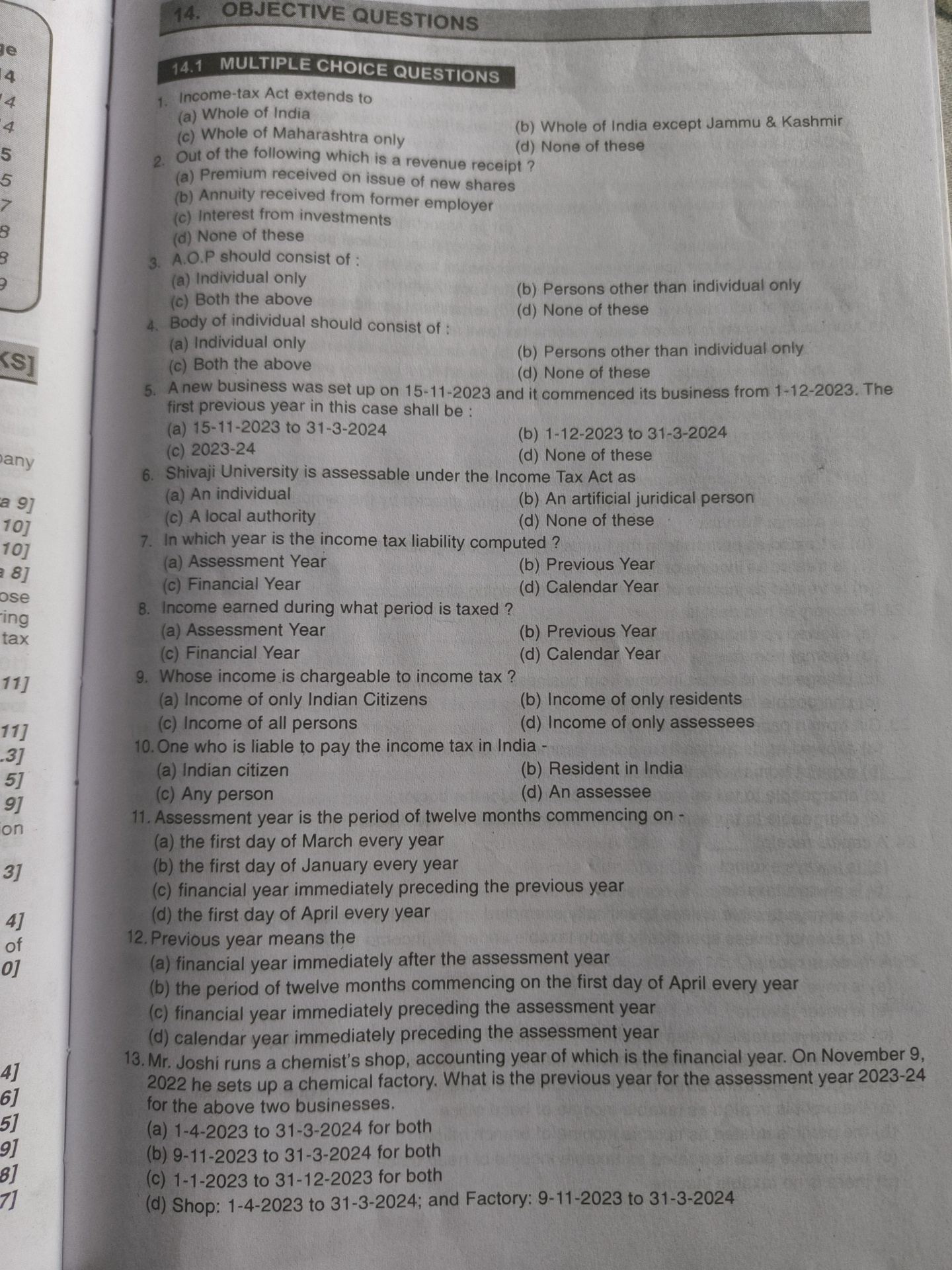

1. Income-tax Act extends to: (a) Whole of India (b) Whole of India except Jammu & Kashmir (c) Whole of Maharashtra only (d) None of these 2. Out of the following which is a revenu... 1. Income-tax Act extends to: (a) Whole of India (b) Whole of India except Jammu & Kashmir (c) Whole of Maharashtra only (d) None of these 2. Out of the following which is a revenue receipt? (a) Premium received on issue of new shares (b) Annuity received from former employer (c) Interest from investments (d) None of these 3. A.O.P should consist of: (a) Individual only (b) Both the above (c) Persons other than individual only (d) None of these 4. Body of individual should consist of: (a) Individual only (b) Both the above (c) Persons other than individual only (d) None of these 5. A new business was set up on 15-11-2023 and it commenced its business from 1-12-2023. The first previous year in this case shall be: (a) 15-11-2023 to 31-3-2024 (b) 1-12-2023 to 31-3-2024 6. Shivaji University is assessable under the Income Tax Act as: (a) An individual (b) An artificial juridical person (c) A local authority (d) None of these 7. In which year is the income tax liability computed? (a) Assessment Year (b) Previous Year (c) Financial Year (d) Calendar Year 8. Income earned during which period is taxed? (a) Assessment Year (b) Previous Year (c) Assessment Year (d) Calendar Year 9. Whose income is chargeable to income tax? (a) Income of only Indian Citizens (b) Income of all persons (c) Income of only residents (d) Income of only assessees 10. One who is liable to pay the income tax in India: (a) Indian citizen (b) Resident in India (c) Any person (d) An assessee 11. Assessment year is the period of twelve months commencing on: (a) the first day of March every year (b) the first day of January every year (c) financial year immediately preceding the previous year (d) the first day of April every year 12. Previous year means the: (a) financial year immediately after the assessment year (b) the period of twelve months commencing on the first day of April every year (c) financial year immediately preceding the assessment year (d) calendar year immediately preceding the assessment year 13. Mr. Joshi runs a chemist’s shop, accounting year of which is the financial year. On November 9, 2022 he sets up a chemical factory. What is the previous year for the assessment year 2023-24 for the above two businesses? (a) 1-4-2023 to 31-3-2024 for both (b) 9-11-2022 to 31-3-2024 for both (c) 1-1-2023 to 31-12-2023 for both (d) Shop: 1-4-2023 to 31-3-2024; and Factory: 9-11-2023 to 31-3-2024.

Understand the Problem

The question set consists of multiple choice questions related to the Income Tax Act and its provisions. It tests knowledge on various aspects such as the scope of the Act, assessment years, liability to pay income tax, and specifics about business commencement for tax purposes.

Answer

1(a), 2(c), 3(b), 4(b), 5(b), 6(b), 7(a), 8(b), 9(b), 10(d), 11(d), 12(c), 13(d)

1(a), 2(c), 3(b), 4(b), 5(b), 6(b), 7(a), 8(b), 9(b), 10(d), 11(d), 12(c), 13(d)

Answer for screen readers

1(a), 2(c), 3(b), 4(b), 5(b), 6(b), 7(a), 8(b), 9(b), 10(d), 11(d), 12(c), 13(d)

More Information

The Income-tax Act applies to the whole of India, including Jammu & Kashmir. Revenue receipts are typically regular income, such as interest. Various terms like 'previous year' and 'assessment year' have specific definitions under the tax law.

Tips

A common mistake is confusing the assessment year with the previous year; remember that the assessment year is the one in which the tax return is filed and taxes are assessed for income earned in the previous year.

AI-generated content may contain errors. Please verify critical information