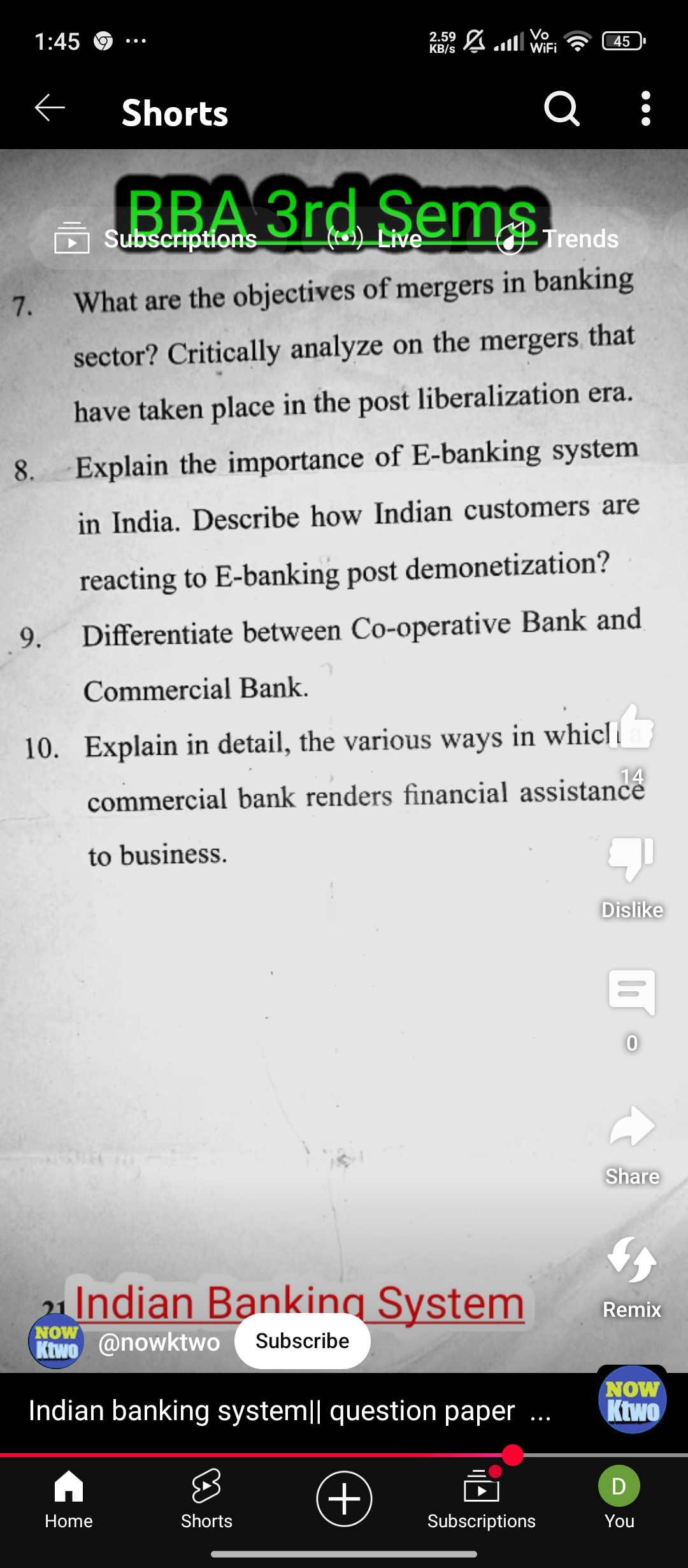

What are the objectives of mergers in the banking sector? Critically analyze the mergers that have taken place in the post-liberalization era.

Understand the Problem

The question is asking about the objectives of mergers in the banking sector and requires a critical analysis of recent mergers that occurred after the liberalization era in India.

Answer

Mergers aim for competitiveness, scale economies, and financial stability. Post-liberalization, they helped consolidate banks, with varied success.

The objectives of mergers in the banking sector include enhancing competitiveness, achieving economies of scale, expanding customer base, and financial stability. Post-liberalization mergers aimed to consolidate financial institutions to thrive in a deregulated environment. Some mergers have strengthened banks, but others faced challenges like cultural integration and operational risks.

Answer for screen readers

The objectives of mergers in the banking sector include enhancing competitiveness, achieving economies of scale, expanding customer base, and financial stability. Post-liberalization mergers aimed to consolidate financial institutions to thrive in a deregulated environment. Some mergers have strengthened banks, but others faced challenges like cultural integration and operational risks.

More Information

Post-liberalization mergers often succeeded in creating stronger banks by combining resources, but differences in corporate culture and technology integration posed challenges. Successful mergers enhanced consumer confidence and banking efficiency.

Tips

A common mistake is assuming all mergers are financially or operationally beneficial; each case varies.

Sources

- Mergers and Acquisitions in the Banking Sector: A Systematic Review - journals.sagepub.com

- Mergers in Banking Industry of India: Some Emerging Issues - researchgate.net

- Strategic and Financial Similarities of Bank Mergers - justinpaul.uprrp.edu

AI-generated content may contain errors. Please verify critical information