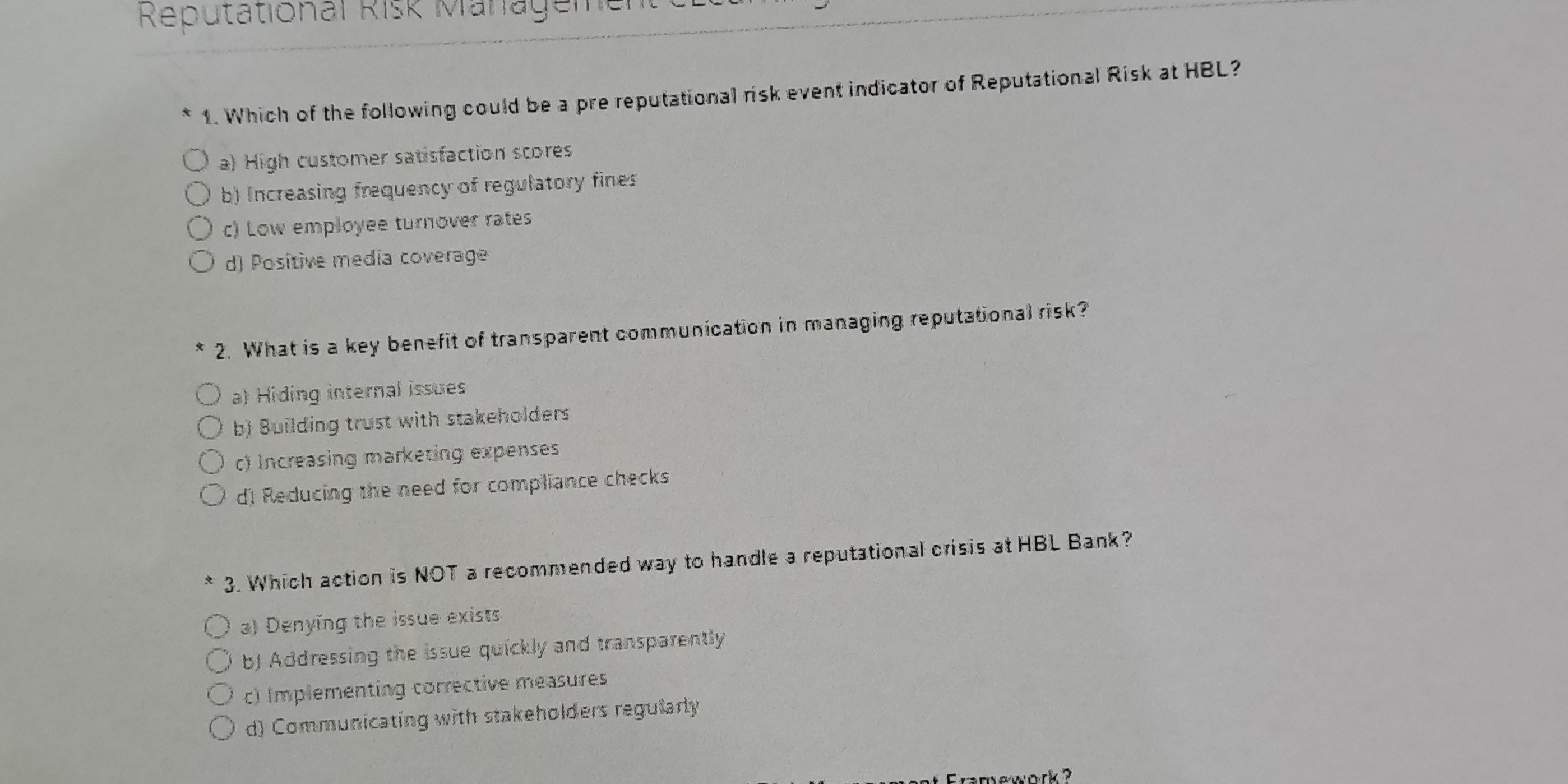

1. Which of the following could be a pre reputational risk event indicator of Reputational Risk at HBL? 2. What is a key benefit of transparent communication in managing reputation... 1. Which of the following could be a pre reputational risk event indicator of Reputational Risk at HBL? 2. What is a key benefit of transparent communication in managing reputational risk? 3. Which action is NOT a recommended way to handle a reputational crisis at HBL Bank?

Understand the Problem

The question is asking for insights related to reputational risk management, specifically indicators of reputational risk, benefits of transparent communication, and recommended actions to handle reputational crises within HBL. It highlights important aspects of risk management in a banking context.

Answer

1) c. Low employee turnover rates, 2) b. Building trust with stakeholders, 3) a. Denying the issue exists.

The final answer is: 1) c. Low employee turnover rates, 2) b. Building trust with stakeholders, 3) a. Denying the issue exists.

Answer for screen readers

The final answer is: 1) c. Low employee turnover rates, 2) b. Building trust with stakeholders, 3) a. Denying the issue exists.

More Information

Low employee turnover rates might indicate underlying issues affecting reputation. Transparent communication builds trust, enhancing reputation management. Denial of issues can worsen reputational crises by not addressing the problem.

Tips

A common mistake is assuming positive factors (e.g., customer satisfaction) are indicators of risk; instead, focus on negative signs like fines or high turnover.

Sources

- Which of the following could be a pre reputational risk event ... - studyx.ai

- Reputational Risk: Definition, Dangers, Causes, and Example - investopedia.com

AI-generated content may contain errors. Please verify critical information