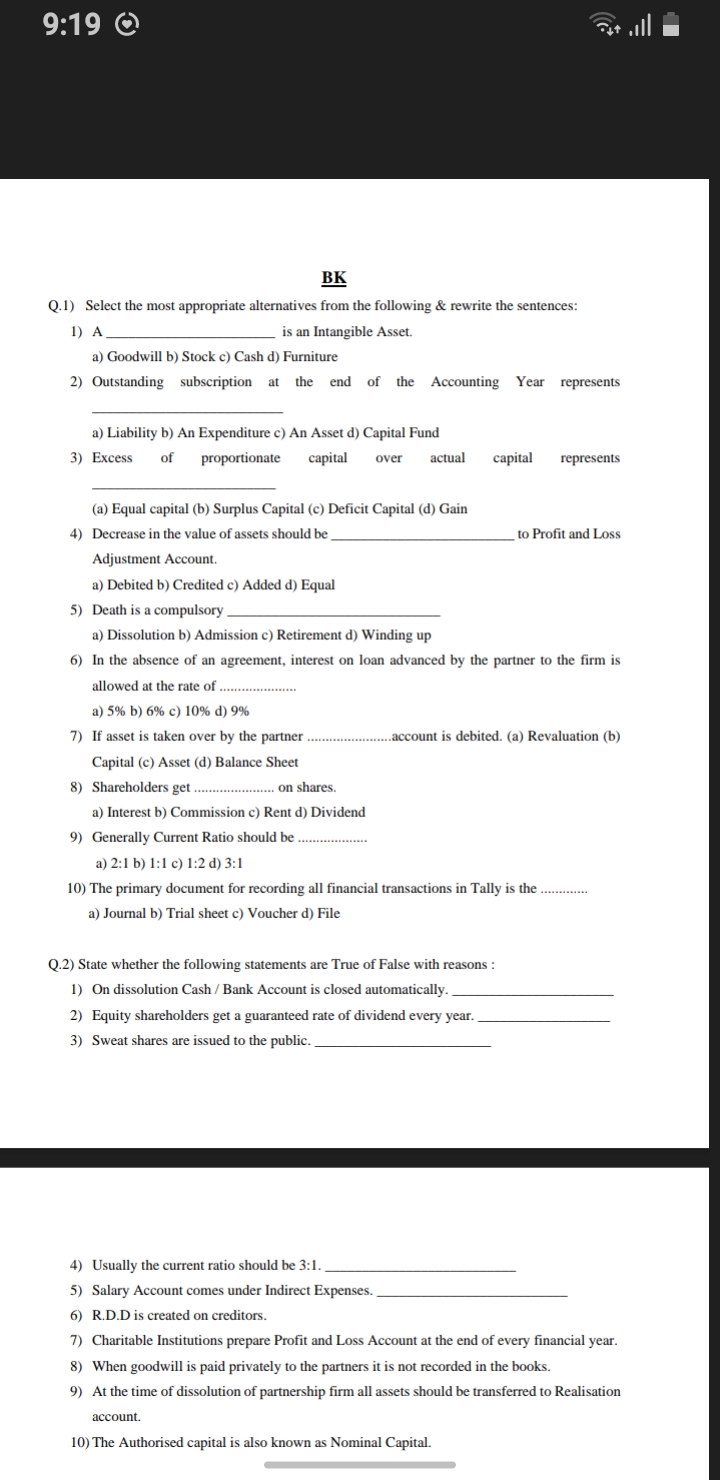

1) A ____________ is an Intangible Asset. a) Goodwill b) Stock c) Cash d) Furniture 2) Outstanding subscription at the end of the Accounting Year represents ____________ a) Liabili... 1) A ____________ is an Intangible Asset. a) Goodwill b) Stock c) Cash d) Furniture 2) Outstanding subscription at the end of the Accounting Year represents ____________ a) Liability b) An Expenditure c) An Asset d) Capital Fund 3) Excess of proportionate capital over actual capital represents a) Equal capital b) Surplus Capital c) Deficit Capital d) Gain 4) Decrease in the value of assets should be ____________ to Profit and Loss Adjustment Account. a) Debited b) Credited c) Added d) Equal 5) Death is a compulsory ____________ a) Dissolution b) Admission c) Retirement d) Winding up 6) In the absence of an agreement, interest on loan advanced by the partner to the firm is allowed at the rate of ____________ a) 5% b) 6% c) 10% d) 9% 7) If asset is taken over by the partner ____________ account is debited. a) Revaluation b) Capital (c) Asset d) Balance Sheet 8) Shareholders get ____________ on shares. a) Interest b) Commission c) Rent d) Dividend 9) Generally Current Ratio should be ____________ a) 2:1 b) 1:1 c) 1:2 d) 3:1 10) The primary document for recording all financial transactions in Tally is the ____________ a) Journal b) Trial sheet c) Voucher d) File 2) State whether the following statements are True or False with reasons: 1) On dissolution Cash / Bank Account is closed automatically. 2) Equity shareholders get a guaranteed rate of dividend every year. 3) Sweat shares are issued to the public. 4) Usually, the current ratio should be 3:1. 5) Salary Account comes under Indirect Expenses. 6) R.D.D is created on creditors. 7) Charitable Institutions prepare Profit and Loss Account at the end of every financial year. 8) When goodwill is paid privately to the partners it is not recorded in the books. 9) At the time of dissolution of partnership firm all assets should be transferred to Realisation account. 10) The Authorised capital is also known as Nominal Capital.

Understand the Problem

The question consists of two parts: the first part asks to select the most appropriate alternatives for accounting-related statements, while the second part requires stating whether certain statements are true or false with explanations. This involves knowledge of accounting principles and practices.

Answer

1) Goodwill; 2) Asset; 3) Surplus Capital; 4) Debited; 5) Dissolution; 6) 6%; 7) Capital; 8) Dividend; 9) 2:1; 10) Voucher. True/False: 1) False, 2) False, 3) False, 4) False, 5) True, 6) False, 7) False, 8) True, 9) True, 10) True.

The correct answers are: 1) Goodwill is an Intangible Asset. 2) Outstanding subscription represents an Asset. 3) Surplus Capital is the excess. 4) Debited to Profit and Loss Adjustment Account. 5) Dissolution. 6) 6% interest rate. 7) Capital account is debited. 8) Dividend on shares. 9) Current Ratio should be 2:1. 10) Voucher is the primary document in Tally. True/False: 1) False. 2) False. 3) False. 4) False. 5) True. 6) False. 7) False. 8) True. 9) True. 10) True.

Answer for screen readers

The correct answers are: 1) Goodwill is an Intangible Asset. 2) Outstanding subscription represents an Asset. 3) Surplus Capital is the excess. 4) Debited to Profit and Loss Adjustment Account. 5) Dissolution. 6) 6% interest rate. 7) Capital account is debited. 8) Dividend on shares. 9) Current Ratio should be 2:1. 10) Voucher is the primary document in Tally. True/False: 1) False. 2) False. 3) False. 4) False. 5) True. 6) False. 7) False. 8) True. 9) True. 10) True.

More Information

Intangible assets like goodwill are essential in financial reporting, reflecting non-physical value. The 6% interest is a general standard in the absence of agreements.

Tips

Ensure understanding of basic accounting concepts and terminology like assets and liabilities.

Sources

- What Is an Intangible Asset? - Investopedia - investopedia.com

AI-generated content may contain errors. Please verify critical information