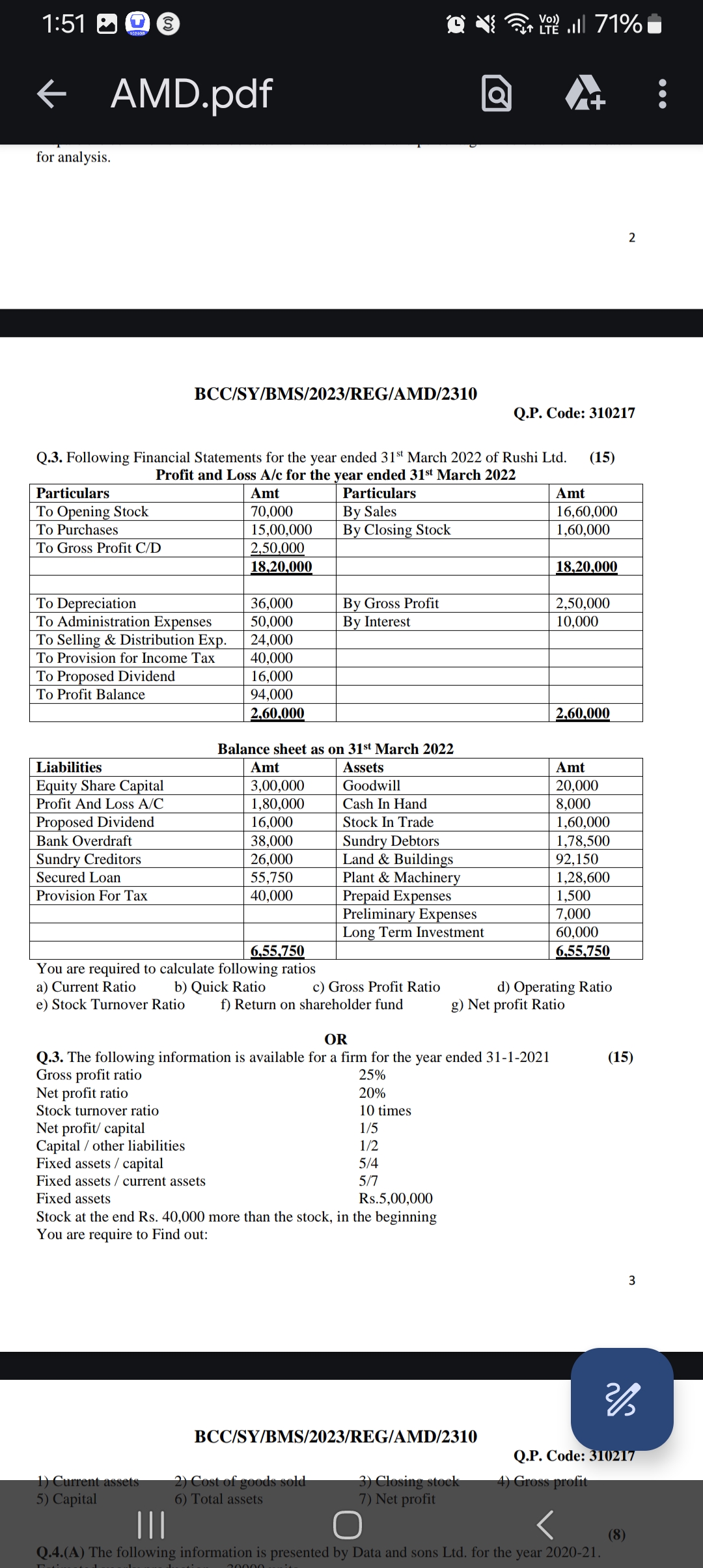

You are required to calculate the following ratios a) Current Ratio b) Quick Ratio c) Gross Profit Ratio d) Operating Ratio e) Stock Turnover Ratio f) Return on shareholder fund g)... You are required to calculate the following ratios a) Current Ratio b) Quick Ratio c) Gross Profit Ratio d) Operating Ratio e) Stock Turnover Ratio f) Return on shareholder fund g) Net profit Ratio

Understand the Problem

The question asks for the calculation of various financial ratios based on the provided financial statements of Rushi Ltd for the year ended March 31, 2022. The user needs to compute ratios such as Current Ratio, Quick Ratio, Gross Profit Ratio, Operating Ratio, Stock Turnover Ratio, and Return on Shareholder Fund using the given data.

Answer

- Current Ratio: $2.55$ - Quick Ratio: $2.91$ - Gross Profit Ratio: $15.06\%$ - Operating Ratio: $10.42\%$ - Stock Turnover Ratio: $0.55$ - Return on Shareholder Fund: $3.13\%$ - Net Profit Ratio: $5.66\%$

Answer for screen readers

- Current Ratio: 2.55

- Quick Ratio: 2.91

- Gross Profit Ratio: 15.06%

- Operating Ratio: 10.42%

- Stock Turnover Ratio: 0.55

- Return on Shareholder Fund: 3.13%

- Net Profit Ratio: 5.66%

Steps to Solve

-

Calculate Current Assets and Current Liabilities

Current Assets = Cash in Hand + Stock in Trade + Sundry Debtors + Prepaid Expenses

Current Liabilities = Bank Overdraft + Sundry Creditors + Proposed DividendFrom the balance sheet:

Current Assets

= 8,000 (Cash in Hand) + 16,000 (Stock in Trade) + 1,78,500 (Sundry Debtors) + 1,500 (Prepaid Expenses)

= 8,000 + 16,000 + 1,78,500 + 1,500 = 2,04,000Current Liabilities

= 38,000 (Bank Overdraft) + 26,000 (Sundry Creditors) + 16,000 (Proposed Dividend)

= 38,000 + 26,000 + 16,000 = 80,000 -

Current Ratio

The formula for Current Ratio is:

$$ \text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}} $$

Substituting in values:

$$ \text{Current Ratio} = \frac{2,04,000}{80,000} = 2.55 $$ -

Calculate Liquid Assets and Quick Liabilities

Liquid Assets = Cash in Hand + Sundry Debtors

Quick Liabilities = Bank Overdraft + Sundry CreditorsLiquid Assets

= 8,000 + 1,78,500 = 1,86,500Quick Liabilities

= 38,000 + 26,000 = 64,000 -

Quick Ratio

The formula for Quick Ratio is:

$$ \text{Quick Ratio} = \frac{\text{Liquid Assets}}{\text{Quick Liabilities}} $$

Substituting in values:

$$ \text{Quick Ratio} = \frac{1,86,500}{64,000} \approx 2.91 $$ -

Gross Profit Ratio

The formula for Gross Profit Ratio is:

$$ \text{Gross Profit Ratio} = \frac{\text{Gross Profit}}{\text{Sales}} \times 100 $$

From the Profit and Loss Account:

Gross Profit = 2,50,000

Sales = 16,60,000So,

$$ \text{Gross Profit Ratio} = \frac{2,50,000}{16,60,000} \times 100 \approx 15.06% $$ -

Operating Ratio

The formula for Operating Ratio is:

$$ \text{Operating Ratio} = \frac{\text{Cost of Goods Sold + Operating Expenses}}{\text{Sales}} \times 100 $$

Cost of Goods Sold = Purchases + Opening Stock - Closing Stock = 15,000 + 70,000 - 1,60,000 = 63,000

Operating Expenses = Selling & Distribution + Administrative + Depreciation = 24,000 + 50,000 + 36,000 = 1,10,000So,

$$ \text{Operating Ratio} = \frac{63,000 + 1,10,000}{16,60,000} \times 100 $$

$$ = \frac{1,73,000}{16,60,000} \times 100 \approx 10.42% $$ -

Stock Turnover Ratio

The formula for Stock Turnover Ratio is:

$$ \text{Stock Turnover Ratio} = \frac{\text{Cost of Goods Sold}}{\text{Average Stock}} $$

Average Stock = (Opening Stock + Closing Stock)/2

Average Stock = (70,000 + 1,60,000)/2 = 115,000

Substituting the values:

$$ \text{Stock Turnover Ratio} = \frac{63,000}{115,000} \approx 0.55 $$ -

Return on Shareholder Fund

The formula for Return on Shareholder Fund is:

$$ \text{Return on Shareholder Fund} = \frac{\text{Net Profit}}{\text{Equity Capital}} \times 100 $$

From the Profit and Loss Account:

Net Profit = 94,000

Equity Share Capital = 30,00,000So,

$$ \text{Return on Shareholder Fund} = \frac{94,000}{30,00,000} \times 100 \approx 3.13% $$ -

Net Profit Ratio

The formula for Net Profit Ratio is:

$$ \text{Net Profit Ratio} = \frac{\text{Net Profit}}{\text{Sales}} \times 100 $$

Substituting the values:

$$ \text{Net Profit Ratio} = \frac{94,000}{16,60,000} \times 100 \approx 5.66% $$

- Current Ratio: 2.55

- Quick Ratio: 2.91

- Gross Profit Ratio: 15.06%

- Operating Ratio: 10.42%

- Stock Turnover Ratio: 0.55

- Return on Shareholder Fund: 3.13%

- Net Profit Ratio: 5.66%

More Information

These ratios help in assessing the company's financial health, liquidity, profitability, and efficiency in managing assets. Financial ratios are critical for both management decisions and external evaluations by investors and creditors.

Tips

- Miscalculating current assets or liabilities, leading to incorrect ratios.

- Forgetting to include certain expenses in operating costs.

- Confusing gross profit with net profit when calculating ratios.

AI-generated content may contain errors. Please verify critical information