Understand the Problem

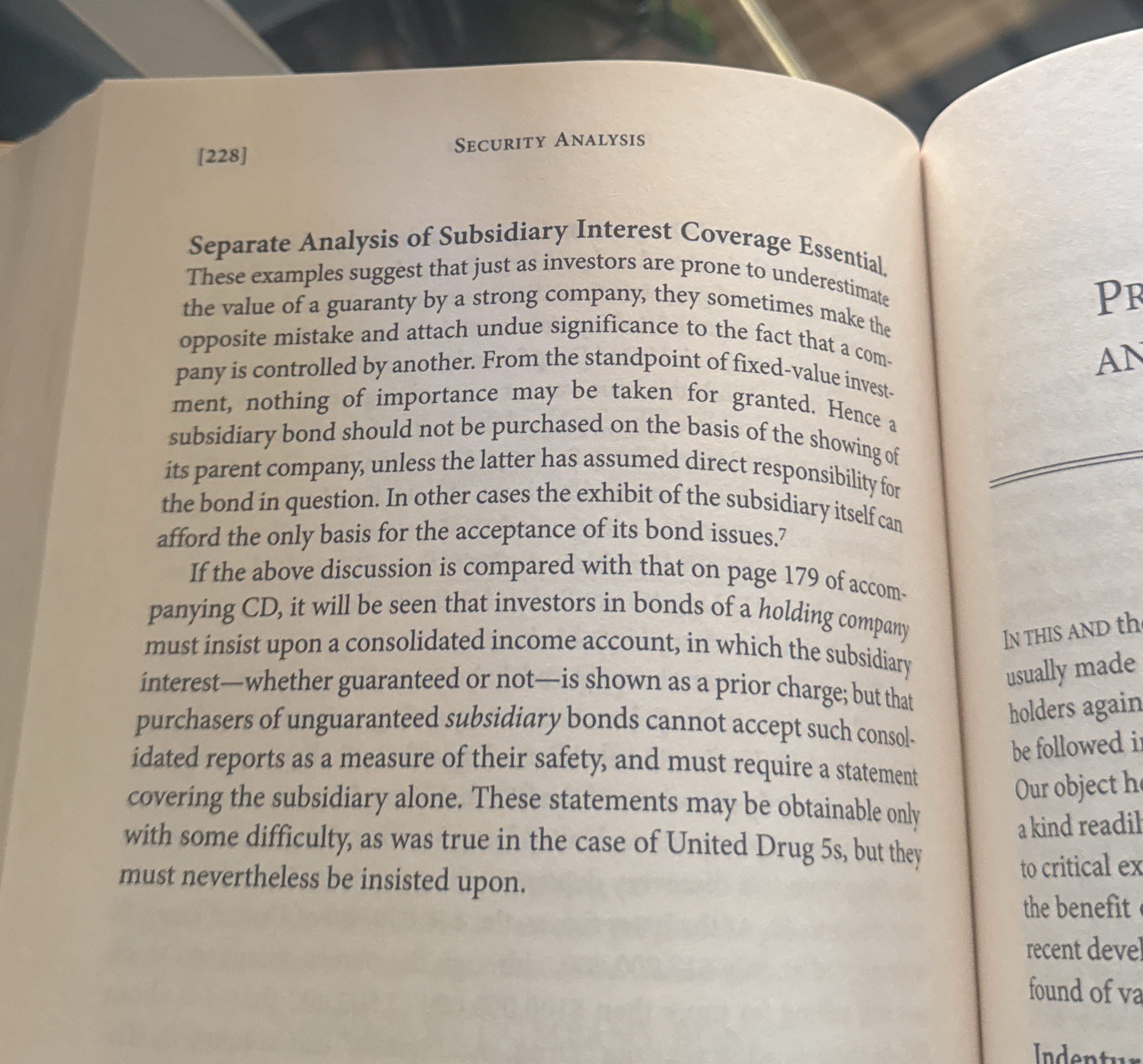

The text discusses the importance of evaluating subsidiary interest coverage and the implications of guarantees by parent companies when investing in subsidiary bonds. It emphasizes the necessity for investors to analyze the financial standings of both parent and subsidiary companies before making investment decisions.

Answer

Investors must assess subsidiary bonds independently unless guaranteed by the parent.

The final answer is that investors should not rely on the parent company's financials when evaluating subsidiary bonds unless the parent guarantees them; they should assess the subsidiary's performance independently.

Answer for screen readers

The final answer is that investors should not rely on the parent company's financials when evaluating subsidiary bonds unless the parent guarantees them; they should assess the subsidiary's performance independently.

More Information

Understanding a subsidiary's standalone financial health is crucial because a parent company's strong performance does not inherently safeguard the bonds of its subsidiaries.

Tips

A common mistake is overvaluing parent company guarantees without verifying that such guarantees are in place for the specific subsidiary bonds.

AI-generated content may contain errors. Please verify critical information