What are the different components of long-term provisions, current liabilities, and other accounts in a company's financial statements?

Understand the Problem

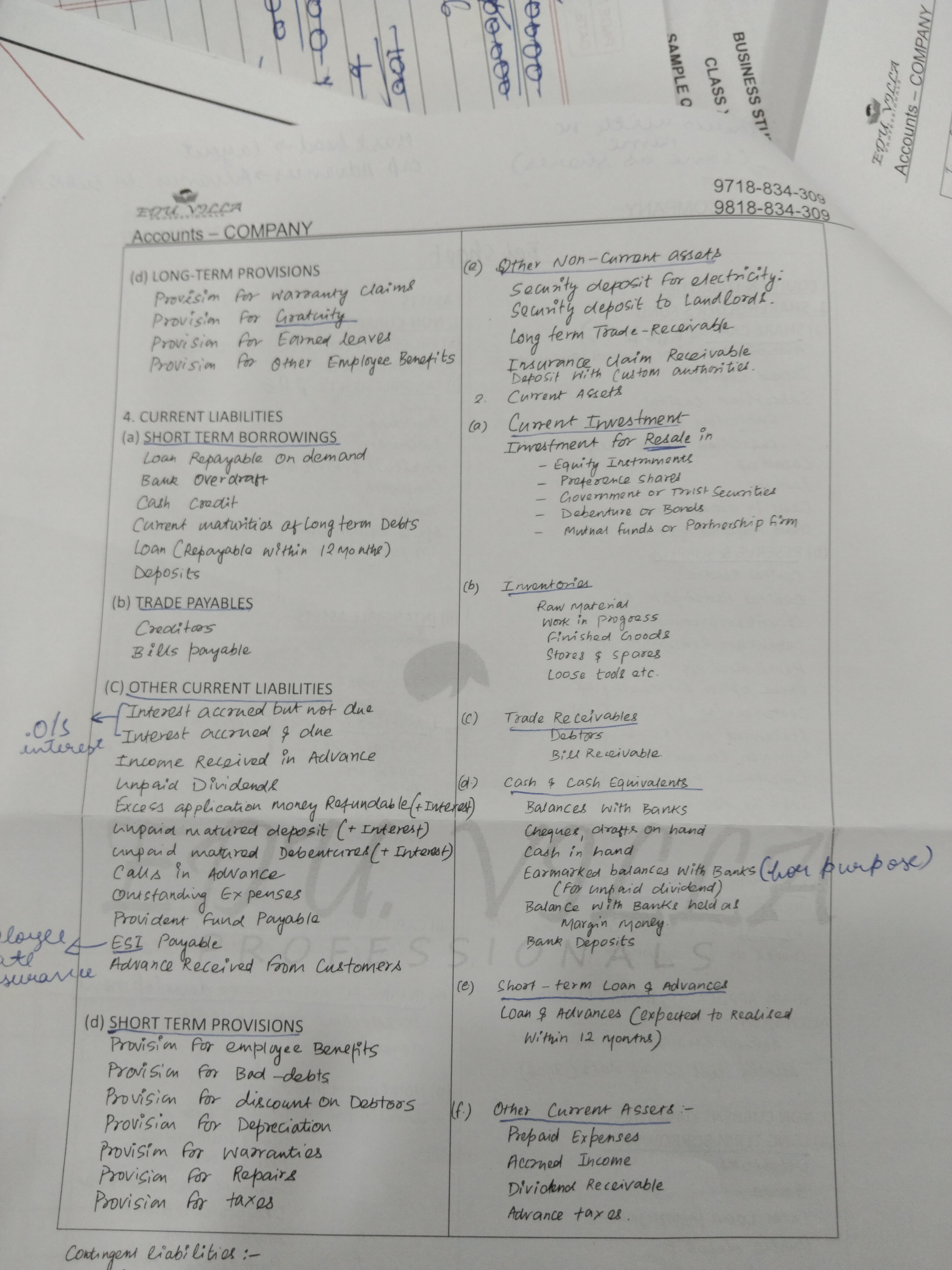

The question pertains to different components of financial statements, particularly liabilities, provisions, and assets in the context of accounting. It details various categories and specific examples related to long-term provisions, current liabilities, trade payables, and other relevant accounts.

Answer

Long-term provisions: employee benefits, gratuity. Current liabilities: short-term borrowings, trade payables. Short-term provisions: bad debts, taxes.

Long-term provisions include provisions for warranty claims, gratuity, leave, and other employee benefits. Current liabilities cover short-term borrowings, trade payables, and other liabilities like accrued interest and unpaid dividends. They also include short-term provisions for employee benefits, bad debts, depreciation, and taxes.

Answer for screen readers

Long-term provisions include provisions for warranty claims, gratuity, leave, and other employee benefits. Current liabilities cover short-term borrowings, trade payables, and other liabilities like accrued interest and unpaid dividends. They also include short-term provisions for employee benefits, bad debts, depreciation, and taxes.

More Information

Understanding these components helps evaluate a company's short-term financial health and obligations.

Tips

A common mistake is mixing long-term and short-term provisions; remember, long-term obligations exceed one year.

Sources

- Provisions - Overview, Types, Recognition and Recording - corporatefinanceinstitute.com

- Current Liabilities: What They Are and How to Calculate Them - investopedia.com

AI-generated content may contain errors. Please verify critical information