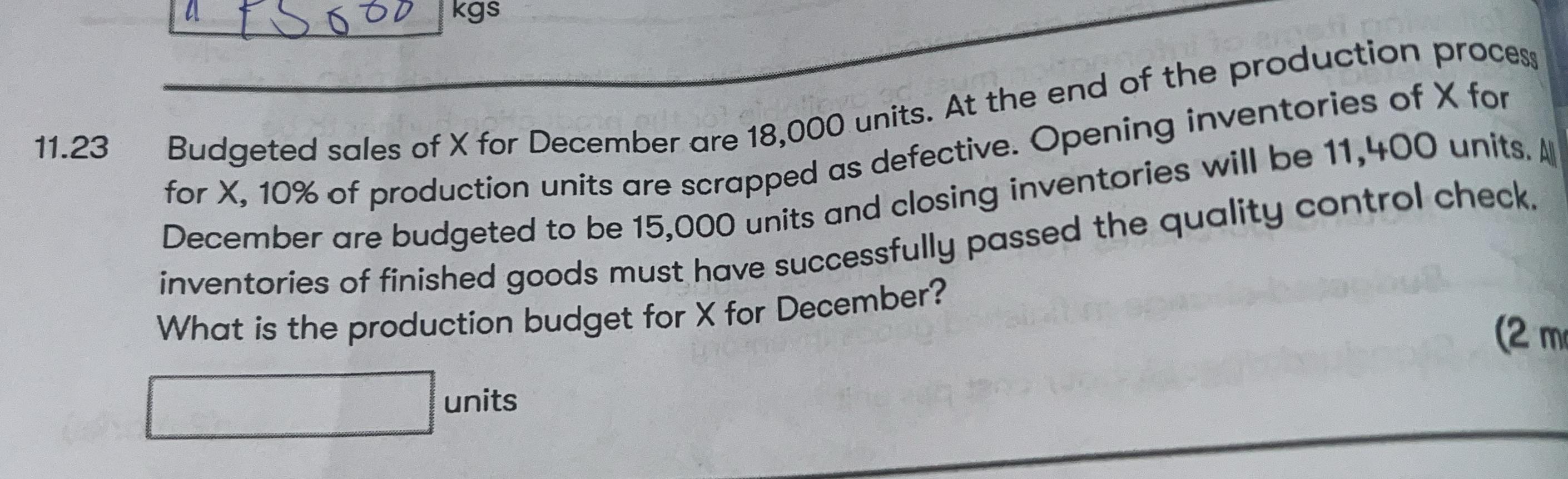

What is the production budget for X for December?

Understand the Problem

The question asks for the production budget needed for item X in December, given the parameters of budgeted sales, defective units, opening and closing inventories. To solve it, we need to calculate the net production required based on these figures.

Answer

The production budget for X in December is $20,000$ units.

Answer for screen readers

The production budget for item X for December is $20,000$ units.

Steps to Solve

-

Determine Required Sales Units The budgeted sales for December are given as 18,000 units.

-

Calculate Production Units Considering Defects Since 10% of the production units are scrapped, we determine the production needed to meet the sales goals: Let $P$ be the production units. The equation will be: $$ 0.9P = 18,000 $$ Solving for $P$, $$ P = \frac{18,000}{0.9} = 20,000 $$

-

Account for Opening and Closing Inventory Next, we need to consider the opening and closing inventories to find out how many units to produce. The formula for production is: $$ \text{Production} = \text{Sales} + \text{Closing Inventory} - \text{Opening Inventory} $$ Substituting our values: $$ \text{Production} = 18,000 + 11,400 - 15,000 $$

-

Calculate Final Production Requirement Now, simplifying: $$ \text{Production} = 18,000 + 11,400 - 15,000 = 14,400 $$

-

Adjust for Defective Units Now that we have the production needed to meet the sales and inventory requirements, we need to ensure we produce enough accounting for defects: Using $P = 20,000$ from step 2, we confirm that we need to produce 20,000 units to end with the required 18,000 units sold after accounting for 10% defects.

The production budget for item X for December is $20,000$ units.

More Information

This process is essential for businesses to ensure they have adequate production to meet sales requirements while accounting for defective units and inventory changes. This helps maintain the quality of finished goods.

Tips

- Forgetting to account for defective units could lead to underproducing.

- Not maintaining clarity on whether to add or subtract inventory changes can lead to incorrect calculations.

AI-generated content may contain errors. Please verify critical information