คำนวณหาวันที่ครบกำหนด, ดอกเบี้ย, และมูลค่าเมื่อครบกำหนดของตั๋วเงินแต่ละรายการ คำนวณหาวันที่ครบกำหนด, ดอกเบี้ย, และมูลค่าเมื่อครบกำหนดของตั๋วเงินแต่ละรายการ

Understand the Problem

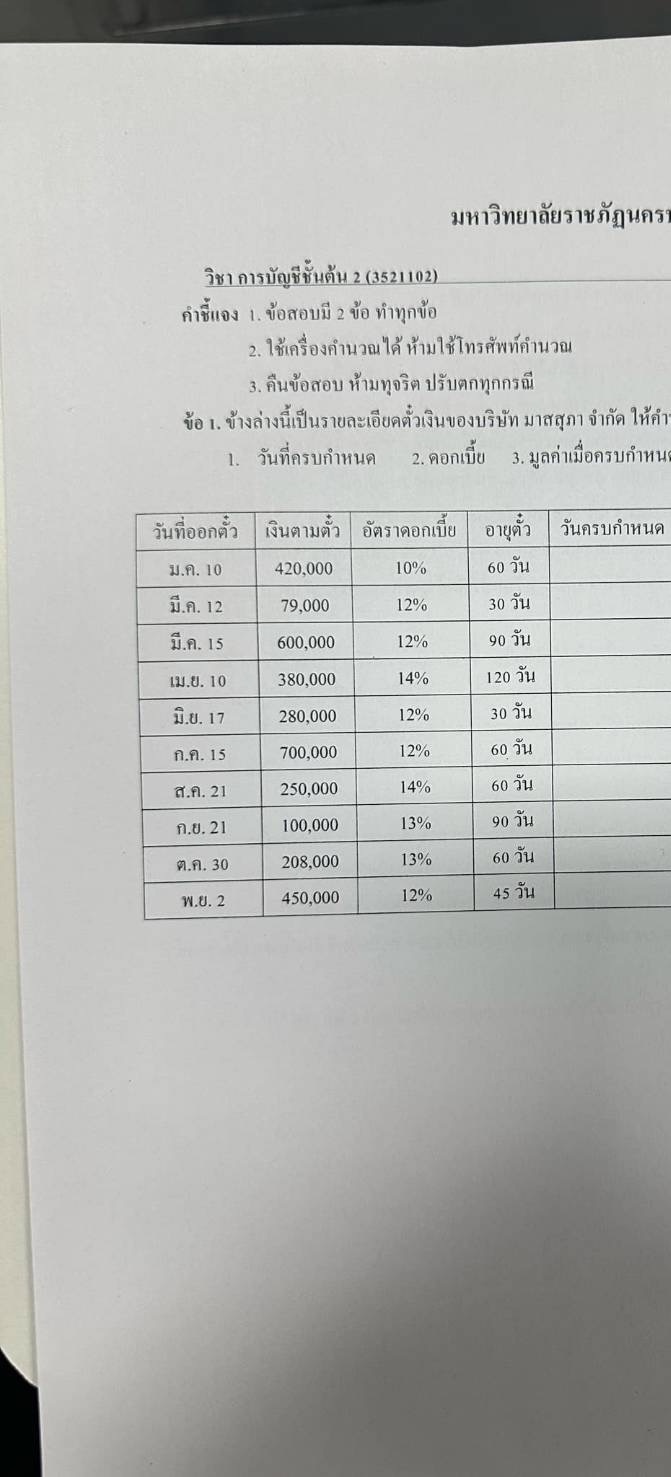

คำถามนี้เกี่ยวกับวิชาการบัญชีชั้นต้น โดยให้รายละเอียดเกี่ยวกับตั๋วเงินของบริษัท มาสสุภา จำกัด และให้คำนวณหาวันที่ครบกำหนด, ดอกเบี้ย, และมูลค่าเมื่อครบกำหนด

Answer

See the table in the answer section for due dates, interests, and maturity values.

Answer for screen readers

| Issue Date | Principal | Rate | Term (Days) | Due Date | Interest | Maturity Value |

|---|---|---|---|---|---|---|

| January 10 | 420,000 | 10% | 60 | March 11 | 6,876.71 | 426,876.71 |

| March 12 | 79,000 | 12% | 30 | April 11 | 776.16 | 79,776.16 |

| March 15 | 600,000 | 12% | 90 | June 13 | 17,753.42 | 617,753.42 |

| April 10 | 380,000 | 14% | 120 | August 8 | 17,479.45 | 397,479.45 |

| June 17 | 280,000 | 12% | 30 | July 17 | 2,761.64 | 282,761.64 |

| July 15 | 700,000 | 12% | 60 | September 13 | 13,726.03 | 713,726.03 |

| August 21 | 250,000 | 14% | 60 | October 20 | 5,753.42 | 255,753.42 |

| September 21 | 100,000 | 13% | 90 | December 20 | 3,205.48 | 103,205.48 |

| October 30 | 208,000 | 13% | 60 | December 29 | 4,438.90 | 212,438.90 |

| November 2 | 450,000 | 12% | 45 | December 17 | 6,657.53 | 456,657.53 |

Steps to Solve

- Calculate the due date

To calculate the due date, add the term (อายุตั๋ว) to the issue date (วันที่ออกตั๋ว). Note the number of days in each month to do this accurately: January has 31 days, February has 28 days (29 in leap years, but we assume not leap year here), March has 31 days, April has 30 days, May has 31 days, June has 30 days, July has 31 days, August has 31 days, September has 30 days, October has 31 days, November has 30 days, December has 31 days.

- Calculate the interest

The formula for simple interest is:

$Interest = Principal \times Rate \times Time$

Where:

- Principal is the face value of the note (เงินตามตัว)

- Rate is the annual interest rate (อัตราดอกเบี้ย)

- Time is the term of the note in years (อายุตั๋ว / 365)

- Calculate the maturity value The maturity value is calculated as:

$Maturity Value = Principal + Interest$

We will go through each row of the table.

Row 1: January 10, 420,000, 10%, 60 days

Due Date: January 10 + 60 days = March 11 Interest: $420,000 \times 0.10 \times \frac{60}{365} = 6,876.71$ Maturity Value: $420,000 + 6,876.71 = 426,876.71$

Row 2: March 12, 79,000, 12%, 30 days

Due Date: March 12 + 30 days = April 11 Interest: $79,000 \times 0.12 \times \frac{30}{365} = 776.16$ Maturity Value: $79,000 + 776.16 = 79,776.16$

Row 3: March 15, 600,000, 12%, 90 days

Due Date: March 15 + 90 days = June 13 Interest: $600,000 \times 0.12 \times \frac{90}{365} = 17,753.42$ Maturity Value: $600,000 + 17,753.42 = 617,753.42$

Row 4: April 10, 380,000, 14%, 120 days

Due Date: April 10 + 120 days = August 8 Interest: $380,000 \times 0.14 \times \frac{120}{365} = 17,479.45$ Maturity Value: $380,000 + 17,479.45 = 397,479.45$

Row 5: June 17, 280,000, 12%, 30 days

Due Date: June 17 + 30 days = July 17 Interest: $280,000 \times 0.12 \times \frac{30}{365} = 2,761.64$ Maturity Value: $280,000 + 2,761.64 = 282,761.64$

Row 6: July 15, 700,000, 12%, 60 days

Due Date: July 15 + 60 days = September 13 Interest: $700,000 \times 0.12 \times \frac{60}{365} = 13,726.03$ Maturity Value: $700,000 + 13,726.03 = 713,726.03$

Row 7: August 21, 250,000, 14%, 60 days

Due Date: August 21 + 60 days = October 20 Interest: $250,000 \times 0.14 \times \frac{60}{365} = 5,753.42$ Maturity Value: $250,000 + 5,753.42 = 255,753.42$

Row 8: September 21, 100,000, 13%, 90 days

Due Date: September 21 + 90 days = December 20 Interest: $100,000 \times 0.13 \times \frac{90}{365} = 3,205.48$ Maturity Value: $100,000 + 3,205.48 = 103,205.48$

Row 9: October 30, 208,000, 13%, 60 days

Due Date: October 30 + 60 days = December 29 Interest: $208,000 \times 0.13 \times \frac{60}{365} = 4,438.90$ Maturity Value: $208,000 + 4,438.90 = 212,438.90$

Row 10: November 2, 450,000, 12%, 45 days

Due Date: November 2 + 45 days = December 17 Interest: $450,000 \times 0.12 \times \frac{45}{365} = 6,657.53$ Maturity Value: $450,000 + 6,657.53 = 456,657.53$

| Issue Date | Principal | Rate | Term (Days) | Due Date | Interest | Maturity Value |

|---|---|---|---|---|---|---|

| January 10 | 420,000 | 10% | 60 | March 11 | 6,876.71 | 426,876.71 |

| March 12 | 79,000 | 12% | 30 | April 11 | 776.16 | 79,776.16 |

| March 15 | 600,000 | 12% | 90 | June 13 | 17,753.42 | 617,753.42 |

| April 10 | 380,000 | 14% | 120 | August 8 | 17,479.45 | 397,479.45 |

| June 17 | 280,000 | 12% | 30 | July 17 | 2,761.64 | 282,761.64 |

| July 15 | 700,000 | 12% | 60 | September 13 | 13,726.03 | 713,726.03 |

| August 21 | 250,000 | 14% | 60 | October 20 | 5,753.42 | 255,753.42 |

| September 21 | 100,000 | 13% | 90 | December 20 | 3,205.48 | 103,205.48 |

| October 30 | 208,000 | 13% | 60 | December 29 | 4,438.90 | 212,438.90 |

| November 2 | 450,000 | 12% | 45 | December 17 | 6,657.53 | 456,657.53 |

More Information

The calculations above assume a 365-day year for calculating simple interest. In some accounting contexts, a 360-day year is used. This will affect the interest and maturity value.

Tips

- Incorrectly calculating the number of days between dates. Be careful with the number of days in each month.

- Using the incorrect time period in the interest calculation. Remember to convert the term of the note into years by dividing by 365.

- Rounding errors. Keep enough decimal places during intermediate calculations to ensure accuracy in the final answer.

- Confusing the principal and maturity value.

AI-generated content may contain errors. Please verify critical information