What are the different types of PE deals by target lifecycle stage?

Understand the Problem

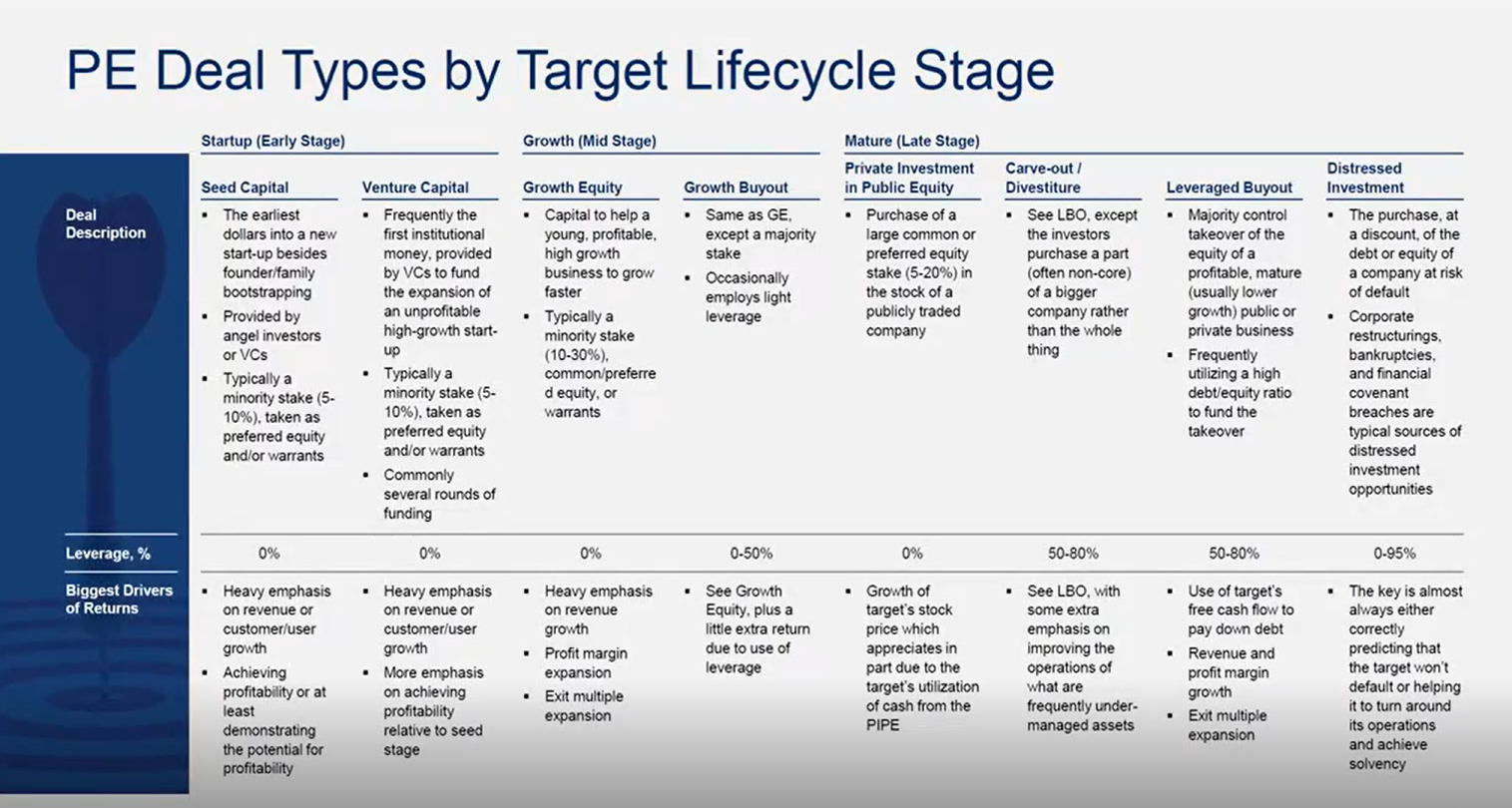

The question appears to be related to understanding the types of private equity (PE) deals and their characteristics based on the lifecycle stage of the target company. It highlights different deal types, their descriptions, leverage, and drivers of returns.

Answer

Seed Capital, Venture Capital, Growth Equity, Growth Buyout, Private Investment in Public Equity, Carve-out/Divestiture, Leveraged Buyout, Distressed Investment.

The final answer is: Different PE deal types by target lifecycle stage include Seed Capital, Venture Capital, Growth Equity, Growth Buyout, Private Investment in Public Equity, Carve-out/Divestiture, Leveraged Buyout, and Distressed Investment.

Answer for screen readers

The final answer is: Different PE deal types by target lifecycle stage include Seed Capital, Venture Capital, Growth Equity, Growth Buyout, Private Investment in Public Equity, Carve-out/Divestiture, Leveraged Buyout, and Distressed Investment.

More Information

Each type of deal targets companies at different stages of their lifecycle and involves varying levels of leverage and focus on growth or profitability.

AI-generated content may contain errors. Please verify critical information