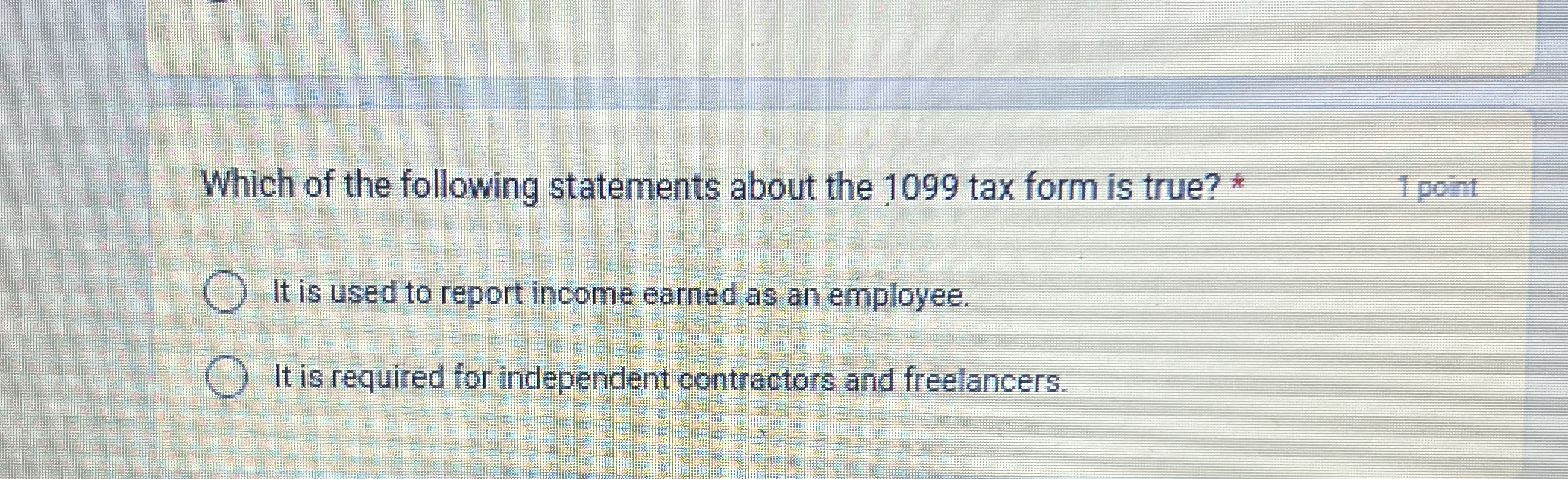

Which of the following statements about the 1099 tax form is true?

Understand the Problem

The question is asking which statement regarding the 1099 tax form is true, specifically focusing on its purposes and requirements.

Answer

It is required for independent contractors and freelancers.

The final answer is: It is required for independent contractors and freelancers.

Answer for screen readers

The final answer is: It is required for independent contractors and freelancers.

More Information

A 1099 form is used to report income not earned from employment, such as various types of non-employment income like dividends or payments for independent work.

Tips

A common mistake is confusing W-2 forms, used for employee wages, with 1099 forms for independent contractor income.

Sources

- What Is an IRS 1099 Form? - TurboTax - Intuit - turbotax.intuit.com

- What Are 10 Things You Should Know About 1099s? - Investopedia - investopedia.com

AI-generated content may contain errors. Please verify critical information