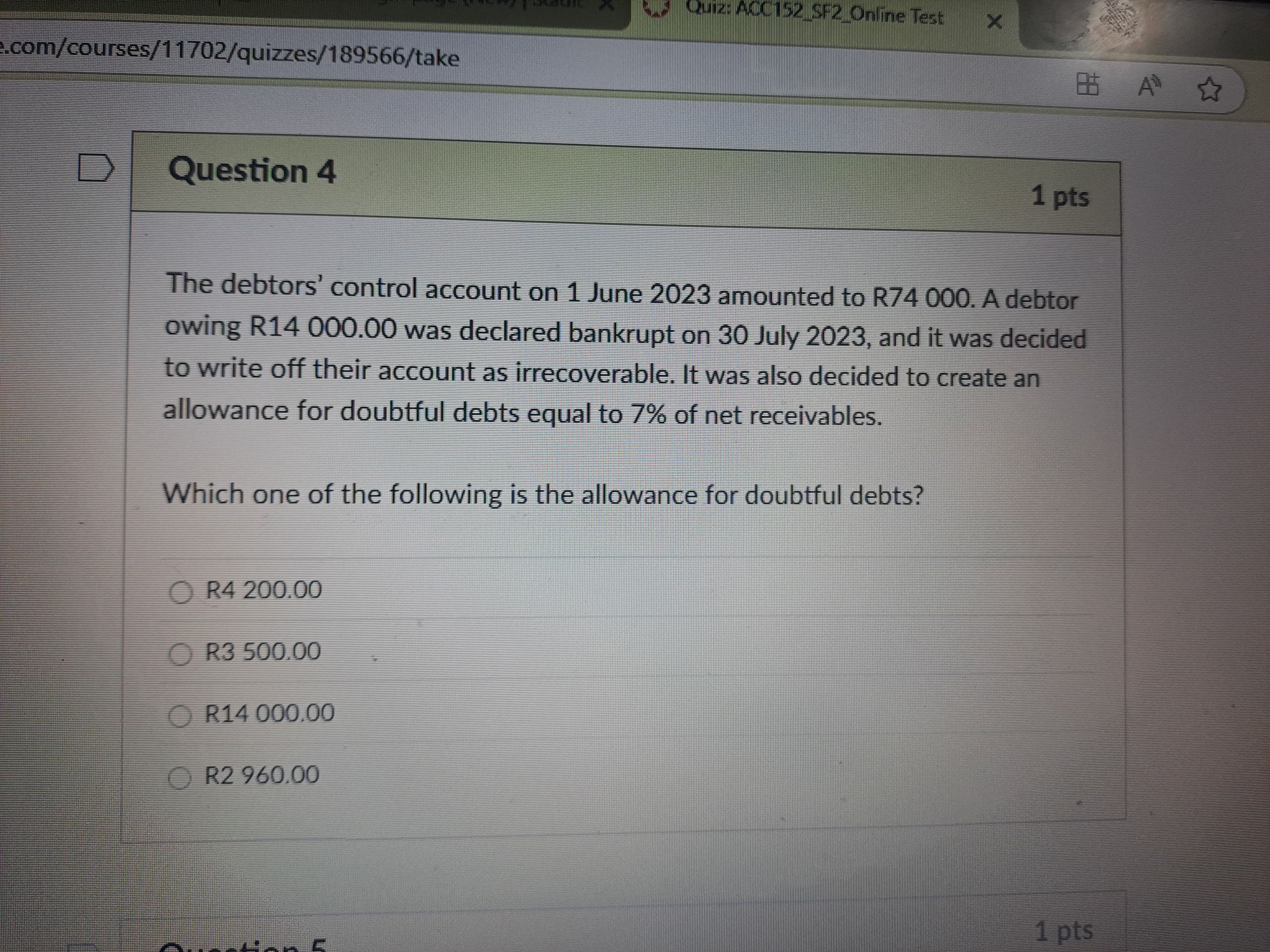

What is the allowance for doubtful debts if the debtors' control account amounted to R74,000 and 7% of net receivables is to be created as an allowance for doubtful debts?

Understand the Problem

The question is asking to calculate the allowance for doubtful debts based on the provided information about debtors' control accounts and the percentage of net receivables designated for this allowance.

Answer

$4,200$

Answer for screen readers

The allowance for doubtful debts is $4,200$.

Steps to Solve

- Calculate Net Receivables

Start with the total amount in the debtors’ control account and subtract the amount that is being written off.

[ \text{Net Receivables} = \text{Total Debtors Control} - \text{Amount Written Off} ]

Here, the total debtors' control amount is R74,000 and the amount written off is R14,000.

[ \text{Net Receivables} = R74,000 - R14,000 = R60,000 ]

- Determine the Percentage for Allowance

Calculate the allowance for doubtful debts, which is specified as 7% of the net receivables.

[ \text{Allowance for Doubtful Debts} = 0.07 \times \text{Net Receivables} ]

Substituting the net receivables into the equation gives:

[ \text{Allowance for Doubtful Debts} = 0.07 \times R60,000 ]

- Calculate the Final Amount

Compute the final amount to find the allowance for doubtful debts.

[ \text{Allowance for Doubtful Debts} = R4,200 ]

The allowance for doubtful debts is $4,200$.

More Information

The allowance for doubtful debts is estimated to absorb potential losses from uncollectible accounts. It is a standard practice for businesses to account for this to provide a more accurate picture of their financial health.

Tips

- Forgetting to subtract the written-off amount: Make sure to calculate net receivables correctly by subtracting any debts that are written off.

- Misapplying the percentage: Ensure that you are using the correct percentage (7% in this case) for the final calculation.

AI-generated content may contain errors. Please verify critical information