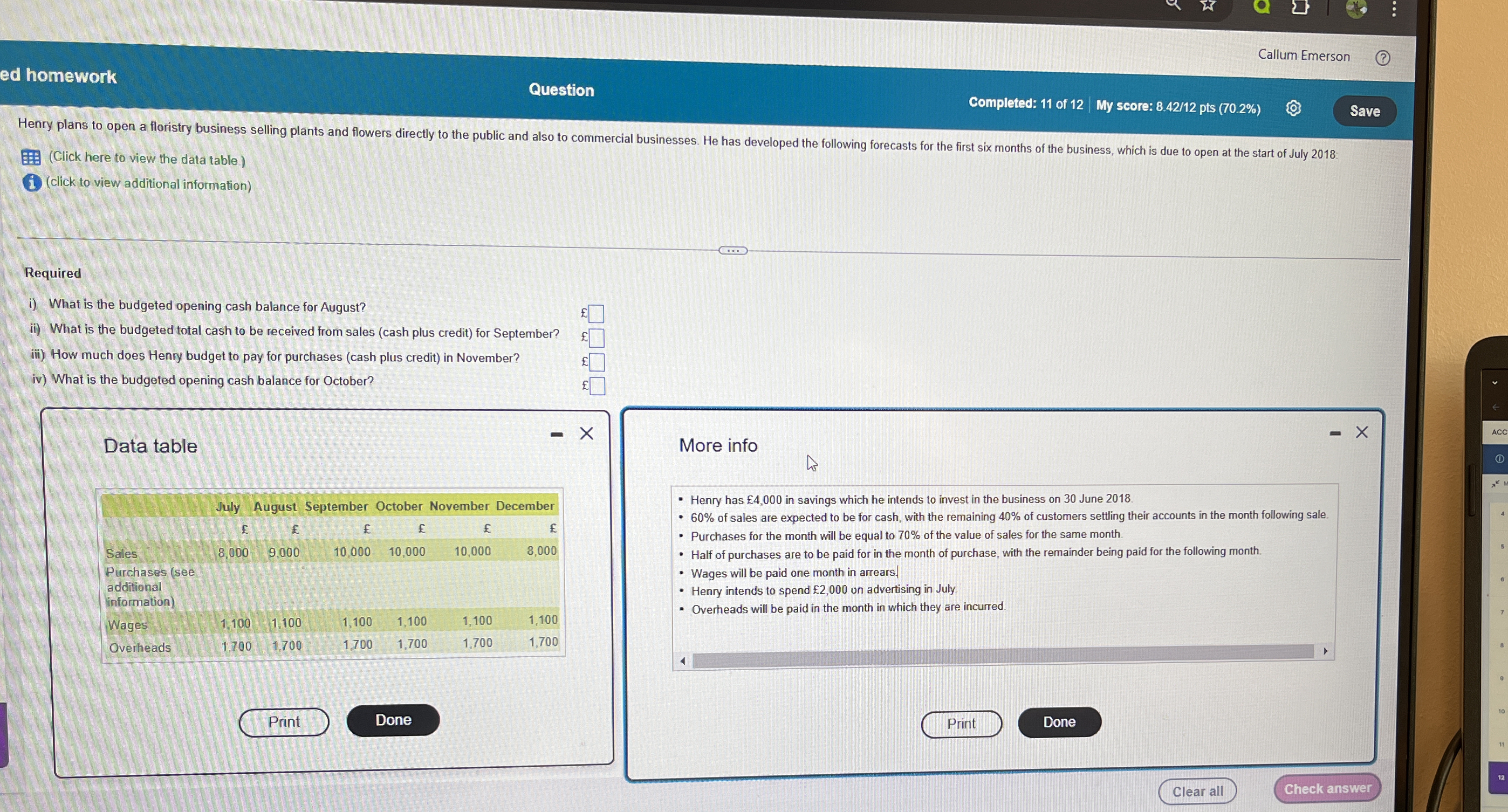

What is the budgeted opening cash balance for August? What is the budgeted total cash to be received from sales for September? How much does Henry buy for purchases in November? Wh... What is the budgeted opening cash balance for August? What is the budgeted total cash to be received from sales for September? How much does Henry buy for purchases in November? What is the budgeted opening cash balance for October?

Understand the Problem

The question is asking for specific financial figures related to Henry's floristry business for different months. This includes determining the opening cash balance for August, total cash from sales for September, purchase payments for November, and the opening cash balance for October based on given data and instructions.

Answer

i) £9,800, ii) £9,600, iii) £7,000, iv) To be calculated.

Answer for screen readers

i) Opening cash balance for August: £9,800

ii) Total cash from sales for September: £9,600

iii) Purchases payment for November: £7,000

iv) Opening cash balance for October: Calculate using values.

Steps to Solve

- Calculate the Opening Cash Balance for August

To find the opening cash balance for August, start with the initial investment of £4,000 from June. The cash balance will change based on the cash inflows from sales and outflows from expenses.

- Determine Sales for August

August's sales are £9,000. According to the data, 60% of this will be received in cash:

$$ \text{Cash Sales for August} = 0.60 \times 9000 = 5400 $$

- Calculate Cash from Previous Month's Sales

Henry receives 40% of the July sales in August. The July sales were £8,000:

$$ \text{Cash from July Sales} = 0.40 \times 8000 = 3200 $$

- Add Cash Inflows for August

Combine the cash from sales and the cash from the previous month:

$$ \text{Total Cash Inflow for August} = 5400 + 3200 = 8600 $$

- Calculate Total Cash Outflows for August

Now, consider the total expenses for August (wages and overheads). Both are paid in cash:

- Wages = £1,100

- Overheads = £1,700

Total outflows:

$$ \text{Total Cash Outflow for August} = 1100 + 1700 = 2800 $$

- Calculate Opening Cash Balance for August

Now, plug everything into the formula for the opening balance:

$$ \text{Opening Cash Balance for August} = \text{Initial Cash} + \text{Total Cash Inflows} - \text{Total Cash Outflows} $$

Using the values:

$$ \text{Opening Cash Balance for August} = 4000 + 8600 - 2800 = 9800 $$

- Calculate Total Cash from Sales for September

For September, the sales amount is £10,000. Using the same logic as above:

$$ \text{Cash Sales for September} = 0.60 \times 10000 = 6000 $$

Along with the 40% from August’s sales:

$$ \text{Cash from August Sales} = 0.40 \times 9000 = 3600 $$

Finally, combine these:

$$ \text{Total Cash for September} = 6000 + 3600 = 9600 $$

- Calculate Purchases Payment for November

November's sales are £10,000, and purchases are 70% of the sales:

$$ \text{Purchases} = 0.70 \times 10000 = 7000 $$

Half of this will be paid in November (£3,500), and half in December (£3,500).

- Calculate the Opening Cash Balance for October

The opening cash balance for October is simply the closing balance for September, which can be calculated as:

$$ \text{Opening Cash Balance for October} = \text{Opening Cash for August} + \text{Total Cash from Sales for September} - \text{Total Outflows for September} $$

Outflows for September are the same as before.

Final computation gives the balance.

i) Opening cash balance for August: £9,800

ii) Total cash from sales for September: £9,600

iii) Purchases payment for November: £7,000

iv) Opening cash balance for October: Calculate using values.

More Information

Henry has an initial investment of £4,000 and a systematic approach to managing cash inflows and outflows in his floristry business, closely related to sales and purchases each month.

Tips

- Failing to account for cash received in the following month from prior sales.

- Miscalculating cash inflows and outflows due to misunderstanding the sales structure (cash vs. credit).

AI-generated content may contain errors. Please verify critical information