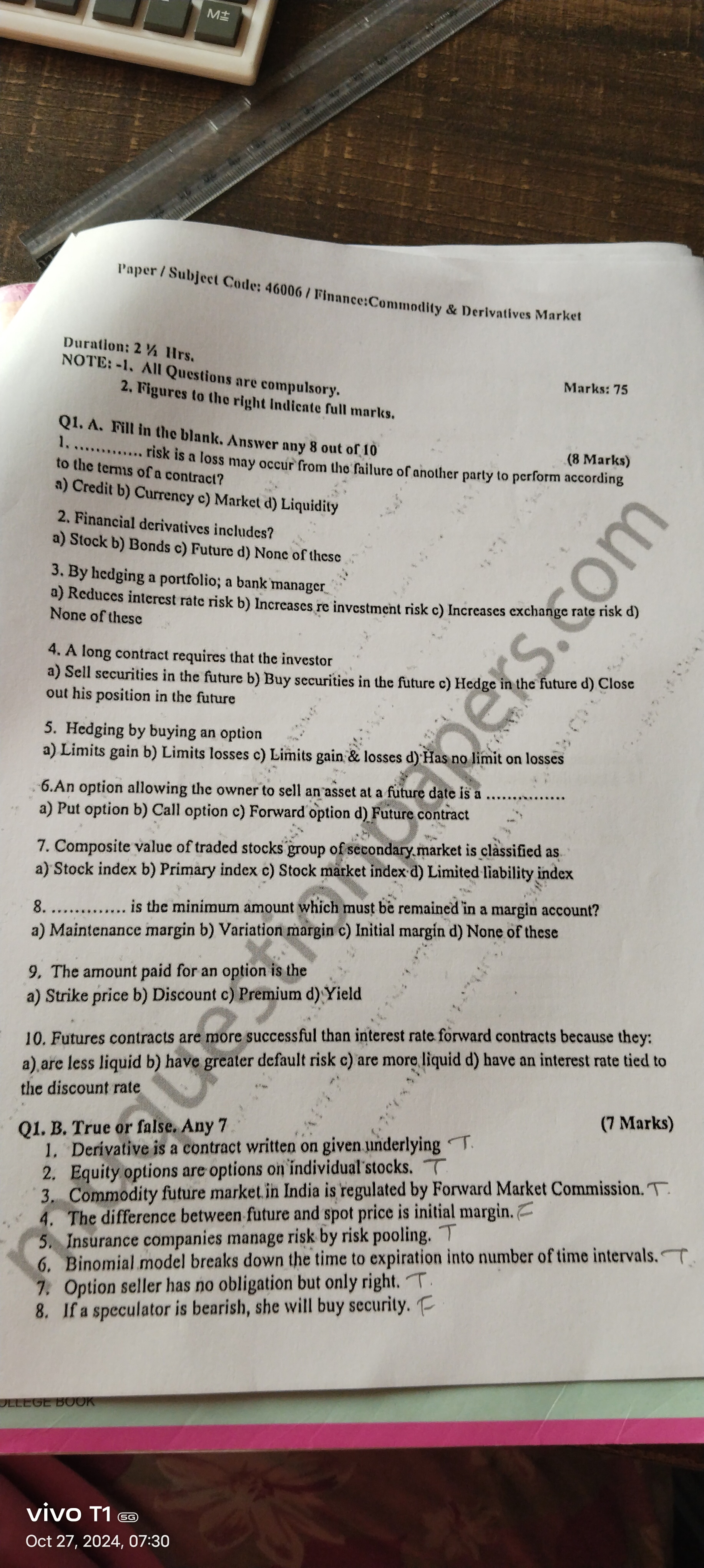

1. Fill in the blank. Answer any 8 out of 10. 1. ............ risk is a loss may occur from the failure of another party to perform according to the terms of a contract? a) Credit... 1. Fill in the blank. Answer any 8 out of 10. 1. ............ risk is a loss may occur from the failure of another party to perform according to the terms of a contract? a) Credit b) Currency c) Market d) Liquidity 2. Financial derivatives includes? a) Stock b) Bonds c) Future d) None of these 3. By hedging a portfolio, a bank manager a) Reduces interest rate risk b) Increases re investment risk c) Increases exchange rate risk d) None of these 4. A long contract requires that the investor a) Sell securities in the future b) Buy securities in the future c) Hedge in the future d) Close out his position in the future 5. Hedging by buying an option a) Limits gain b) Limits losses c) Limits gain & losses d) Has no limit on losses 6. An option allowing the owner to sell an asset at a future date is a ............. a) Put option b) Call option c) Forward option d) Future contract 7. Composite value of traded stocks group of secondary market is classified as a) Stock index b) Primary index c) Stock market index d) Limited liability index 8. .......... is the minimum amount which must be remained in a margin account? a) Maintenance margin b) Variation margin c) Initial margin d) None of these 9. The amount paid for an option is the a) Strike price b) Discount c) Premium d) Yield 10. Futures contracts are more successful than interest rate forward contracts because they: a) are less liquid b) have greater default risk c) are more liquid d) have an interest rate tied to the discount rate 1B. True or false. Any 7 1. Derivative is a contract written on given underlying. 2. Equity options are options on 'individual' stocks. 3. Commodity future market in India is regulated by Forward Market Commission. 4. The difference between future and spot price is initial margin. 5. Insurance companies manage risk by risk pooling. 6. Binomial model breaks down the time to expiration into number of time intervals. 7. Option seller has no obligation but only right. 8. If a speculator is bearish, she will buy security.

Understand the Problem

The question comprises a series of items related to finance, particularly focusing on the commodity and derivatives market. It contains multiple-choice questions and true/false statements that assess knowledge in this field.

Answer

Fill in the blanks and true/false answers are provided for financial concepts and derivatives.

["1. Credit","2. Future","3. Reduces interest rate risk","4. Buy securities in the future","5. Limits losses","6. Put option","7. Stock market index","8. Maintenance margin","9. Premium","10. are more liquid","True or False: All given answers are marked as True."]

Answer for screen readers

["1. Credit","2. Future","3. Reduces interest rate risk","4. Buy securities in the future","5. Limits losses","6. Put option","7. Stock market index","8. Maintenance margin","9. Premium","10. are more liquid","True or False: All given answers are marked as True."]

More Information

The document tests knowledge of various financial risks and concepts such as credit risk, derivatives, options, and futures.

Tips

Be familiar with key financial terms and concepts such as derivatives, options, and margin accounts.

AI-generated content may contain errors. Please verify critical information