What are the key provisions of the Insurance Laws (Amendment) Act, 2015, and its impact on health insurance and reinsurance in India?

Understand the Problem

The question provides information about reforms in the insurance sector in India, focusing on the Insurance Laws (Amendment) Act of 2015 and details about health insurance and reinsurance.

Answer

Allows foreign reinsurers in India and boosts health insurance as a separate category with a 100-crore capital requirement.

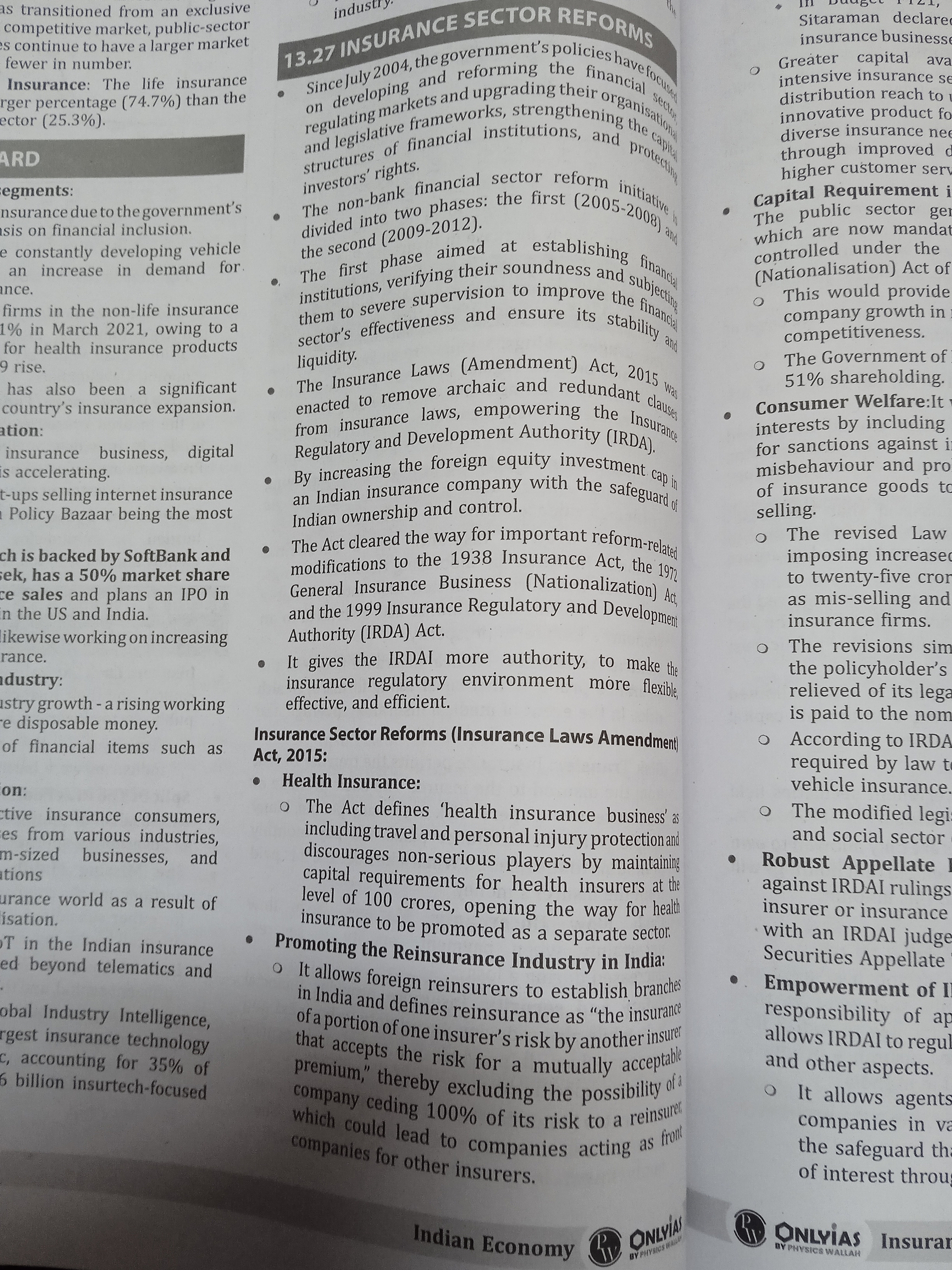

The Insurance Laws (Amendment) Act, 2015, allows foreign reinsurers to establish branches in India and promotes the health insurance sector as a separate category by defining it clearly. It requires a capital of 100 crores for health insurers, ensuring serious market players.

Answer for screen readers

The Insurance Laws (Amendment) Act, 2015, allows foreign reinsurers to establish branches in India and promotes the health insurance sector as a separate category by defining it clearly. It requires a capital of 100 crores for health insurers, ensuring serious market players.

More Information

The Act was designed to modernize India's insurance industry by integrating international players and creating detailed regulations for improving market stability and efficiency.

Tips

A common mistake is not considering the distinct capitalization requirements for health insurers, which are key to ensuring stability.

Sources

- The Insurance Laws Amendment Act, 2015 - PIB - pib.gov.in

- Insurance Sector Reforms - ONV IAS - onvias.in

AI-generated content may contain errors. Please verify critical information