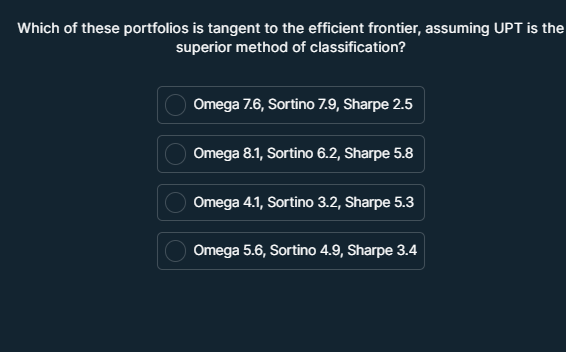

Which of these portfolios is tangent to the efficient frontier, assuming UPT is the superior method of classification?

Understand the Problem

The question is asking which portfolio is tangent to the efficient frontier, considering UPT as the superior classification method. It implies a need for a comparison of portfolio performance metrics such as Omega, Sortino, and Sharpe ratios to determine the optimal portfolio.

Answer

Omega 8.1, Sortino 6.2, Sharpe 5.8

The portfolio with Omega 8.1, Sortino 6.2, Sharpe 5.8 is tangent to the efficient frontier.

Answer for screen readers

The portfolio with Omega 8.1, Sortino 6.2, Sharpe 5.8 is tangent to the efficient frontier.

More Information

The Sharpe ratio measures the risk-adjusted return, which is key to determining the portfolio tangent to the efficient frontier.

Tips

A common mistake is not prioritizing the Sharpe ratio, which is essential for identifying the tangent portfolio.

Sources

- The web page with info on - Example Source - brainly.com

AI-generated content may contain errors. Please verify critical information