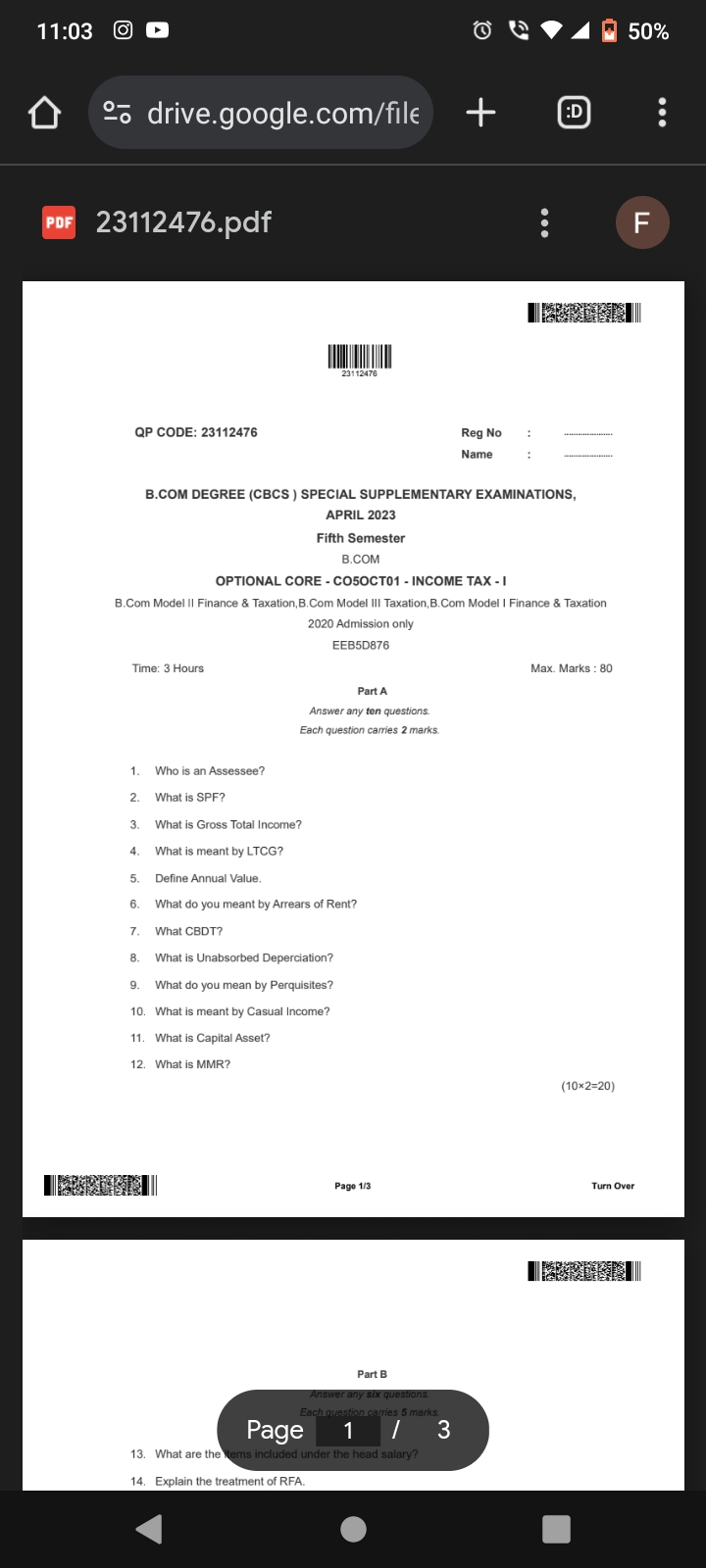

Who is an Assessee? What is SPF? What is Gross Total Income? What is meant by LTCG? Define Annual Value. What do you mean by Arrears of Rent? What is CBDT? What is Unabsorbed Depre... Who is an Assessee? What is SPF? What is Gross Total Income? What is meant by LTCG? Define Annual Value. What do you mean by Arrears of Rent? What is CBDT? What is Unabsorbed Depreciation? What do you mean by Perquisites? What is meant by Casual Income? What is Capital Asset? What is MMR?

Understand the Problem

The document appears to be an examination paper for a B.Com degree course, specifically focusing on Income Tax. It includes a series of questions that the students need to answer regarding various concepts of income tax and taxation principles.

Answer

1. Assessee: person liable to pay tax. 2. SPF: statutory public finance. 3. Gross Total Income: total income before deductions. 4. LTCG: Long-Term Capital Gains. 5. Annual Value: potential annual rent. 6. Arrears of Rent: unpaid rent. 7. CBDT: Central Board of Direct Taxes. 8. Unabsorbed Depreciation: undeducted depreciation. 9. Perquisites: benefits besides salary. 10. Casual Income: non-recurring income. 11. Capital Asset: property or investment. 12. MMR: Maximum Marginal Rate.

- An Assessee is a person liable to pay tax.

- SPF can refer to statutory public finance, but more context is needed.

- Gross Total Income is the total income before deductions.

- LTCG means Long-Term Capital Gains.

- Annual Value is the potential annual rent for real estate.

- Arrears of Rent refer to unpaid rent amounts.

- CBDT stands for Central Board of Direct Taxes.

- Unabsorbed Depreciation is depreciation not deducted in a financial year.

- Perquisites are benefits besides salary.

- Casual Income refers to non-recurring income like lottery winnings.

- Capital Asset is any property or investment.

- MMR is Maximum Marginal Rate, typically the highest tax rate.

Answer for screen readers

- An Assessee is a person liable to pay tax.

- SPF can refer to statutory public finance, but more context is needed.

- Gross Total Income is the total income before deductions.

- LTCG means Long-Term Capital Gains.

- Annual Value is the potential annual rent for real estate.

- Arrears of Rent refer to unpaid rent amounts.

- CBDT stands for Central Board of Direct Taxes.

- Unabsorbed Depreciation is depreciation not deducted in a financial year.

- Perquisites are benefits besides salary.

- Casual Income refers to non-recurring income like lottery winnings.

- Capital Asset is any property or investment.

- MMR is Maximum Marginal Rate, typically the highest tax rate.

More Information

The Central Board of Direct Taxes (CBDT) is the authority responsible for administering India's direct tax laws including the Income Tax Act. Long-term capital gains (LTCG) tax rate can differ based on the holding period of assets.

Tips

Mixing up gross total income with taxable income is common; ensure you account for deductions separately.

Sources

- Capital Gains Explained | FINRA.org - finra.org

- Topics on Gross Total Income and Capital Gains - cacsnetwork.co.in

- Definition and Explanation of Key Tax Concepts - investopedia.com

AI-generated content may contain errors. Please verify critical information