What are the types of loans from commercial banks and how do public deposits work?

Understand the Problem

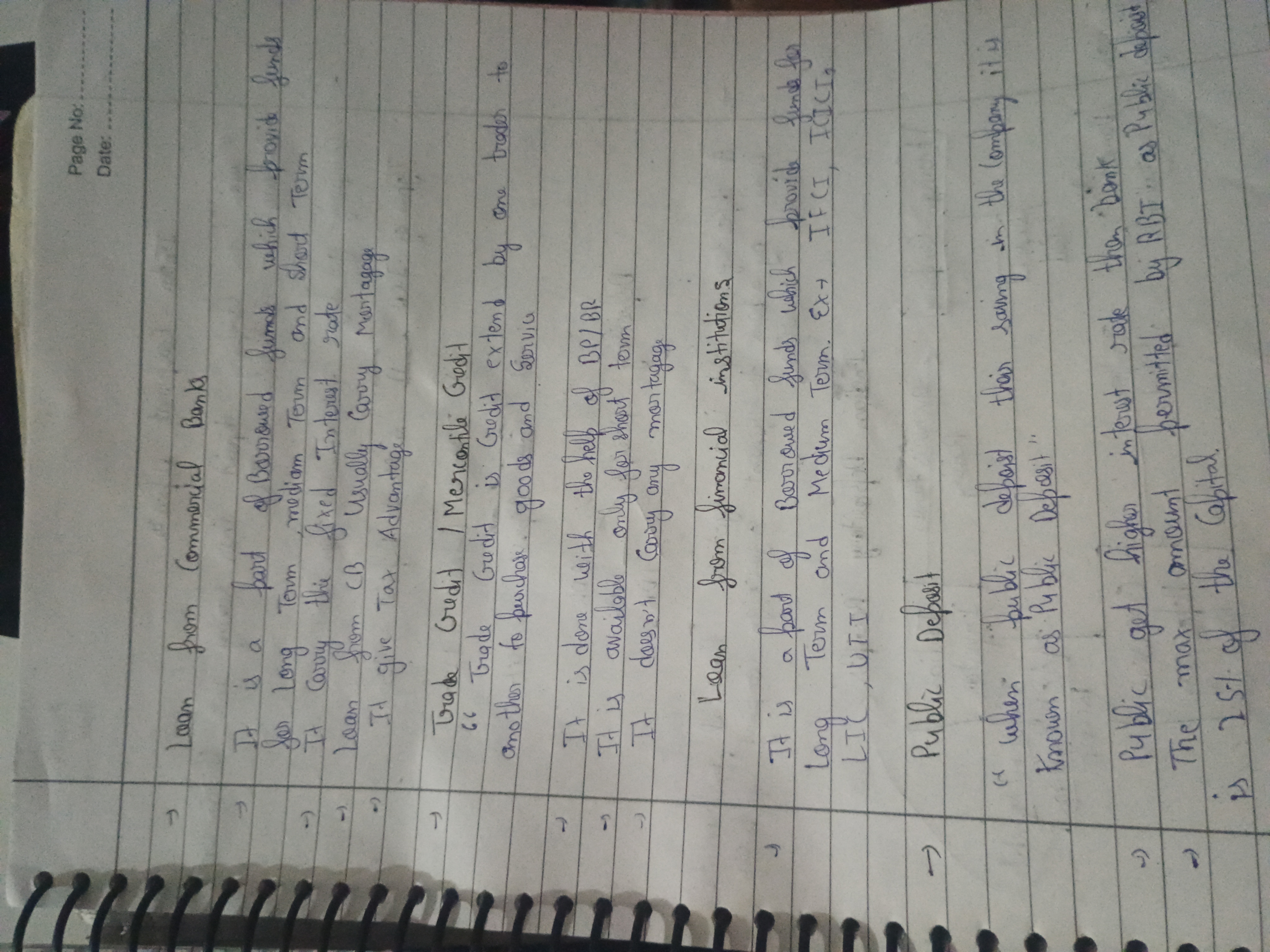

The text discusses various types of loans and deposits from commercial banks and financial institutions, explaining loans' characteristics and the concept of public deposits.

Answer

Types of loans: mortgages, auto, business, personal. Public deposits: savings in a company, potentially higher interest.

Commercial banks offer loans such as mortgages, auto loans, business loans, and personal loans. Public deposits involve individuals saving money in a company at a potentially higher interest rate than banks, with a cap determined by regulations.

Answer for screen readers

Commercial banks offer loans such as mortgages, auto loans, business loans, and personal loans. Public deposits involve individuals saving money in a company at a potentially higher interest rate than banks, with a cap determined by regulations.

More Information

Commercial banks play a critical role in the economy by providing various loan types, each tailored to different needs, alongside managing public deposits which fund such loans.

Tips

A common mistake is confusing public deposits with standard bank savings accounts; however, they often carry different terms and conditions.

Sources

- Commercial bank - Wikipedia - en.wikipedia.org

- Common Types of Bank Loans | Wolters Kluwer - wolterskluwer.com

AI-generated content may contain errors. Please verify critical information