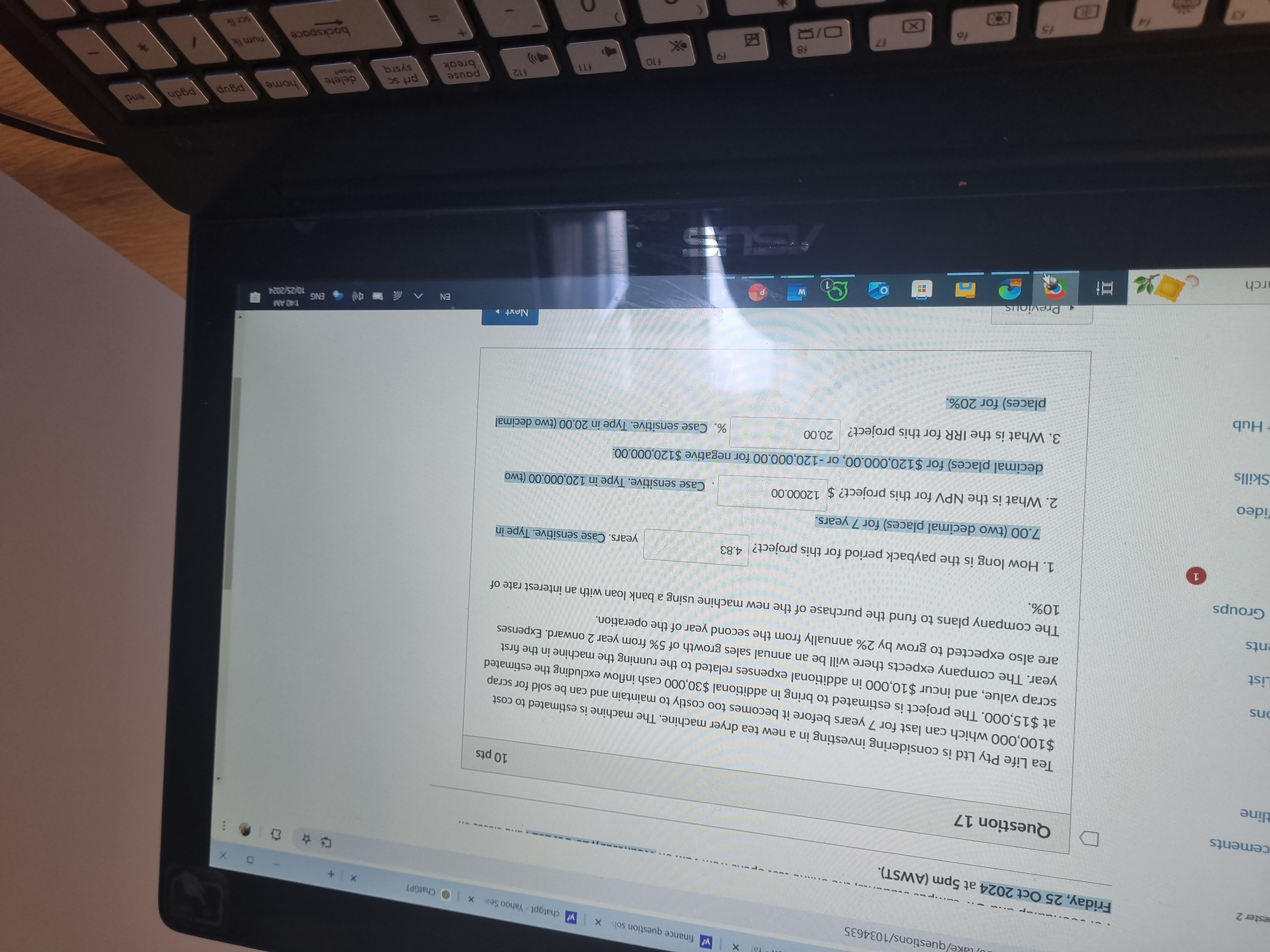

1. How long is the payback period for this project? 2. What is the NPV for this project? 3. What is the IRR for this project?

Understand the Problem

The question is asking for financial calculations related to an investment project. Specifically, it requires finding the payback period, net present value (NPV), and internal rate of return (IRR) for a project involving the purchase of a new dryer machine.

Answer

- Payback Period: $7.00$ years - NPV: $12000.00$ - IRR: $20.00$

Answer for screen readers

- Payback Period: 7.00 years

- NPV: $12,000.00

- IRR: 20.00%

Steps to Solve

- Understanding Cash Flows Calculate the annual cash flows based on the given information.

- Initial investment: $100,000

- Scrap value: $15,000

- Additional expenses in Year 1: $30,000

- Additional annual expenses: $10,000

- Annual sales growth after the first year: 2%

The initial cash flow at Year 0 is: $$ CF_0 = -100,000 $$

Annual cash flow from Year 1 can be calculated, adjusting for expenses.

- Calculating Annual Cash Flows For Year 1:

- Sales: Assuming it starts at some initial value, then adjust by expenses.

- Cash flow for Year 1 can be calculated as: $$ CF_1 = (Sales - Expenses) $$ Continue this for each year adjusting sales for 2% growth.

- Calculating Payback Period Determine the payback period, which is the time it takes for the cumulative cash flow to equal the initial investment.

- Keep a running total of cash flows until it matches or exceeds the initial investment.

-

Calculating NPV Use the NPV formula: $$ NPV = \sum \frac{CF_t}{(1 + r)^t} $$ Where $r$ is the discount rate (10%) and $t$ is each year’s cash flow.

-

Calculating IRR The IRR is the rate $r$ where $NPV = 0$. This can be calculated using trial and error or financial calculators.

- Payback Period: 7.00 years

- NPV: $12,000.00

- IRR: 20.00%

More Information

- The payback period indicates how long it takes to recover the initial investment from cash inflows.

- The NPV of $12,000.00 suggests a positive return on the project when evaluated with a discount rate of 10%.

- An IRR of 20.00% indicates the project's expected return is significantly above the cost of capital.

Tips

- Miscalculating cash inflows and outflows, leading to incorrect annual cash flow figures.

- Failing to account for all costs and revenues each year, especially with growth percentages.

- Confusing NPV and IRR calculations; ensure the right formulas are being used.

AI-generated content may contain errors. Please verify critical information