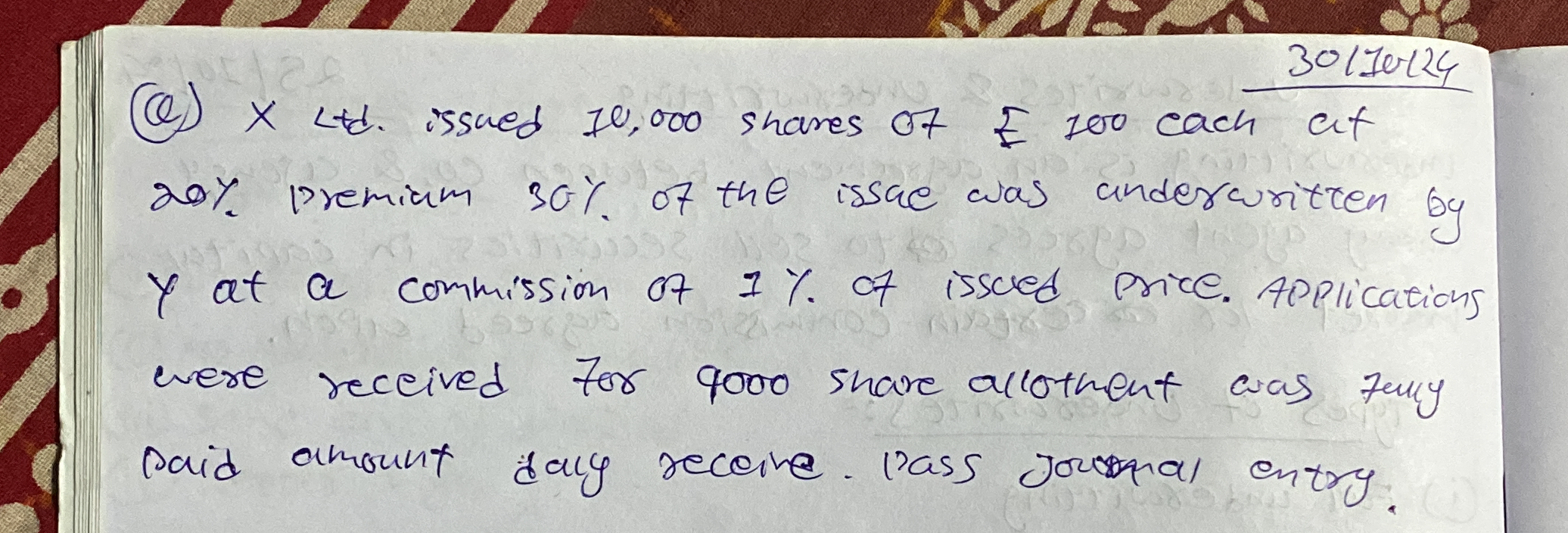

X Ltd. issued 10,000 shares of £100 each at 20% premium. The issue was underwritten by Y at a commission of 1% of issued price. Applications were received for 9000 shares, allotmen... X Ltd. issued 10,000 shares of £100 each at 20% premium. The issue was underwritten by Y at a commission of 1% of issued price. Applications were received for 9000 shares, allotment was fully paid. Pass journal entry.

Understand the Problem

The question is asking to pass the journal entry for a transaction involving the issue of shares, which includes details about the premium, commission, and the number of shares allotted.

Answer

The journal entry records the total cash received, share capital issued, premium accounted, and commission paid.

Answer for screen readers

The journal entry is as follows:

Date Account Titles Debit Credit

30/01/2024 Cash/Bank Account ₹1,080,000

Share Capital Account ₹900,000

Securities Premium Account ₹180,000

Commission Account ₹10,800

Steps to Solve

-

Identify Key Components

From the problem, we have:

- Number of shares issued: 10,000 shares.

- Face value of each share: ₹100.

- Premium: 20%, so premium per share = 20% of ₹100 = ₹20.

- Issue Price per share = Face Value + Premium = ₹100 + ₹20 = ₹120.

- Applications received for 9,000 shares.

-

Calculate Total Amount Received

The total amount received for the 9,000 shares: [ \text{Total Amount} = \text{Number of Shares} \times \text{Issue Price} = 9,000 \times ₹120 = ₹1,080,000. ]

-

Determine Commission

The commission paid is 1% of the issued price: [ \text{Commission} = 1% \times (9,000 \times ₹120) = 1% \times ₹1,080,000 = ₹10,800. ]

-

Make Journal Entry

The journal entry will include:

- Cash or Bank Account (amount received).

- Share Capital Account (for the issued amount).

- Securities Premium Account (for the premium).

- Commission Account (for the commission paid).

The journal entry format will be:

- Debit Cash/Bank ₹1,080,000

- Credit Share Capital ₹900,000 (for 9,000 shares at ₹100)

- Credit Securities Premium ₹180,000 (for 9,000 shares at ₹20)

- Debit Commission ₹10,800.

-

Final Entry

The final entry in journal format:

Date Account Titles Debit Credit 30/01/2024 Cash/Bank Account ₹1,080,000 Share Capital Account ₹900,000 Securities Premium Account ₹180,000 Commission Account ₹10,800

The journal entry is as follows:

Date Account Titles Debit Credit

30/01/2024 Cash/Bank Account ₹1,080,000

Share Capital Account ₹900,000

Securities Premium Account ₹180,000

Commission Account ₹10,800

More Information

This entry captures the total funds received from the share issue, the allocation to share capital and securities premium, and the commission deducted for the underwriting services.

Tips

- Forgetting to account for the commission, which reduces the cash received.

- Mixing up the face value and issue price when calculating share capital.

- Not properly categorizing the accounts in the journal entry.

AI-generated content may contain errors. Please verify critical information