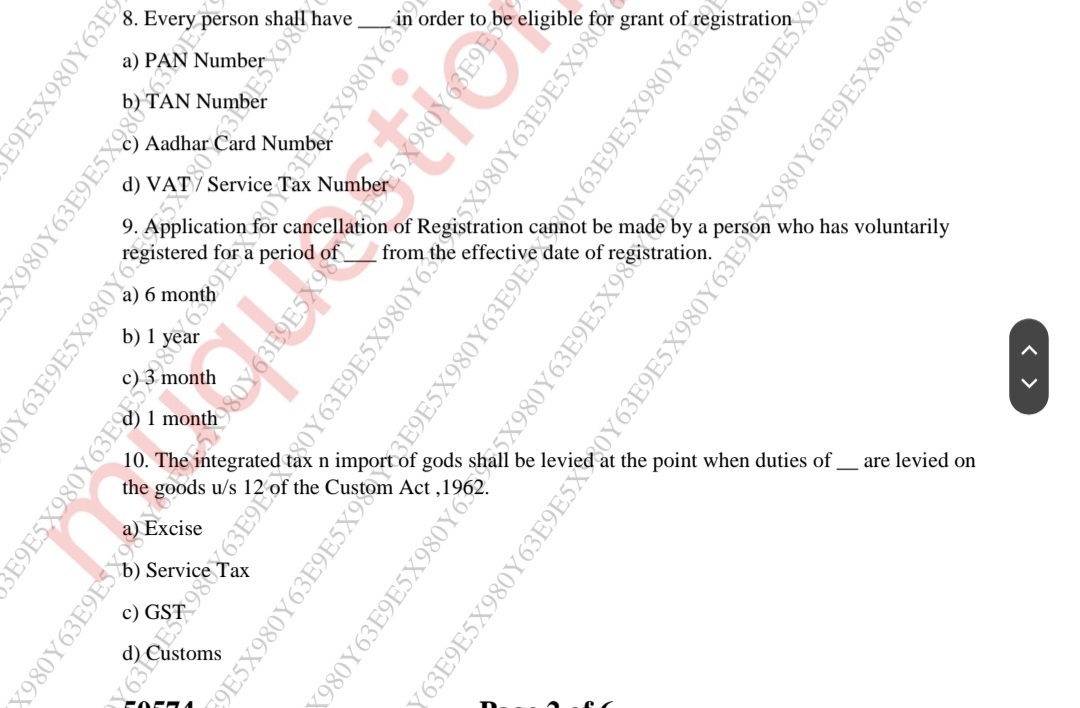

1. Every person shall have ___ in order to be eligible for grant of registration. 2. Application for cancellation of Registration cannot be made by a person who has voluntarily reg... 1. Every person shall have ___ in order to be eligible for grant of registration. 2. Application for cancellation of Registration cannot be made by a person who has voluntarily registered for a period of ___ from the effective date of registration. 3. The integrated tax on import of goods shall be levied at the point when duties of ___ are levied on the goods u/s 12 of the Custom Act, 1962.

Understand the Problem

The question is asking about eligibility requirements for registration, conditions for the cancellation of registration, and taxation related to imports under the Custom Act. It seems to focus on compliance with regulatory frameworks in a specific legal context.

Answer

1. PAN Number 2. 1 year 3. Customs

The final answer is: 1. PAN Number 2. 1 year 3. Customs

Answer for screen readers

The final answer is: 1. PAN Number 2. 1 year 3. Customs

More Information

Each requirement is specific to registration and taxation regulations in India under GST and Customs Act.

Tips

Ensure understanding of legal terms regarding GST, registration duration, and customs duties for accurate answers.

Sources

- Cancelling GST registration - Singapore - IRAS - iras.gov.sg

- GST-Divyastra-Ch-8-Registration-R-2.pdf - CA Kishan Kumar - cakishankumar.com