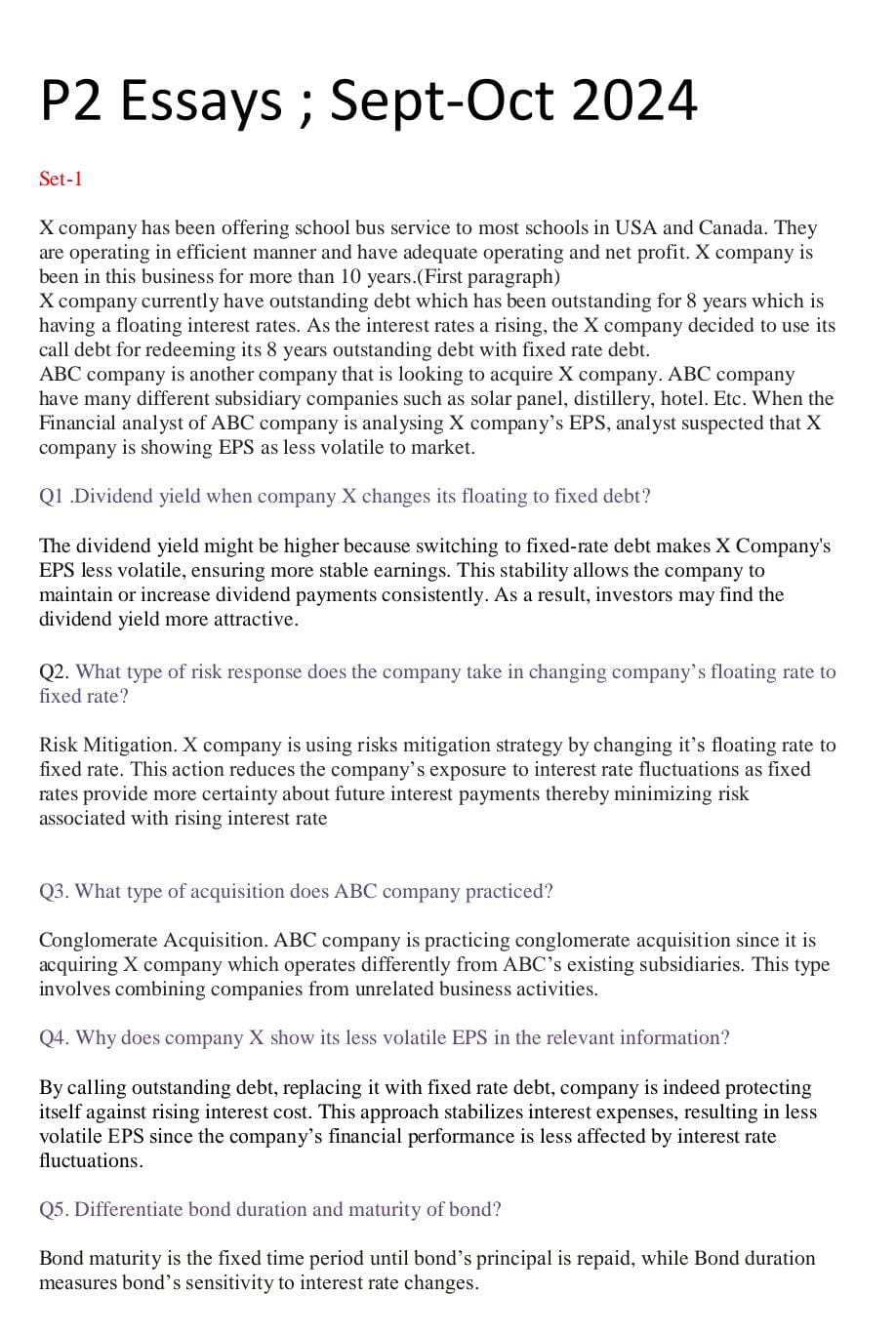

What is the dividend yield when company X changes its floating to fixed debt?

Understand the Problem

The question is asking about key financial concepts related to company X's transition from floating to fixed debt, the implications for dividend yield, risk response strategies, types of acquisition, volatility in earnings per share (EPS), and bond characteristics.

Answer

The dividend yield might be higher due to more stable earnings from fixed-rate debt.

The dividend yield might be higher because switching to fixed-rate debt makes X Company's EPS less volatile, ensuring more stable earnings. This stability allows the company to maintain or increase dividend payments consistently. As a result, investors may find the dividend yield more attractive.

Answer for screen readers

The dividend yield might be higher because switching to fixed-rate debt makes X Company's EPS less volatile, ensuring more stable earnings. This stability allows the company to maintain or increase dividend payments consistently. As a result, investors may find the dividend yield more attractive.

More Information

Switching to fixed-rate debt can provide a company with predictable interest expenses, which helps in maintaining stable earnings and potentially higher dividend payouts.

Tips

A common mistake is not considering the impact of interest rate fluctuations on floating-rate debt and how fixing the rate stabilizes the company's financials over time.

Sources

- Yields in Finance: Formula, Types, and What It Tells You - investopedia.com

- Floating-Rate Note (FRN): Here's What You Need To Know - investopedia.com

- Cost of Debt - Corporate Finance Institute - corporatefinanceinstitute.com

AI-generated content may contain errors. Please verify critical information