Podcast

Questions and Answers

What does a high market share indicate about a company or product?

What does a high market share indicate about a company or product?

- High competition with other companies

- Strong market position (correct)

- Limited growth potential

- Weak market presence

During market growth rate evaluation, what does a high growth rate typically suggest?

During market growth rate evaluation, what does a high growth rate typically suggest?

- Increased market competition

- Expanding market with profit potential (correct)

- Declining market potential

- Stable market conditions

What is the primary purpose of product portfolio management?

What is the primary purpose of product portfolio management?

- To focus solely on high market share products

- To maximize profitability through analysis (correct)

- To identify opportunities for diversification

- To eliminate all underperforming products

What category is assigned to products with low growth and high market share?

What category is assigned to products with low growth and high market share?

Which factor is NOT essential for successful strategic planning using the BCG matrix?

Which factor is NOT essential for successful strategic planning using the BCG matrix?

How is market share calculated?

How is market share calculated?

In the BCG matrix, which of the following represents products with high growth and low market share?

In the BCG matrix, which of the following represents products with high growth and low market share?

Why is resource allocation important in strategic planning using the BCG matrix?

Why is resource allocation important in strategic planning using the BCG matrix?

What characterizes a 'Question Mark' product in a portfolio?

What characterizes a 'Question Mark' product in a portfolio?

Which strategy is typically employed for 'Cash Cows'?

Which strategy is typically employed for 'Cash Cows'?

What should a company do with 'Dogs' in its product portfolio?

What should a company do with 'Dogs' in its product portfolio?

In market share analysis, what is the key focus for 'Stars'?

In market share analysis, what is the key focus for 'Stars'?

The primary evaluation factor for investment in 'Question Marks' is based on which of the following?

The primary evaluation factor for investment in 'Question Marks' is based on which of the following?

Flashcards

BCG Matrix

BCG Matrix

A framework to evaluate a company's product portfolio based on market share and growth rate.

Market Share

Market Share

Percentage of a market controlled by a specific company or product.

Growth Rate

Growth Rate

The speed at which a market is expanding, measured in volume and value.

Stars (BCG)

Stars (BCG)

Signup and view all the flashcards

Question Marks (BCG)

Question Marks (BCG)

Signup and view all the flashcards

Cash Cows (BCG)

Cash Cows (BCG)

Signup and view all the flashcards

Dogs (BCG)

Dogs (BCG)

Signup and view all the flashcards

Product Portfolio Management

Product Portfolio Management

Signup and view all the flashcards

Cash Cow

Cash Cow

Signup and view all the flashcards

Question Mark

Question Mark

Signup and view all the flashcards

Dog

Dog

Signup and view all the flashcards

Market Leadership

Market Leadership

Signup and view all the flashcards

Investment Strategy (Question Mark)

Investment Strategy (Question Mark)

Signup and view all the flashcards

Study Notes

BCG Matrix Overview

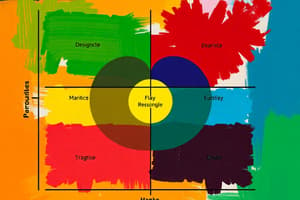

- The Boston Consulting Group (BCG) Matrix is a framework for evaluating a company's product portfolio.

- It categorizes products based on market share and market growth rate.

- This helps companies allocate resources effectively and develop strategic plans.

- The matrix visualizes four quadrants, each representing a different product type with different strategic implications.

Market Share Analysis

- Market share analysis assesses the proportion of a given market held by a particular company or product.

- This is a crucial metric for understanding market penetration and competitiveness.

- It is calculated by dividing the company's sales by the total market sales.

- High market share suggests strong market position and competitive advantage.

- Low market share indicates a smaller market presence.

Growth Rate Evaluation

- Growth rate analysis evaluates the rate at which a particular market is expanding.

- This analysis considers both volume and value growth to assess market potential.

- High growth rates indicate an expanding market with potential for significant profits for companies successfully operating within it.

- Low growth rates suggest a mature or declining market, requiring different strategic responses.

Product Portfolio Management

- Product portfolio management is a strategic approach to managing a company's product lines.

- It involves analyzing profitability, market share, and growth potential.

- Effective portfolio management guides resource allocation and prioritization to maximize profitability.

- It helps companies identify opportunities to improve product performance and minimize losses in underperforming areas.

Business Unit Categorization

- The framework categorizes business units into four types:

- Stars: High growth, high market share.

- Question Marks: High growth, low market share.

- Cash Cows: Low growth, high market share.

- Dogs: Low growth, low market share.

Strategic Planning

- Strategic planning using the BCG matrix helps companies make resource allocation decisions.

- Understanding the characteristics of each quadrant guides specific strategic actions.

- Analyzing market trends, competitor actions, and internal capabilities is crucial for successful strategic planning.

- Planning for resource allocation, product development, and marketing strategies depends on the product's position within the matrix.

The 4 Quadrants of the BCG Matrix

-

Stars: High growth, high market share products. These are often dominant products in high-potential markets. They require substantial investment to maintain market leadership and often generate significant future cash flow. Strategies may involve maintaining market leadership, expanding into new segments or diversifying.

-

Question Marks: High growth, low market share products. These products require substantial investment to potentially achieve market leadership. Investment strategy hinges on market evaluation - high or sustainable growth potential. Strategic moves include focusing on achieving a higher market share or divesting if prospects are unsustainable.

-

Cash Cows: Low growth, high market share products. These products are generally profitable. Strategies involve milking these products for maximum cash generation. Maintaining market share and limiting further investment is a characteristic strategy.

-

Dogs: Low growth, low market share products. These products are typically not profitable. Strategies include divesting of the product, reducing investments, or maintaining a small presence as a niche contender.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.