Podcast

Questions and Answers

According to the study, what two dimensions of the BCG matrix differentiate businesses in terms of performance and strategic attributes?

According to the study, what two dimensions of the BCG matrix differentiate businesses in terms of performance and strategic attributes?

Product life cycle stage (growth rate) and market share.

What are the three groups into which most discussions of business-level strategy fall?

What are the three groups into which most discussions of business-level strategy fall?

Normative propositions, empirically based 'universal laws', and empirically based situational approaches.

What are some strategic actions that theorists emphasize for early stages of the product life cycle?

What are some strategic actions that theorists emphasize for early stages of the product life cycle?

Aggressive pricing, building capacity, heavy marketing expenditures, and product R&D.

In later stages of product life cycle, what strategic actions are emphasized?

In later stages of product life cycle, what strategic actions are emphasized?

According to the paper, what makes the choice of the product life cycle and market share as contingent variables attractive?

According to the paper, what makes the choice of the product life cycle and market share as contingent variables attractive?

What is the recommendation by the BCG for managing high share/low growth businesses (Cash Cows)?

What is the recommendation by the BCG for managing high share/low growth businesses (Cash Cows)?

What is the recommendation by the BCG for low growth/low share Dogs?

What is the recommendation by the BCG for low growth/low share Dogs?

What is the conclusion of the study regarding Dogs, in contrast to BCG's advice?

What is the conclusion of the study regarding Dogs, in contrast to BCG's advice?

What does the paper suggest researchers should do instead of focusing solely on harvesting or liquidation strategies for Dogs?

What does the paper suggest researchers should do instead of focusing solely on harvesting or liquidation strategies for Dogs?

What are the strategic attributes that the study included for analysis?

What are the strategic attributes that the study included for analysis?

List the four performance measures examined in the study.

List the four performance measures examined in the study.

What is 'relative market share' defined as in this paper?

What is 'relative market share' defined as in this paper?

According to the study what is one possible reason that Wildcats have a higher receivables/revenue ratio?

According to the study what is one possible reason that Wildcats have a higher receivables/revenue ratio?

What 'future oriented' expenses do growth businesses tend to spend more on, proportionately?

What 'future oriented' expenses do growth businesses tend to spend more on, proportionately?

Through what medium do Stars and Cash Cows command their high prices?

Through what medium do Stars and Cash Cows command their high prices?

What is the conclusion related to the advice that Dogs should be harvested or liquidated?

What is the conclusion related to the advice that Dogs should be harvested or liquidated?

What is the only contingent variable that had an inverse relationship between market share change and 'any of the measures of returns'

What is the only contingent variable that had an inverse relationship between market share change and 'any of the measures of returns'

What is the definition of the term 'domain' as used in this study?

What is the definition of the term 'domain' as used in this study?

What is suggested as a way of being creative and positive about managing 'Dogs'?

What is suggested as a way of being creative and positive about managing 'Dogs'?

What does the study say that high market share businesses tend to do in order to perpetuate their high growth?

What does the study say that high market share businesses tend to do in order to perpetuate their high growth?

Which type of business has proven to have proven the lowest amount of new product sales?

Which type of business has proven to have proven the lowest amount of new product sales?

What is a key aspect that the data base's disguised dollar figures prevent a test of?

What is a key aspect that the data base's disguised dollar figures prevent a test of?

What does the paper suggest regarding the correlation of market share and cash flow?

What does the paper suggest regarding the correlation of market share and cash flow?

How are mature businesses adding comparatively more value than growth businesses?

How are mature businesses adding comparatively more value than growth businesses?

What may a high sales/employee compared to mature businesses suggest about the labour force?

What may a high sales/employee compared to mature businesses suggest about the labour force?

Flashcards

Mid-Range Theories

Mid-Range Theories

Empirically based theories that offer guidance on business-level strategy.

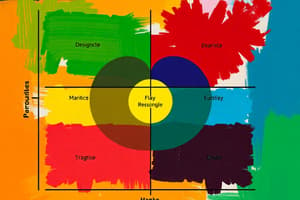

BCG Matrix

BCG Matrix

Examines corporate strategy by analyzing a firm's product portfolio.

Business-Level Strategy

Business-Level Strategy

A company's approach to gaining and sustaining competitive advantage.

Contingency Models

Contingency Models

Signup and view all the flashcards

Product Life Cycle

Product Life Cycle

Signup and view all the flashcards

Cash Cow

Cash Cow

Signup and view all the flashcards

Return on Investment

Return on Investment

Signup and view all the flashcards

Cash Flow on Investment (CFOI)

Cash Flow on Investment (CFOI)

Signup and view all the flashcards

Return Per Risk (RPR)

Return Per Risk (RPR)

Signup and view all the flashcards

Market Share Change (MSC)

Market Share Change (MSC)

Signup and view all the flashcards

Domain

Domain

Signup and view all the flashcards

Vertical Integration

Vertical Integration

Signup and view all the flashcards

Dog

Dog

Signup and view all the flashcards

Star

Star

Signup and view all the flashcards

Wildcat / Question Mark

Wildcat / Question Mark

Signup and view all the flashcards

Study Notes

Overview

- The study empirically explores the performance and strategic attributes of businesses within the Boston Consulting Group (BCG) product portfolio matrix

- The performance and strategic attributes of businesses differed based on product life cycle stage (growth rate) and market share.

Business-Level Strategy

-

Discussions of business-level strategy fall into three groups:

- Normative propositions: Strategic actions that make sense

- Empirically based literature: Demonstrates universal "laws" of strategy

- Empirical strategy varies: Strategy must be highly situational

-

Contingent factors affect strategy

-

Empirical "mid-range" theories about business-level strategy needed

Key Contingent Variables

- Product life cycle and market share are two key contingent variables

- Little empirical research has been done treating the above variables as contingent factors

- Together, the above variables form the framework for the Boston Consulting Group (BCG) product portfolio matrix

BCG Matrix

- The vertical dimension of the BCG matrix is "market growth"

- Growth rates correspond with certain stages of the life cycle

- Each stage is attributed with characteristics like customer adoption rates and the nature of competition

- The study focuses on product life cycle and market share, it has the potential for generating empirically strong and managerially meaningful results

- Study addresses two broad questions:

- Businesses differences in performance based on profitability, risk, cash flow, and market share change within the BCG matrix

- Strategic attributes differences within the BCG matrix

Theoretical Review

- The distinction between corporate and business-level strategy exists

- The study focuses on business-level strategy and the concept of "competing"

- All functional areas of the business are encompassed (operations, marketing, distribution, R&D, finance, and personnel)

- The business's basis for competing is determined by the above

Contingency Theories

- Contingency models are abundant in organizational theory, however, progress in investigating contingent models of strategy has been slow

- Identifying and testing contingencies has not been a main focus

- Contingent variables lead to the strongest theory

- Product life cycle is a fundamental variable in determining business strategy

Product Life Cycle

- The product life cycle concept is well established

- Theorists have prescribed strategic behaviors for success at each stage

- Emphasis on gaining a strong competitive foothold during early stages (introductory and growth)

Market Share

- Market share is empirically demonstrated to show that a key factor affects business unit performance

- High share businesses have significantly higher earnings than low share businesses

- Little systematic research has been done on different strategies for different share positions

- Recent studies identify discrete clusters of high and low performing businesses

Combining Both Dimensions

- Combining product life cycle and market share forms the BCG Matrix

- Despite limitations, the matrix is widely cited in academic and popular discussions of strategy

- Other portfolio matrices are consistent with the BCG framework

Considerations

- The BCG favors 10% real market growth as the point where someone can differentiate between high and low growth rates and market share

- 1.0 ratio, indicating highest market share

- 1.5 ratio is necessary to claim and exploit true dominance in a market

- Systematic data is absent which is an alternative, the study relies on 10% market growth rate and 1.0 relative market share points in the matrix

- Emphasis has been on how to allocate resources and what kinds of performance patterns to seek for each area

- High share/low growth should want maximum cash generation

- That cash should be directed to newer/higher growth

- Low growth/low share are cash drains and should be divested

Propositions

- Businesses in the four cells will differ systematically in their performance and strategic attributes

- Approach will be to enhance understanding of a widely recognized, but little-documented strategic framework

PIMS Data Base

- Data was drawn from Profit Impact of Market Strategies (PIMS), which is an ongoing study of environmental, strategic, and performance variables for individual business units

- About 200 corps submit data on 2000 business units annually

- Each business is a product-market unit, often a division

- PIMS staffers help each business interpret and answer questions, assuring high data comparability

- Companies pay to participate, data accuracy provides ability to give meaningful conclusions

- Businesses that are participating are sophisticated, dominant and effective in the U.S

Classifying Businesses

- Based on most recent four years of PIMS data for businesses that manufacture industrial products

- Businesses classified into four cells of the BCG matrix:

- Life cycle stage (market growth rate)

- Relative market share

- Respondents indicate business' life cycle stage through a question

- Distinction between a growth and mature business is a real growth rate in primary demand of 10%

Market Share

- Relative market share is the ratio of the unit's market share to the competitor

- 1.00 is a high relative market share; below 1.00 is low relative market share

Variables

- There are two types of variables distinguished are strategic attributes and performance

- Environmental variables are not included

Resource Usage

- Dozens of strategic attributes were included in the study, specifically:

- Investment/revenue

- Plant and equipment newness

- Capacity utilization

- Capacity/market size

- Sales/employee

- Working Capital Management includes:

- Receivables/revenue

- Inventory/revenue

- Domain includes:

- Relative product line breadth

- Relative customer type breadth

- Relative number of customers

- Customer fragmentation

- Vertical Integration includes:

- Value/added revenue

- Relative integration backward

- Relative integration forward

- Expense Structure consists of:

- Manufacturing/revenue

- Product R&D/revenue

- Process R&D/revenue

- Sales force/revenue

- Advertising and promotion/revenue

- Competitive Devices include:

- Sales from new products

- Relative sales from new products

- Relative prices

- Relative direct costs

- Relative image

- Relative services

- Relative advertising expenses

- Relative promotion expenses

- Relative sales force expenses

Performances Measured

- ROI or return on investment is measured via pretax income less cost

- CFOI or cash flow on investment, percentage of average investment

- RPR or return per risk, average ROI divided by the variability of ROI

- MSC or market share change.

Analysis

-

The primary theme that has been corroborated the four types of businesses tendencies to generate cash

-

Wildcat - requires large cash inputs

-

Star - may or may not generate all of its own cash

-

Cash Cows - are net cash generators

-

Dogs - Worthless

-

ROI was higher for businesses with high share over low share

-

Differences across the four cells reflect both profitability and stability of the share

-

Cows score the highest

-

Stars are in turbulent markets

-

Dogs are next highest

-

Wildcats are the lowest

-

There were indications of greater share increases

-

There are no apparent attempts to gain truly large share increases

-

Little correlation existed between performance measures and market share, suggest no real tradeoff exists

-

These results indicate managers will be relieved of profitability or cash flow goals while also charged to gain

Strategic Attributes

- Strategic Attributes indicate the differences in Businesses

- Some attributes varied primarily according to market share

- Some varied to life cycle stage

Resources and Resource Usage

- High share businesses can have more production capacity than low shares

Expenses Overview

- Growth have more "Future Oriented Expenses"

- High R&D Mature Businesses will have less growth R&D and capital can change

Domain

- Is a means of gaining share

- There is little Customer fragmentation

- Few high Customers

Vertical Integration

- As with domain broadness, there is no method knowing from these data to know if vertical integration has high market share

Competitive Differences

- Growth businesses will have new highs, and Dogs are the lowest

- If both Stars and Cash Cows will reap double the rewards from the force: there can be high price.

Conclusions

- Testing of the BCG product portfolio matrix

- BCG have quite different tendencies or consumers

- All 4 matrix types contribute to the balanced performance

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.