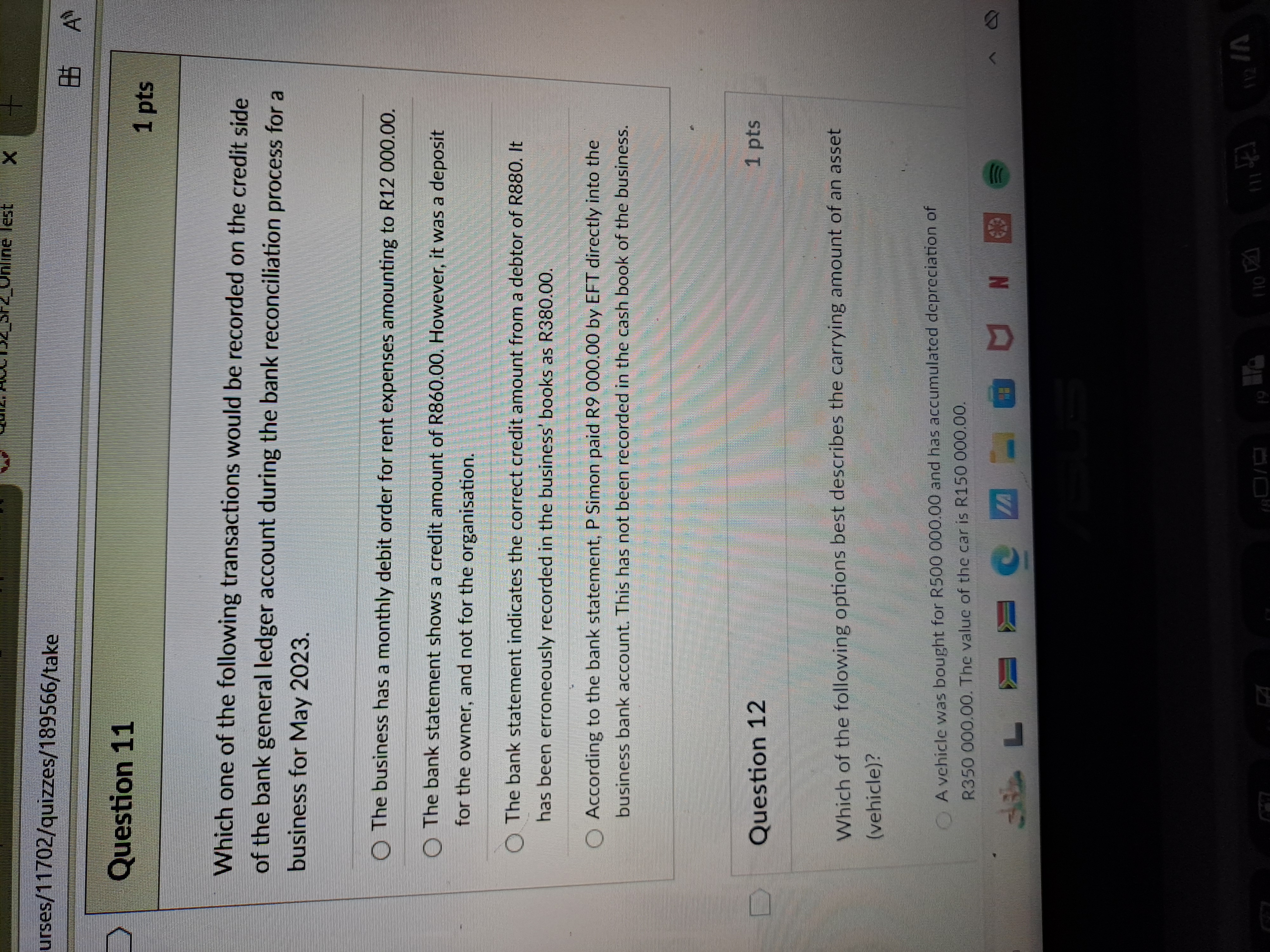

Which one of the following transactions would be recorded on the credit side of the bank general ledger account during the bank reconciliation process for a business for May 2023?... Which one of the following transactions would be recorded on the credit side of the bank general ledger account during the bank reconciliation process for a business for May 2023? Which of the following options best describes the carrying amount of an asset (vehicle)?

Understand the Problem

The questions are asking about accounting transactions and asset valuation. Question 11 relates to recognizing proper entries during bank reconciliation, while Question 12 deals with understanding the concept of carrying amounts for assets such as vehicles.

Answer

Credit: 'R860 deposit'. Carrying amount: R150,000.

The transaction that would be recorded on the credit side of the bank general ledger is 'The bank statement shows a credit amount of R860.00. However, it was a deposit for the owner, and not for the organisation.' The carrying amount of the vehicle is R150,000.

Answer for screen readers

The transaction that would be recorded on the credit side of the bank general ledger is 'The bank statement shows a credit amount of R860.00. However, it was a deposit for the owner, and not for the organisation.' The carrying amount of the vehicle is R150,000.

More Information

During bank reconciliation, errors or omissions in the cash book compared to the bank statement are adjusted. In this case, the R860 deposit affects the bank but is not intended for the business. The carrying amount reflects the depreciated value of the vehicle, confirming it's R150,000.

Tips

A common mistake is misidentifying the nature of transactions that need reconciliation adjustments. Ensure correct distinction between owner transactions and organization transactions.

Sources

- What Is a Bank Reconciliation Statement, and How Is It Done? - investopedia.com

AI-generated content may contain errors. Please verify critical information