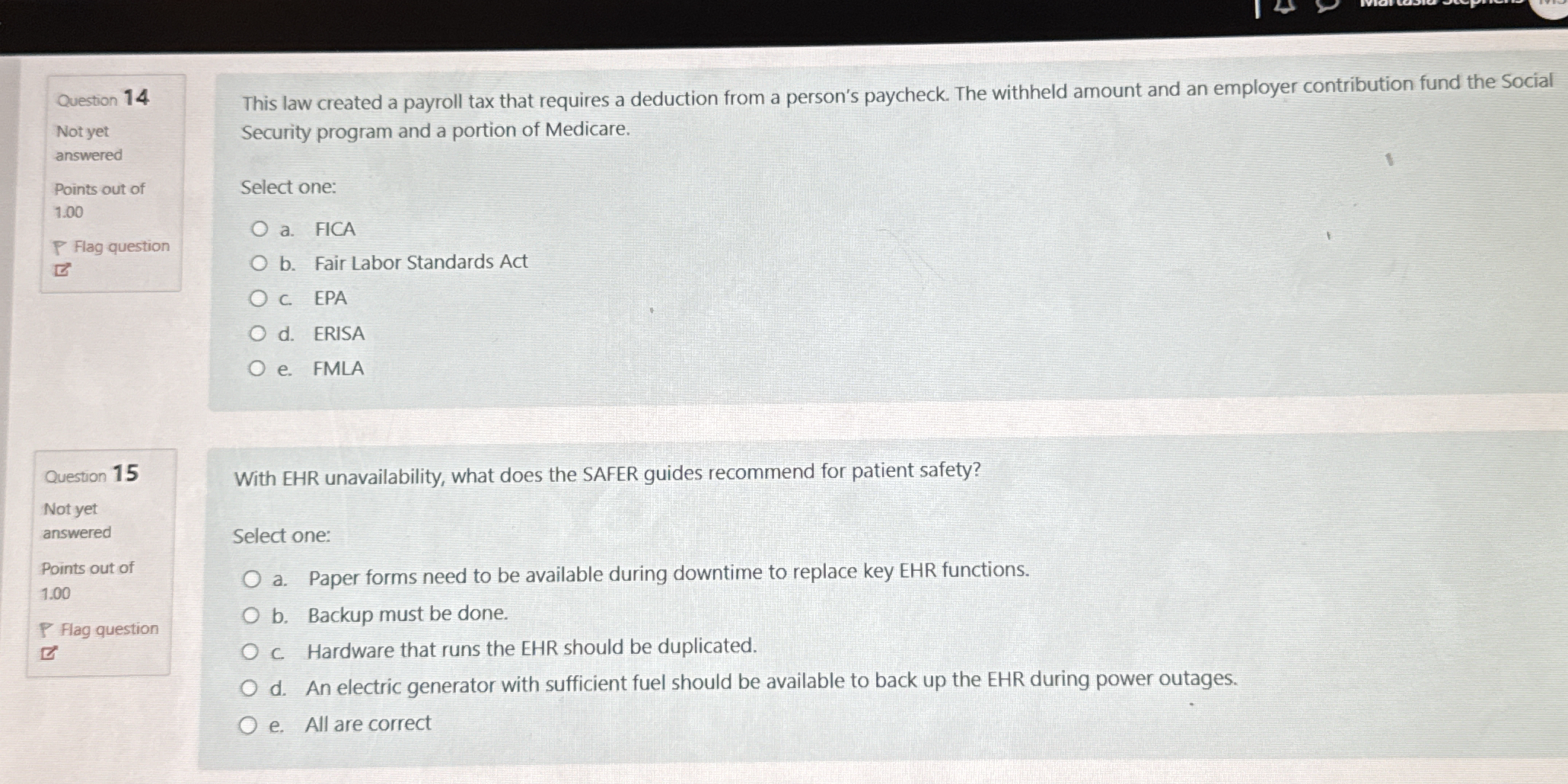

What law created a payroll tax that requires a deduction from a person's paycheck? With EHR unavailability, what do the SAFER guides recommend for patient safety?

Understand the Problem

The questions ask about specific laws related to payroll tax and patient safety recommendations in case of electronic health record (EHR) unavailability. The first question is focused on identifying a law related to payroll deductions, while the second question seeks practical measures for patient safety when EHR systems are down.

Answer

FICA; All options for EHR unavailability.

The Federal Insurance Contributions Act (FICA) created a payroll tax requiring paycheck deductions. The SAFER guides recommend all options for EHR unavailability: paper forms, backups, duplicated hardware, and a generator.

Answer for screen readers

The Federal Insurance Contributions Act (FICA) created a payroll tax requiring paycheck deductions. The SAFER guides recommend all options for EHR unavailability: paper forms, backups, duplicated hardware, and a generator.

More Information

FICA taxes fund Social Security and Medicare. SAFER guides ensure patient safety during EHR downtime by recommending multiple contingency plans.

Tips

A common mistake is not recognizing all necessary contingency measures for EHR outages.

Sources

- Federal Insurance Contributions Act (FICA) - Study - studocu.com

AI-generated content may contain errors. Please verify critical information