What are the learning objectives regarding the taxation of corporations as discussed in Chapter 3?

Understand the Problem

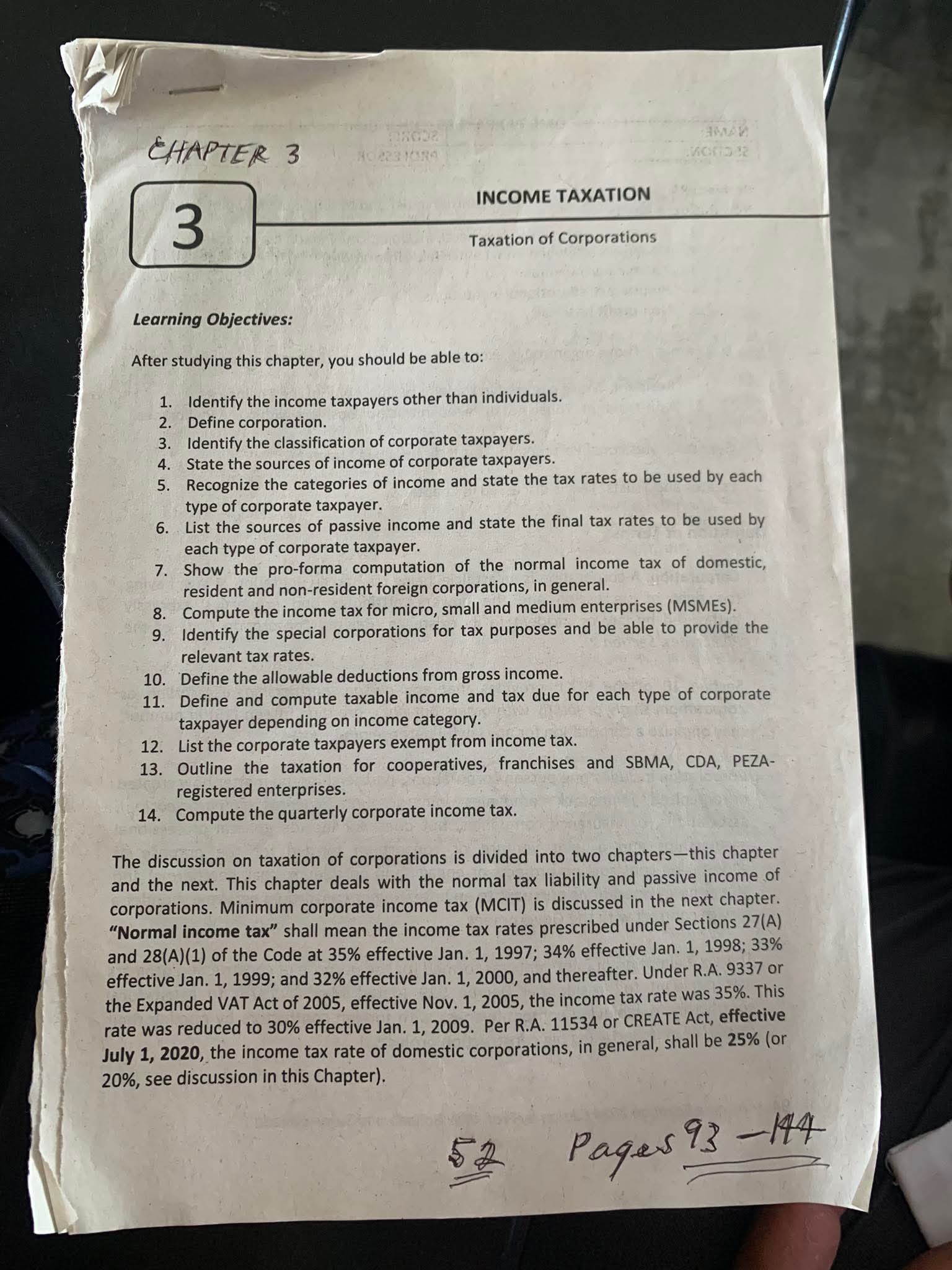

The question pertains to the taxation of corporations, specifically focusing on various concepts required to understand corporate income tax and its implications. It outlines objectives such as identifying corporate taxpayers, defining corporations, listing sources of income, and understanding tax rates applicable to different types of corporate taxpayers.

Answer

Key objectives include identifying corporate taxpayers, defining corporations, and understanding tax computations.

The learning objectives for Chapter 3 on taxation of corporations include identifying corporate taxpayers, defining corporations, classifying corporate taxpayers, understanding taxable sources and their rates, calculating taxes for different corporations, and recognizing exemptions.

Answer for screen readers

The learning objectives for Chapter 3 on taxation of corporations include identifying corporate taxpayers, defining corporations, classifying corporate taxpayers, understanding taxable sources and their rates, calculating taxes for different corporations, and recognizing exemptions.

More Information

This chapter provides comprehensive learning objectives that cover identification of various corporate taxpayers, how to calculate taxes for different classifications, and understanding exemptions and deductions.

Tips

Ensure understanding of different corporate tax categories and the applicable rates.

AI-generated content may contain errors. Please verify critical information