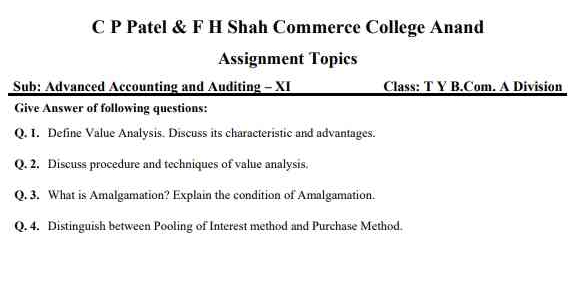

1. Define Value Analysis. Discuss its characteristic and advantages. 2. Discuss procedure and techniques of value analysis. 3. What is Amalgamation? Explain the condition of Amalga... 1. Define Value Analysis. Discuss its characteristic and advantages. 2. Discuss procedure and techniques of value analysis. 3. What is Amalgamation? Explain the condition of Amalgamation. 4. Distinguish between Pooling of Interest method and Purchase Method.

Understand the Problem

The question is asking about advanced accounting and auditing topics, specifically related to Value Analysis, Amalgamation, and different accounting methods. This covers definitions, characteristics, procedures, and distinctions between methods in the context of accounting.

Answer

1. Value Analysis improves product value via function and cost analysis, reducing costs and enhancing efficiency. 2. This involves evaluating functions and using techniques like brainstorming. 3. Amalgamation combines companies into a new entity, requiring legal compliance. 4. Pooling combines book values; Purchase uses fair values.

- Value Analysis is a systematic approach to improve a product's value by analyzing its function and cost. Characteristics include function analysis, cost-effectiveness, and teamwork. Advantages are cost reduction and improved efficiency.

- Procedure involves identifying functions, generating alternatives, and evaluating solutions. Techniques include brainstorming, function analysis, and cost/benefit analysis.

- Amalgamation is the combination of companies into a new entity. Conditions include legal regulation compliance and shareholder approval.

- Pooling of Interest Method records assets and liabilities at book value as the companies are combined as equals. Purchase Method records them at fair value with one company acquiring the other.

Answer for screen readers

- Value Analysis is a systematic approach to improve a product's value by analyzing its function and cost. Characteristics include function analysis, cost-effectiveness, and teamwork. Advantages are cost reduction and improved efficiency.

- Procedure involves identifying functions, generating alternatives, and evaluating solutions. Techniques include brainstorming, function analysis, and cost/benefit analysis.

- Amalgamation is the combination of companies into a new entity. Conditions include legal regulation compliance and shareholder approval.

- Pooling of Interest Method records assets and liabilities at book value as the companies are combined as equals. Purchase Method records them at fair value with one company acquiring the other.

More Information

Value analysis focuses on functions to improve products and services. Amalgamations form new companies, differing from mergers. The pooling method is often used for consolidating similar entities, while the purchase method identifies acquisitions.

Tips

Confusing pooling and purchase methods: pooling uses historical costs; purchase involves revaluation.

Sources

- Value Analysis - The Decision Lab - thedecisionlab.com

- Amalgamation: Definition, Pros and Cons, vs. Merger & Acquisition - investopedia.com

- Pooling of Interests - Definition, How It Works, and Advantages - corporatefinanceinstitute.com

AI-generated content may contain errors. Please verify critical information