What does the tax on buyers illustrate in the demand and supply curve for ice cream cones?

Understand the Problem

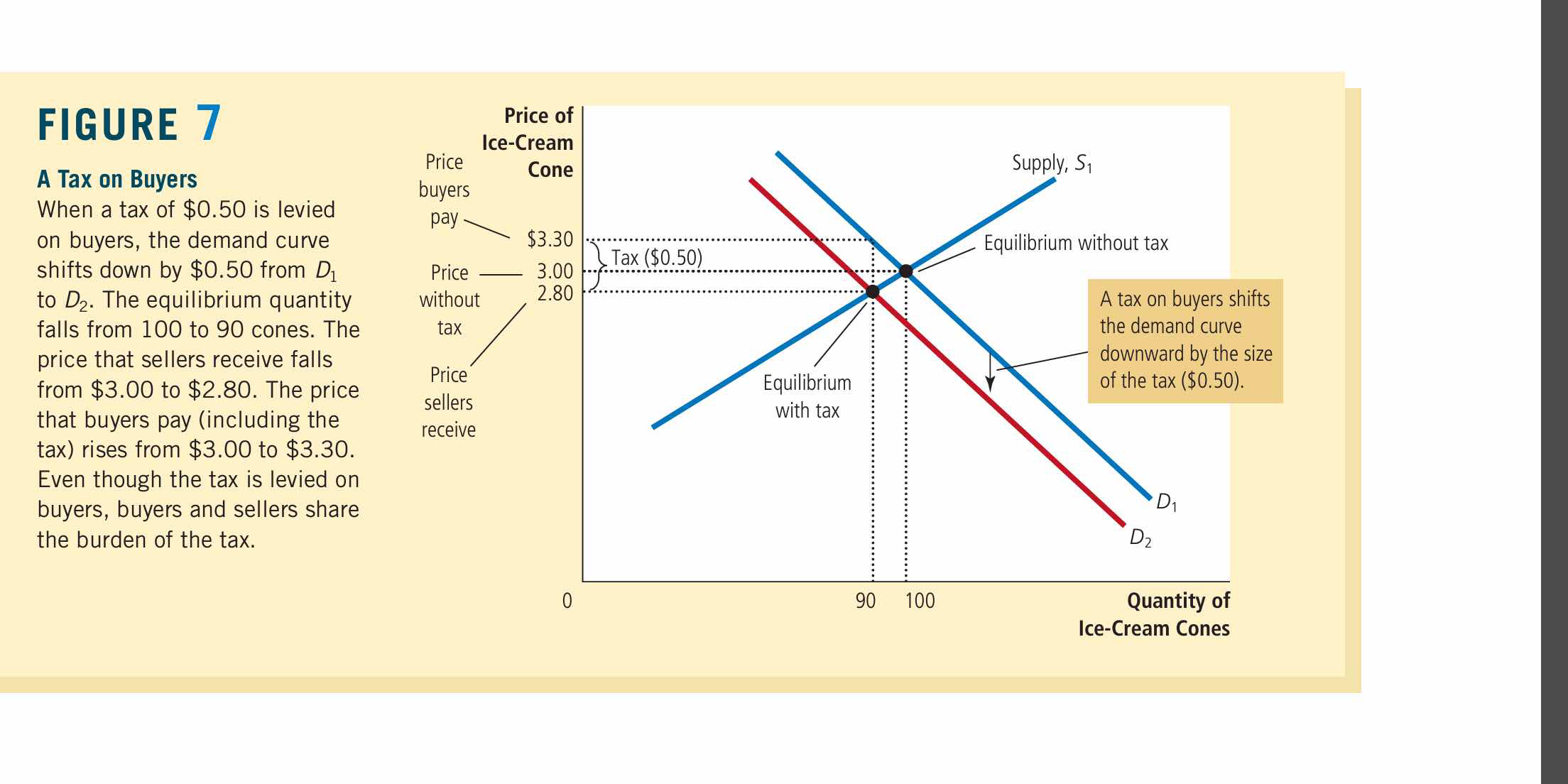

The question is asking to analyze a diagram illustrating the impact of a tax on buyers of ice cream cones. It describes how the tax affects the demand curve, equilibrium quantity, and prices, highlighting the shared burden of the tax between buyers and sellers.

Answer

The demand curve shifts downward by the tax amount, affecting equilibrium.

A tax on buyers shifts the demand curve downward by the amount of the tax (e.g., $0.50). This reduces the equilibrium quantity sold and increases the price buyers pay while decreasing the price sellers receive.

Answer for screen readers

A tax on buyers shifts the demand curve downward by the amount of the tax (e.g., $0.50). This reduces the equilibrium quantity sold and increases the price buyers pay while decreasing the price sellers receive.

More Information

When a tax is imposed on buyers, their willingness to pay decreases, resulting in a leftward (or downward) shift of the demand curve. This affects the quantities and prices received by sellers, even when the tax is levied only on buyers.

Tips

A common mistake is thinking the demand curve does not shift or affects only the price without changing the quantity sold.

Sources

- Effect of a tax on the demand curve for ice cream cones - studocu.com

AI-generated content may contain errors. Please verify critical information