What are common banking fees and account alerts?

Understand the Problem

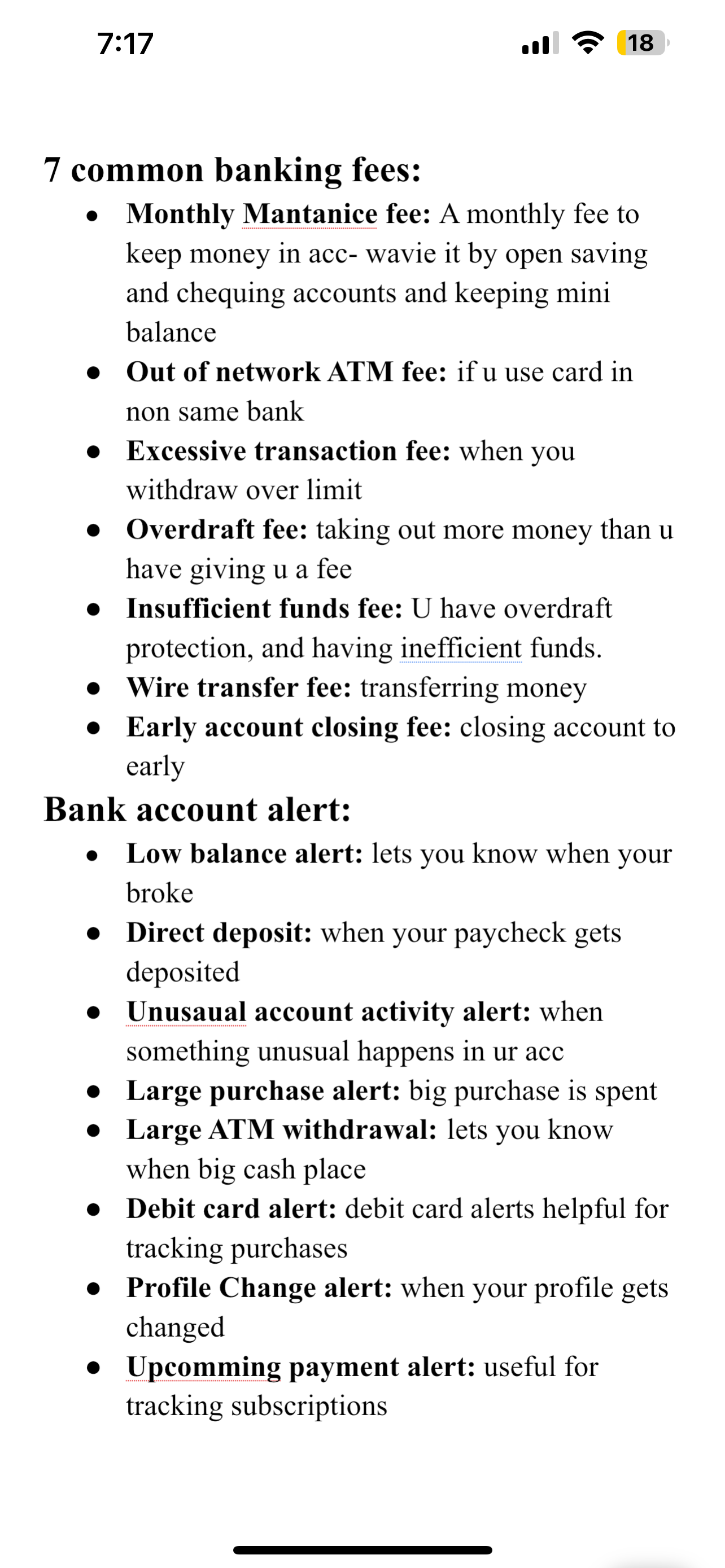

The question pertains to common banking fees and alerts that account holders may encounter. It provides a list of various banking fees along with descriptions and also includes categories of bank account alerts. The aim is to understand what these fees and alerts signify in relation to bank accounts.

Answer

Bank fees: monthly maintenance, ATM, transaction, overdraft, insufficient funds, wire transfer, early closing. Alerts: low balance, direct deposit, unusual activity.

Common banking fees include monthly maintenance fees, out-of-network ATM fees, excessive transaction fees, overdraft fees, insufficient funds fees, wire transfer fees, and early account closing fees. Account alerts include low balance alerts, direct deposit alerts, unusual account activity alerts, and large purchase alerts.

Answer for screen readers

Common banking fees include monthly maintenance fees, out-of-network ATM fees, excessive transaction fees, overdraft fees, insufficient funds fees, wire transfer fees, and early account closing fees. Account alerts include low balance alerts, direct deposit alerts, unusual account activity alerts, and large purchase alerts.

More Information

Bank fees can often be avoided by maintaining the required balance, using in-network ATMs, and staying informed about account activity through alerts. Alerts help manage finances effectively by notifying users of transactions and account changes.

Tips

A common mistake is not setting up account alerts, which can lead to being unaware of low balances or unusual transactions, resulting in unnecessary fees.

Sources

- How to Avoid Bank Fees - cnbc.com

AI-generated content may contain errors. Please verify critical information