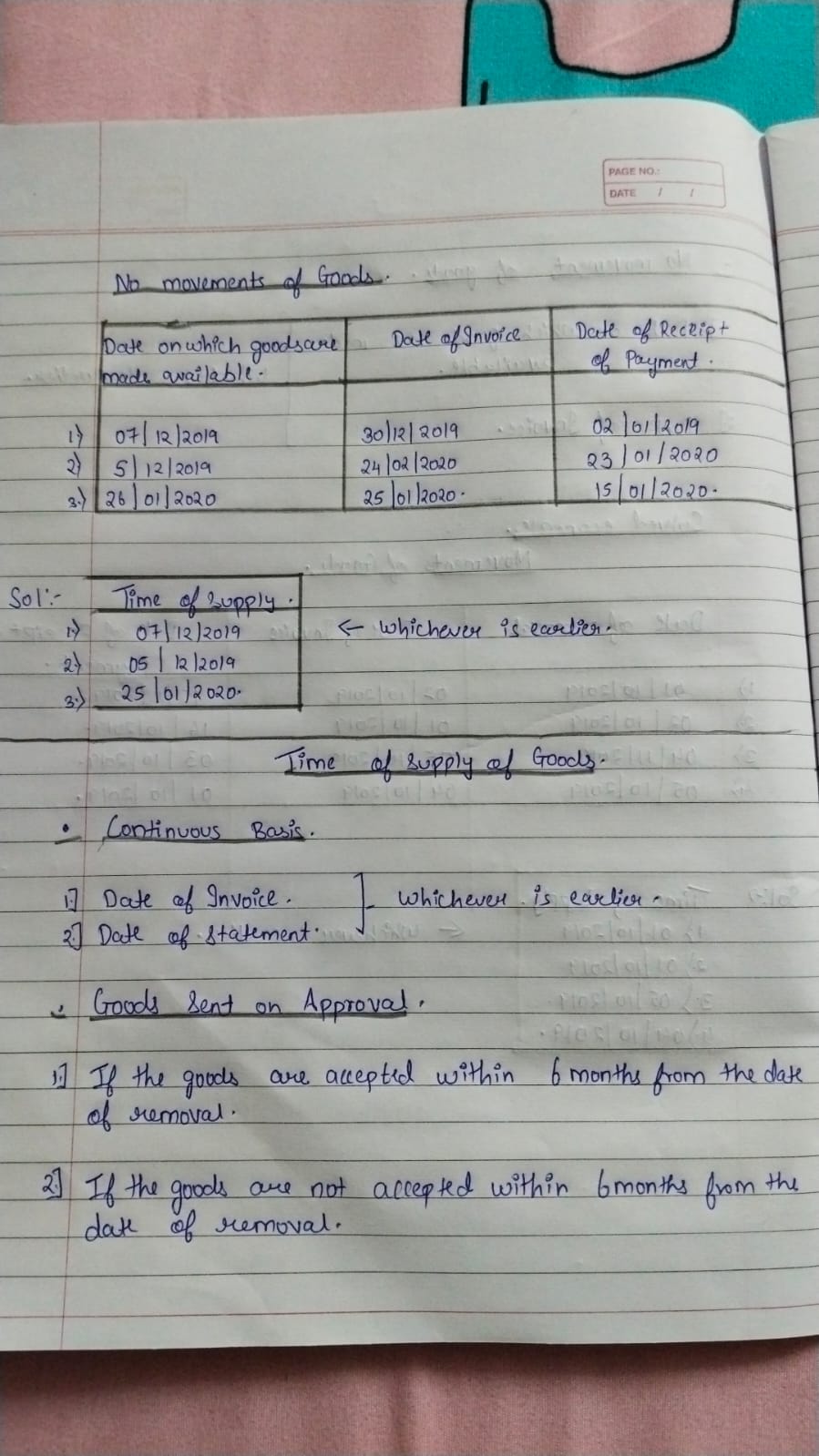

What are the rules for determining the time of supply of goods based on the dates provided?

Understand the Problem

The question is asking about the accounting procedure for determining the time of supply of goods, taking into account several dates related to the movement and invoicing of goods. It requires identifying the relevant dates and applying rules for supply of goods according to specified conditions.

Answer

Earliest of date goods made available, invoice date, or payment date.

The time of supply for goods is the earliest of the three dates: date goods are made available, date on the invoice, or date of receipt of payment.

Answer for screen readers

The time of supply for goods is the earliest of the three dates: date goods are made available, date on the invoice, or date of receipt of payment.

More Information

In GST, determining the time of supply is crucial for establishing when the goods are legally supplied for tax purposes. It affects when tax is due.

Tips

A common mistake is not using the earliest date. Always compare the dates provided to determine which comes first.

Sources

- Time of Supply Under GST - razorpay.com

- Time of Supply in GST - gstcouncil.gov.in

AI-generated content may contain errors. Please verify critical information