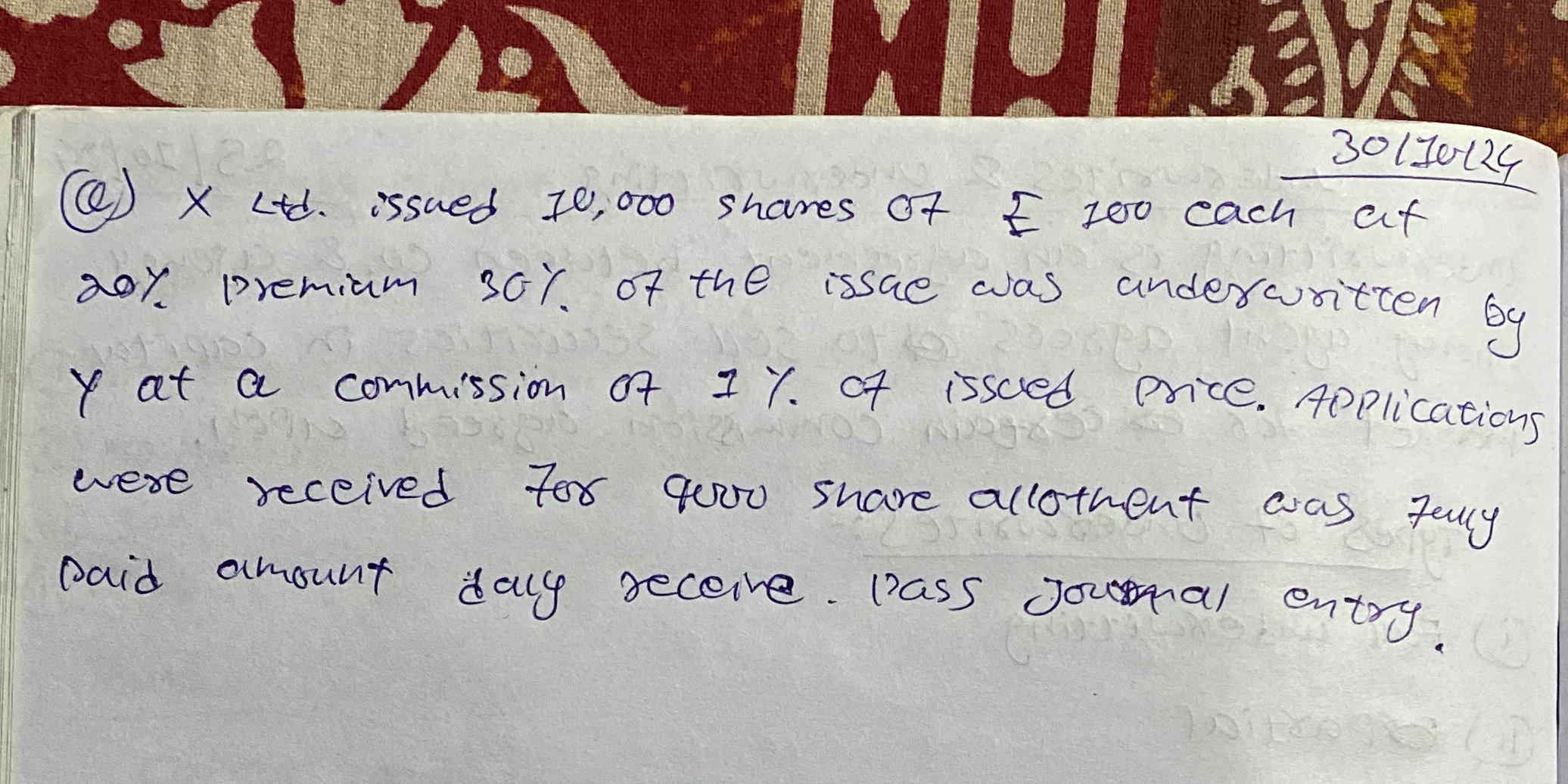

X Ltd. issued 10,000 shares of £100 each at a 20% premium. 30% of the issue was underwritten by Y at a commission of 1% of the issued price. Applications were received for 8,000 sh... X Ltd. issued 10,000 shares of £100 each at a 20% premium. 30% of the issue was underwritten by Y at a commission of 1% of the issued price. Applications were received for 8,000 share allotment. Pass journal entry.

Understand the Problem

The question is asking for the journal entry related to the issuance of shares by a company, X Ltd. It requires calculating the issued capital, considering the premium, commission, and the applications received. This involves applying accounting principles to record the financial transaction accurately.

Answer

The journal entry is: ``` Bank Account Dr. £1,188,000 Subscription Account Cr. £1,200,000 Commission Account Dr. £12,000 To Share Capital Account Cr. £1,000,000 To Premium on Shares Account Cr. £200,000 ```

Answer for screen readers

The journal entry for the issuance of shares by X Ltd. is as follows:

Bank Account Dr. £1,188,000

Subscription Account Cr. £1,200,000

Commission Account Dr. £12,000

To Share Capital Account Cr. £1,000,000

To Premium on Shares Account Cr. £200,000

Steps to Solve

- Determine the total number of shares issued

X Ltd. issued 10,000 shares.

- Calculate the nominal value of shares

Each share has a nominal value of £100.

- Find the issuance price per share

The issued shares are at a 20% premium.

Thus, the total price per share is:

$$

\text{Price per share} = \text{Nominal Value} + \text{Premium} = 100 + (0.20 \times 100) = 100 + 20 = £120

$$

- Calculate the total issued capital

The total issued capital is calculated by multiplying the total number of shares by the price per share: $$ \text{Total Issued Capital} = \text{Number of Shares} \times \text{Price per Share} = 10,000 \times 120 = £1,200,000 $$

- Determine the commission on the total issued price

The commission is 1% of the issued price. Thus, the commission amount is: $$ \text{Commission} = 0.01 \times \text{Total Issued Capital} = 0.01 \times 1,200,000 = £12,000 $$

- Prepare the journal entry

The journal entry will reflect the issued shares, the cash received, and the commission. The journal entry can be represented as follows:

Bank Account Dr. 1,188,000

Subscription Account Cr. 1,200,000

Commission Account Dr. 12,000

To Share Capital Account Cr. 1,000,000

To Premium on Shares Account Cr. 200,000

The journal entry for the issuance of shares by X Ltd. is as follows:

Bank Account Dr. £1,188,000

Subscription Account Cr. £1,200,000

Commission Account Dr. £12,000

To Share Capital Account Cr. £1,000,000

To Premium on Shares Account Cr. £200,000

More Information

This journal entry reflects the cash inflow from the issuance of shares, the share capital created, the premium collected, and the commission expense incurred.

Tips

- Forgetting to include the premium in the calculation of the total issued capital.

- Incorrectly calculating the commission, which should be based on the total issued capital, not the nominal value of shares.

- Not accounting for the journal format and proper debits and credits.

AI-generated content may contain errors. Please verify critical information