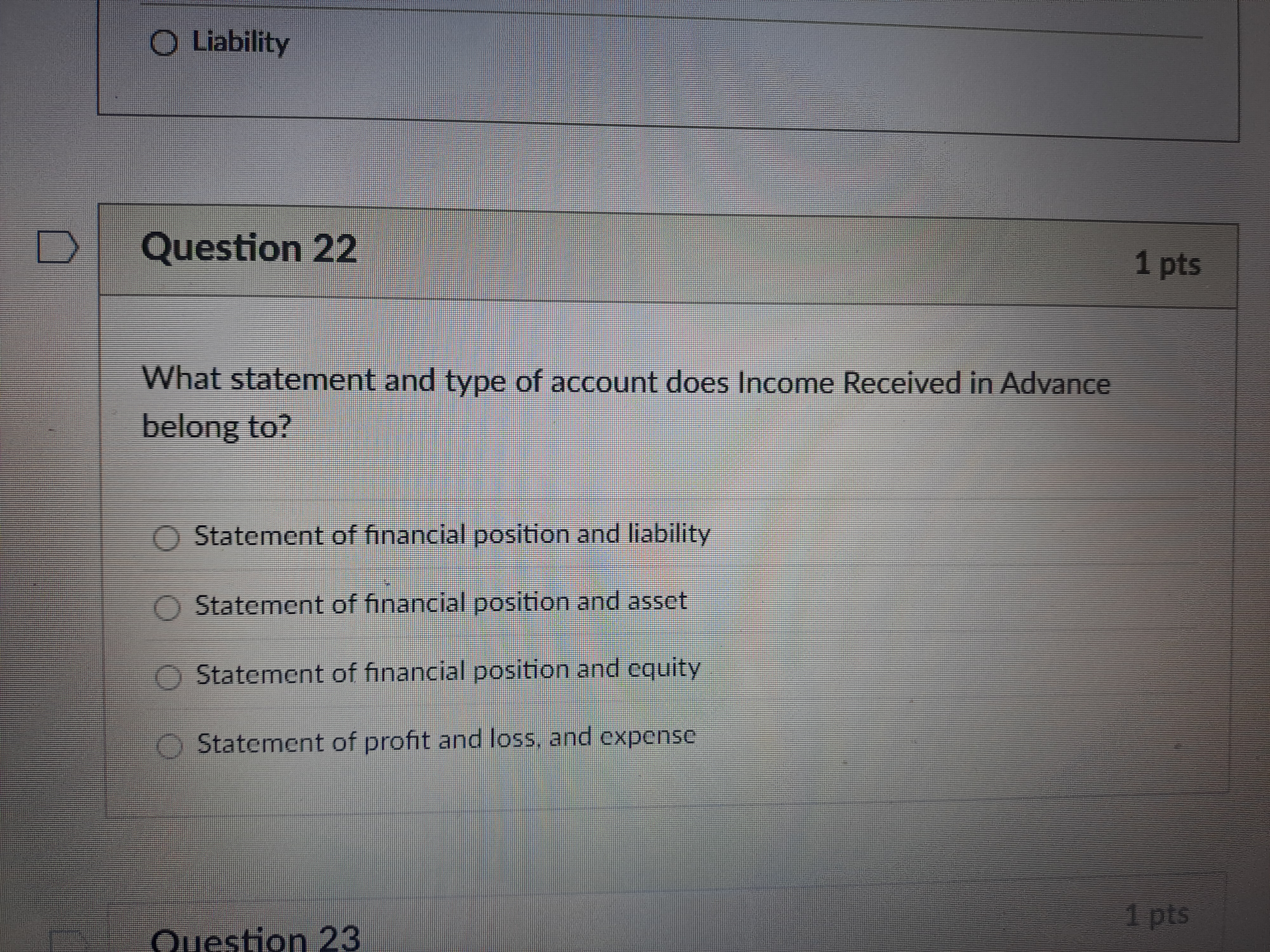

What statement and type of account does Income Received in Advance belong to?

Understand the Problem

The question is asking which financial statement and account type Income Received in Advance belongs to. The possible options pertain to accounting classifications, where the user needs to identify the correct statement related to income received before services are performed.

Answer

Statement of financial position and liability

The final answer is 'Statement of financial position and liability'.

Answer for screen readers

The final answer is 'Statement of financial position and liability'.

More Information

Income received in advance is classified as a liability because the revenue has not been earned yet. It is recorded on the balance sheet under the liabilities section, reflecting the obligation to deliver goods or services in the future.

Tips

A common mistake is to classify it as an asset, but since the revenue has not yet been earned, it remains a liability.

Sources

- Income Received in Advance - Vedantu - vedantu.com

- Where does revenue received in advance go - AccountingCoach - accountingcoach.com

AI-generated content may contain errors. Please verify critical information