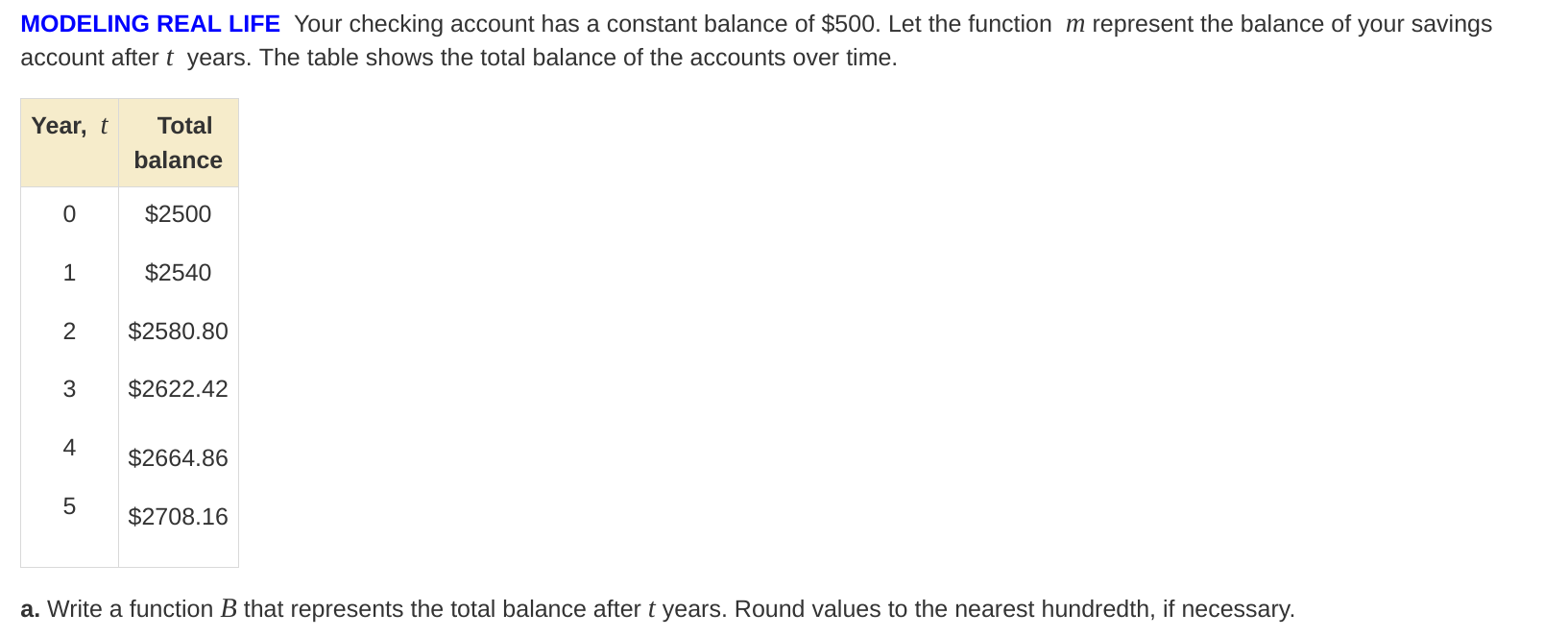

Write a function B that represents the total balance after t years. Round values to the nearest hundredth, if necessary.

Understand the Problem

The question is asking us to create a function that models the total balance of a checking account over time, specifically after a certain number of years. We need to analyze the provided data to derive this function appropriately.

Answer

The function is given by $B(t) = 2500 + 41.63t$.

Answer for screen readers

The function that represents the total balance after ( t ) years is

$$ B(t) = 2500 + 41.63t $$

Steps to Solve

- Identify the initial balance and the changes over time

The initial balance at year ( t = 0 ) is $2500. As time progresses, we note the total balance for each year.

- Calculate the increase in balance per year

To find the total increase in balance from year 0 to year 5, we calculate:

[ \text{Total increase} = B(5) - B(0) = 2708.16 - 2500 = 208.16 ]

Now, we divide this increase by the number of years (5 years):

[ \text{Annual increase} = \frac{208.16}{5} = 41.632 ]

- Write the function for the total balance

The total balance after ( t ) years can be expressed as:

[ B(t) = 2500 + (41.632 \cdot t) ]

Where:

- ( B(t) ) is the total balance after ( t ) years.

- ( 2500 ) is the initial balance.

- ( 41.632 ) is the annual increase rounded to the nearest hundredth.

- Final function formulation

The final function representing the total balance is:

[ B(t) = 2500 + 41.63t ]

The function that represents the total balance after ( t ) years is

$$ B(t) = 2500 + 41.63t $$

More Information

This function indicates that the account balance increases at an approximate rate of $41.63 each year, starting from an initial amount of $2500.

Tips

- Rounding too early: Ensure calculations for annual increase are kept to multiple decimal points before rounding to the nearest hundredth in the final function.

- Not correctly interpreting the problem context: Make sure to understand that the constant addition to the balance is due to annual interest or deposits.

AI-generated content may contain errors. Please verify critical information